Get the free ON DEATH TOD DEED - saclaworg

Show details

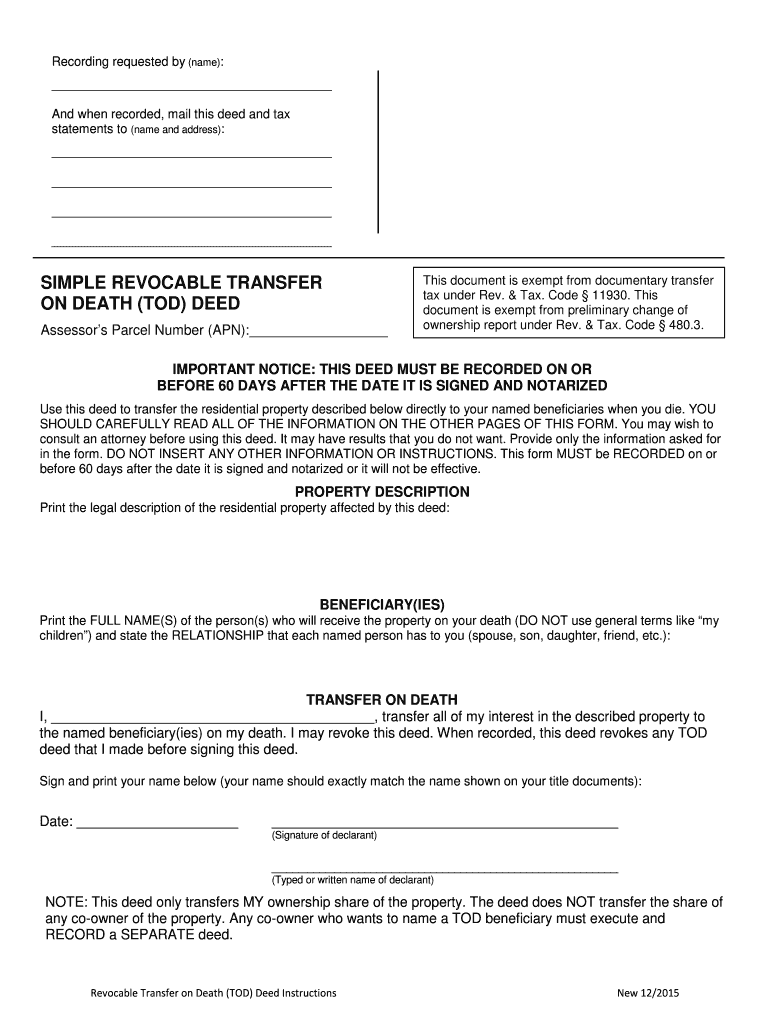

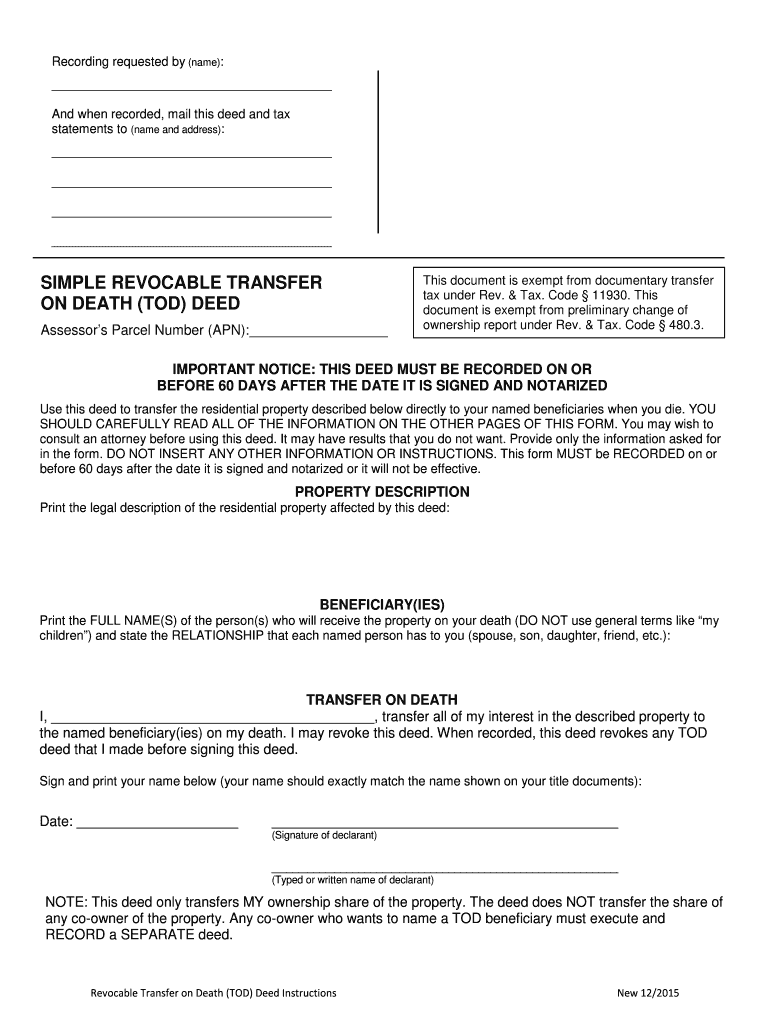

Recording requested by (name): And when recorded, mail this deed and tax statements to (name and address): SIMPLE REVOCABLE TRANSFER ON DEATH (TOD) DEED Assessors Parcel Number (APN): This document

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign on death tod deed

Edit your on death tod deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your on death tod deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing on death tod deed online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit on death tod deed. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out on death tod deed

How to fill out an on death TOD deed:

01

Start by obtaining the necessary form for an on death TOD deed. This form can typically be obtained from your local county recorder's office or online.

02

Begin filling out the form by entering your personal information, including your full legal name, address, and contact information. Make sure to provide accurate and up-to-date information.

03

Identify the real estate property that you wish to designate in the on death TOD deed. Include the full address, legal description, and any other relevant details to ensure clarity and accuracy.

04

Specify the beneficiaries or recipients of the property upon your death. Include their full legal names, addresses, and contact information. It is important to provide accurate and up-to-date information to avoid any confusion in the future.

05

Consider adding alternate beneficiaries in case the primary beneficiaries predecease you or are unable to inherit the property for any reason. This step is optional but can be beneficial in ensuring your intentions are carried out.

06

Review and double-check all the information you have entered on the on death TOD deed form. Ensure that there are no spelling errors, missing information, or inconsistencies. It is crucial to be accurate and precise to avoid any legal challenges later on.

07

Sign and date the on death TOD deed in the presence of a notary public. Notarization is typically a requirement for this type of deed to ensure its validity and enforceability.

Who needs an on death TOD deed:

01

Individuals who wish to have control over the distribution of their real estate property after their death may consider executing an on death TOD deed.

02

Homeowners who want to simplify the transfer of their property to their chosen beneficiaries without the need for probate may find the on death TOD deed a useful estate planning tool.

03

Those who want to avoid potential delays or complications associated with the probate process may opt for an on death TOD deed to ensure a smoother and faster transfer of their property.

Note: The specific requirements and regulations surrounding on death TOD deeds may vary by jurisdiction. It is recommended to consult with a legal professional or estate planning expert to ensure compliance with local laws and to address any individual circumstances or concerns.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send on death tod deed for eSignature?

Once you are ready to share your on death tod deed, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete on death tod deed online?

pdfFiller has made filling out and eSigning on death tod deed easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit on death tod deed on an iOS device?

Create, edit, and share on death tod deed from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is on death tod deed?

On death tod deed or transfer-on-death deed is a legal document that allows an individual to transfer their real property to a designated beneficiary upon their death.

Who is required to file on death tod deed?

The property owner is required to file an on death tod deed to ensure that the property transfers to the designated beneficiary upon their death.

How to fill out on death tod deed?

To fill out an on death tod deed, the property owner must provide information about the property, the designated beneficiary, and sign the document in the presence of a notary public.

What is the purpose of on death tod deed?

The purpose of an on death tod deed is to avoid probate and ensure that the property transfers directly to the designated beneficiary without going through the court process.

What information must be reported on on death tod deed?

The on death tod deed must include information about the property, the designated beneficiary, and the property owner's signature in the presence of a notary public.

Fill out your on death tod deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

On Death Tod Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.