Get the free Tourist Development Tax OverviewFlorida Tax Collector ...

Show details

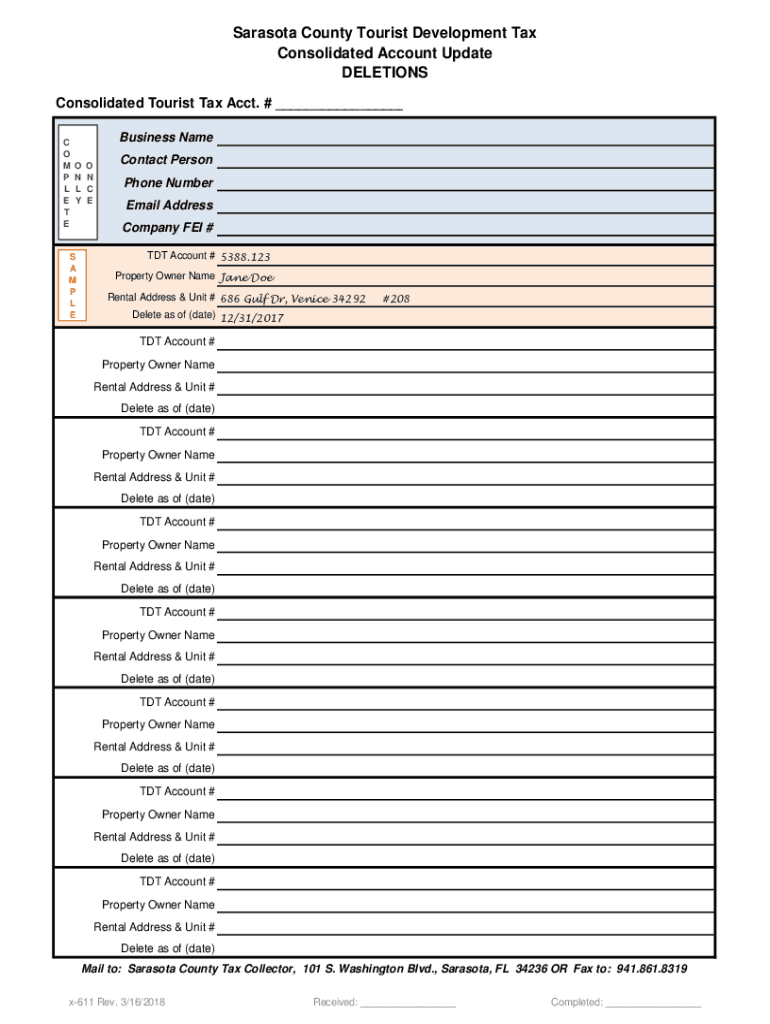

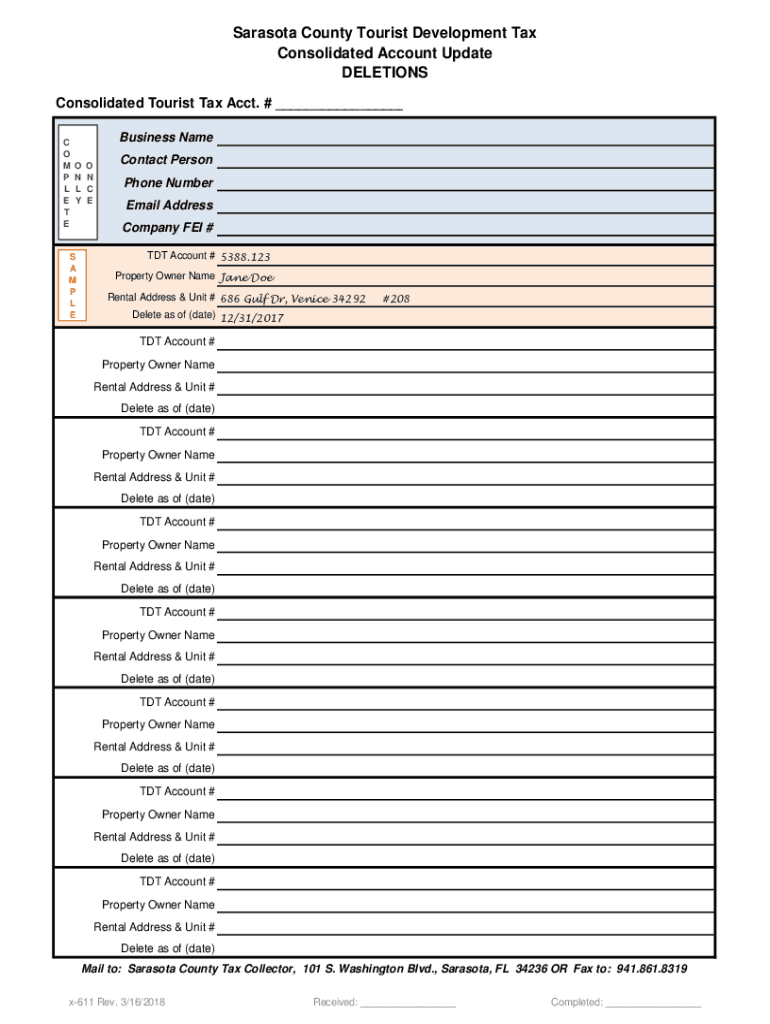

Sarasota County Tourist Development Tax Consolidated Account Update DELETIONS Consolidated Tourist Tax Acct. # ___ C O M P L E TE Business Name O N L IS A M P L EO N CE Contact Person Phone Number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tourist development tax overviewflorida

Edit your tourist development tax overviewflorida form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tourist development tax overviewflorida form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tourist development tax overviewflorida online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tourist development tax overviewflorida. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tourist development tax overviewflorida

How to fill out tourist development tax overviewflorida:

01

Gather necessary documents and information: Before starting the process, make sure to gather all the documents and information you will need. This may include your business information, tax identification number, sales records, and any relevant financial statements.

02

Access the online portal: Visit the official website of Florida's tourist development tax department to access the online portal for filling out the tax overview form. You can usually find this portal under the "Businesses" or "Taxation" section of the website.

03

Provide your business details: Begin by entering your business details, including your legal business name, address, and contact information. Make sure to double-check the accuracy of this information to avoid any potential errors.

04

Enter the tax period: Indicate the tax period for which you are filing the overview. This usually corresponds to a specific period, such as a month, quarter, or year.

05

Report your sales and receipts: Provide an accurate report of your business's sales and receipts during the specified tax period. This may include revenue from hotel room rentals, vacation rentals, short-term rentals, or any other applicable tourist accommodations.

06

Calculate the tax due: Based on the information you provided, the online portal will automatically calculate the amount of tax you owe. Check this calculation to ensure its accuracy.

07

Make the payment: Once you have determined the amount of tax due, you will need to make the payment. The online portal should provide various payment options, such as credit/debit card or electronic funds transfer. Select the method that is most convenient for you.

08

Review and submit: Before submitting your tax overview, carefully review all the information you have entered for accuracy. This step is crucial to avoid any mistakes or discrepancies.

09

Save a copy: After submitting the tax overview, it is recommended to save a digital or physical copy for your records. This will serve as proof of compliance and can be useful for future reference.

Who needs tourist development tax overviewflorida:

01

Hotels and resorts: Any hotel or resort that provides accommodations to tourists in Florida is required to file a tourist development tax overview. This includes large chains, boutique hotels, and bed and breakfast establishments.

02

Vacation rental owners: Individuals who own and rent out vacation properties in Florida are also required to file the tourist development tax overview. This applies to homeowners who offer short-term rentals through platforms like Airbnb or VRBO.

03

Property management companies: Property management companies that handle rentals and bookings on behalf of property owners are responsible for filing the tourist development tax overview. These companies typically handle a large number of properties and therefore need to ensure compliance with tax regulations.

04

Other tourist accommodations: Any business or individual that provides tourist accommodations, such as campsites, RV parks, or timeshare properties, must also file the tourist development tax overview.

It is important to note that the specific requirements and regulations may vary, so it's advisable to consult with a tax professional or refer to the official guidelines provided by Florida's tourist development tax department.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tourist development tax overviewflorida online?

With pdfFiller, you may easily complete and sign tourist development tax overviewflorida online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in tourist development tax overviewflorida?

With pdfFiller, it's easy to make changes. Open your tourist development tax overviewflorida in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an eSignature for the tourist development tax overviewflorida in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your tourist development tax overviewflorida right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is tourist development tax overview in Florida?

Tourist Development Tax Overview in Florida is a tax on the rental of living or sleeping accommodations for periods of six months or less.

Who is required to file tourist development tax overview in Florida?

Any person or business in Florida that rents out living or sleeping accommodations for periods of six months or less is required to file tourist development tax.

How to fill out tourist development tax overview in Florida?

To fill out tourist development tax overview in Florida, one must report the total rental revenue collected and calculate the tax owed based on the applicable tax rate.

What is the purpose of tourist development tax overview in Florida?

The purpose of tourist development tax overview in Florida is to generate revenue to fund tourism promotion, marketing, and beach renourishment projects in the state.

What information must be reported on tourist development tax overview in Florida?

The information that must be reported on tourist development tax overview in Florida includes total rental revenue collected, applicable tax rate, and amount of tax owed.

Fill out your tourist development tax overviewflorida online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tourist Development Tax Overviewflorida is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.