Get the free US SMALL BUSINESS ADMINISTRATION LOAN REQUEST FORM

Show details

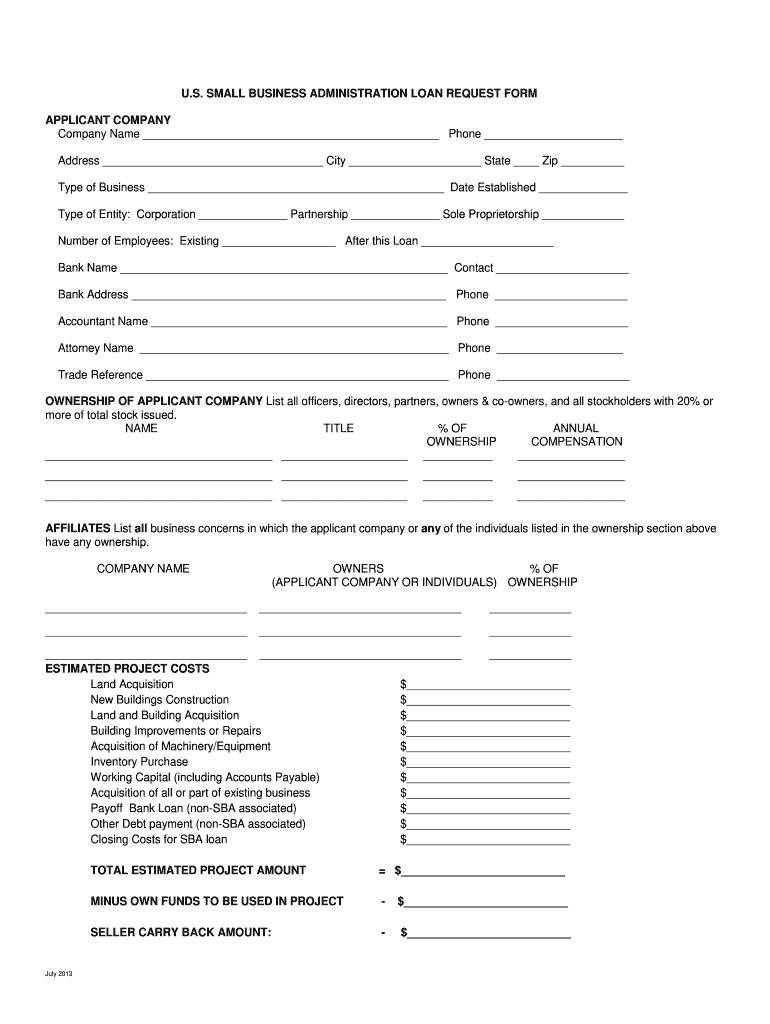

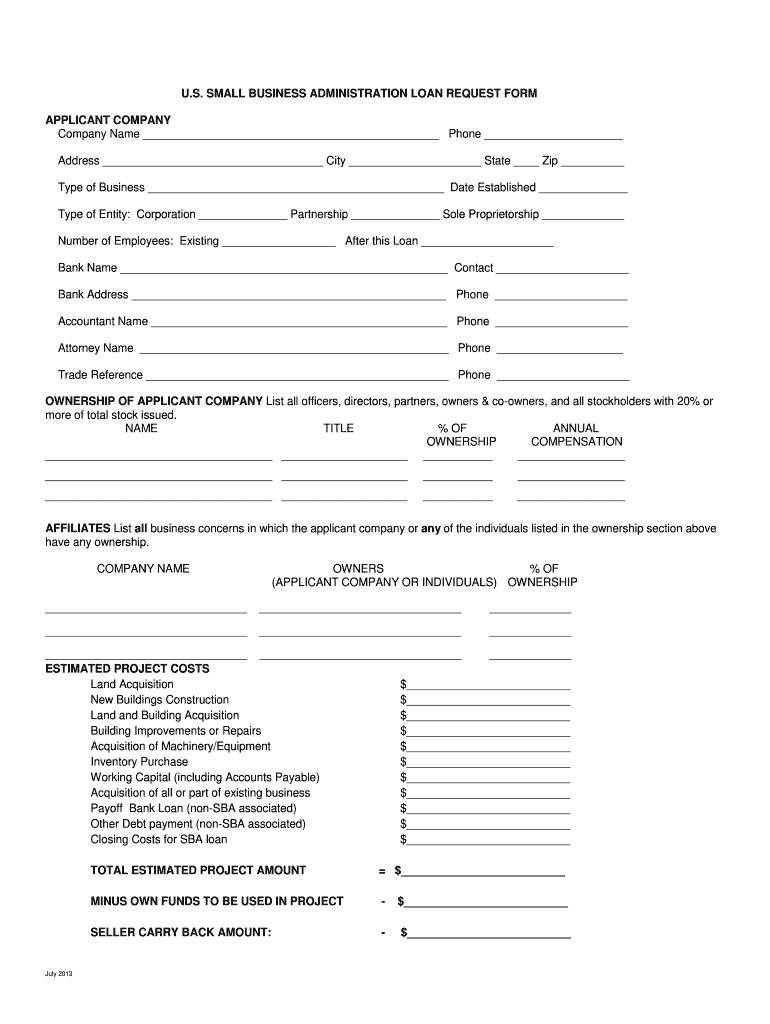

U.S. SMALL BUSINESS ADMINISTRATION LOAN REQUEST FORM APPLICANT COMPANY Name Phone Address City State Zip Type of Business Date Established Type of Entity: Corporation Partnership Sole Proprietorship

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us small business administration

Edit your us small business administration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us small business administration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit us small business administration online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit us small business administration. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us small business administration

How to fill out US Small Business Administration:

01

Begin by gathering all necessary documents and information, such as your business identification number, tax returns, financial statements, and legal documents.

02

Visit the official website of the US Small Business Administration to access the appropriate forms and applications.

03

Carefully read the instructions provided with each form to ensure accurate and complete information.

04

Start filling out the forms electronically or print them out for manual completion, depending on the preference and convenience.

05

Provide accurate details about your business, including its name, address, contact information, legal structure, and ownership.

06

Include information about your business activities, such as the products or services offered, target market, and any licenses or permits required.

07

Complete the financial sections, including details about your business's revenue, expenses, loans, and any financial projections.

08

If applying for a loan or grant, carefully review the eligibility requirements and provide the necessary financial documentation, such as bank statements and credit reports.

09

Ensure all calculations are accurate and all required fields are completed before submitting the forms.

10

Finally, submit the completed forms electronically through the US Small Business Administration's online portal or by mail, following the provided instructions.

Who needs US Small Business Administration:

01

Small business owners: The primary target audience for the US Small Business Administration is small business owners. Whether you are starting a new business or looking to grow an existing one, the SBA offers various resources, programs, and funding options to support you.

02

Entrepreneurs: Individuals with innovative business ideas and the drive to start their own ventures can benefit from the US Small Business Administration. It provides access to training programs, mentorship, and counseling services to help entrepreneurs navigate the challenges of starting a business.

03

Minority-owned businesses: The SBA recognizes the importance of supporting minority-owned businesses. It offers resources specifically tailored to assist minority entrepreneurs in overcoming barriers to business ownership and development.

04

Women-owned businesses: The SBA actively supports women entrepreneurs by providing specialized programs and funding opportunities. It aims to promote gender equality in business ownership and help women succeed in traditionally male-dominated industries.

05

Veterans and service-disabled veterans: The SBA has initiatives dedicated to assisting veterans and service-disabled veterans in starting or expanding their businesses. It offers access to capital, counseling services, and procurement programs specifically designed to support veterans' entrepreneurship.

06

Small businesses affected by disasters: The US Small Business Administration plays a crucial role in disaster recovery by providing low-interest disaster loans to small businesses affected by natural or man-made disasters. These loans help businesses rebuild and recover from the financial impacts of such events.

Overall, the US Small Business Administration serves as a valuable resource for a diverse range of individuals and businesses seeking support, guidance, and financial assistance in starting, operating, and growing small businesses in the United States.

Fill

form

: Try Risk Free

People Also Ask about

What is the SBA form 3502?

Use form FTB 3502 to request abatement of unpaid qualified taxes, interest, and penalties for the taxable years of a qualified nonprofit corporation that certifies it is not doing business and is not able to dissolve through the California SOS normal dissolution process.

Is SBA form 912 still required?

When you're applying for an SBA 7(a) loan, one of the forms you'll have to fill out is the SBA Form 912. The SBA uses Form 912 as a statement of personal history to help determine the your eligibility for a loan. This form applies no matter what type of SBA loan you're getting.

What is the SBA form 3503?

Use form FTB 3503, Natural Heritage Preservation Credit, to fgure the amount of the credit. Also, use this form to claim pass-through credits received from S corporations, estates, trusts, partnerships, or limited liability companies (LLCs) classifed as partnerships.

What forms are needed for SBA loan?

Borrower information form (required): Complete SBA Form 1919 and submit it to an SBA-participating lender. Financial statements (as applicable): The lender may require personal financial statements for the applicant(s) or owner(s) of the applicant.

What is SBA form 1244?

This Form 1244 incorporates 504 Debt Refinancing updates made in the Economic Aid Act and is used to review the Applicant's eligibility for a 504 loan.

How does the SBA loan modification work?

Any changes to original loan documents are considered loan modifications, including changes to the interest rates, repayment terms or other items related to the loan authorization. Modifications can be made to any loan, though there may be varying requirements for eligibility.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit us small business administration in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing us small business administration and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit us small business administration on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing us small business administration right away.

How do I edit us small business administration on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute us small business administration from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is us small business administration?

The US Small Business Administration (SBA) is a government agency that provides support to small businesses through loans, contracts, counseling, and other forms of assistance.

Who is required to file us small business administration?

Small businesses that meet the eligibility requirements set by the SBA are required to file.

How to fill out us small business administration?

You can fill out the SBA forms online or by submitting paper forms through mail.

What is the purpose of us small business administration?

The purpose of the SBA is to help small businesses start, grow, and succeed.

What information must be reported on us small business administration?

Information about the business owner, financial records, and business operations must be reported.

Fill out your us small business administration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Small Business Administration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.