KS K-WC 113 2012 free printable template

Show details

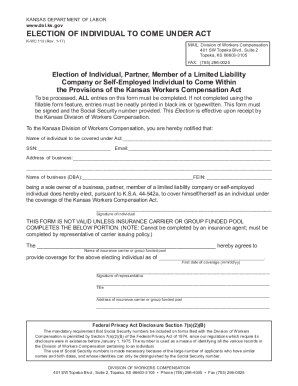

KANSAS DEPARTMENT OF LABOR www.dol.ks.gov ELECTION OF INDIVIDUAL TO COME UNDER ACT KWC 113 (Rev. 612) Election of Individual, Partner, Member of a Limited Liability Company or Reemployed Individual

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ks k come act

Edit your ks k come act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ks k come act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ks k come act online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ks k come act. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS K-WC 113 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ks k come act

How to fill out KS K-WC 113

01

Begin by downloading the KS K-WC 113 form from the appropriate website.

02

Fill out your personal information at the top of the form, including your name, address, and contact details.

03

In the next section, provide the specific details regarding the tax year for which you are filing.

04

Indicate any relevant income sources, ensuring you categorize them correctly.

05

Enter any deductions or credits you may qualify for in the designated section.

06

Review all information filled in the form for accuracy to avoid any future issues.

07

Sign and date the form, making sure you comply with any additional requirements listed.

08

Submit the completed form according to the instructions provided, either electronically or via mail.

Who needs KS K-WC 113?

01

Individuals who are filing state taxes in Kansas may need to fill out the KS K-WC 113 form.

02

Taxpayers who have income from sources that require reporting on this form.

03

Those looking for deductions or credits specific to the Kansas tax jurisdiction.

Fill

form

: Try Risk Free

People Also Ask about

How much is the exemption allowance in Kansas?

The amount of credit is $125 for each qualified exemption. NOTE: Dependents that are 18 years of age or older (born before January 1, 2005) do not qualify as exemptions for this tax credit and no additional exemption is allowed for head of household filing status.

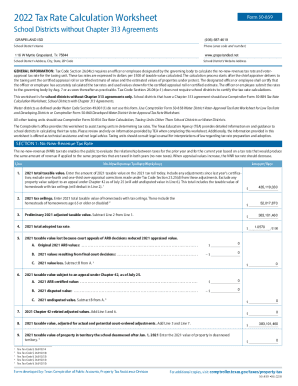

What is the standard deduction for the Kansas K 40?

For most taxpayers, the 2021 standard deduction amounts are: Single: $3,500. Married filing separately: $4,000. Head of household: $6,000.

How do I get a Kansas withholding number?

Kansas Withholding Account Number & Filing Frequency Register online as a new business. You will receive your Tax ID Number immediately after completing the registration online. After 3-5 business days, call the agency at (785) 368-8222 to receive your filing frequency.

What is the standard deduction for dependents in Kansas?

A minor child claimed on another person's return can claim a standard deduction of $3,500. Unearned income (such as interest and dividends) over $3,500 is taxable to Kansas, and a return must be filed.

How do I set up payroll in Kansas?

Thank you for downloading! Step 1: Set up your business as an employer. Step 2: Register with Kansas. Step 3: Create your payroll process. Step 4: Have employees fill out relevant forms. Step 5: Review and approve time sheets. Step 6: Calculate employee gross pay and taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ks k come act online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your ks k come act to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in ks k come act without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your ks k come act, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out ks k come act using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign ks k come act and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is KS K-WC 113?

KS K-WC 113 is a form used in Kansas for reporting employee injuries and occupational diseases to the Workers Compensation Division.

Who is required to file KS K-WC 113?

Employers in Kansas who have an employee that sustains a work-related injury or occupational disease are required to file KS K-WC 113.

How to fill out KS K-WC 113?

To fill out KS K-WC 113, employers must provide information about the employee, the injury, the employer's insurance, and any other relevant details as specified on the form.

What is the purpose of KS K-WC 113?

The purpose of KS K-WC 113 is to formally notify the Kansas Workers Compensation system about an employee's injury or occupational disease so that appropriate benefits can be processed.

What information must be reported on KS K-WC 113?

The information reported on KS K-WC 113 must include the employee's personal details, details of the injury or disease, the date of injury, nature of the claim, and employer and insurance information.

Fill out your ks k come act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ks K Come Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.