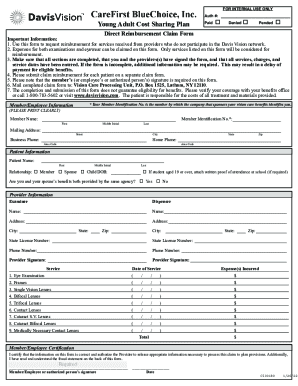

FL Instructions for Levy 2014-2025 free printable template

Show details

This document provides instructions for the sheriff regarding the levy of property based on a Writ of Execution for money judgment in Florida. It includes details such as case number, plaintiff and

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign instructions for levy form

Edit your fl instructions levy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instructions levy fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing florida instructions levy online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit instructions levy form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL Instructions for Levy Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out instructions levy pdf form

How to fill out FL Instructions for Levy

01

Obtain the FL Instructions for Levy form from your local court or download it from the official website.

02

Read the instructions carefully to understand the requirements for filing the levy.

03

Gather necessary information, including the names and addresses of the parties involved, the court case number, and details of the judgment.

04

Complete the form by filling in the required fields accurately and completely.

05

Provide any additional documents or evidence that may be required to support your levy request.

06

Review the form to ensure all information is correct and all necessary documents are attached.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate court or agency, following any specific submission guidelines.

Who needs FL Instructions for Levy?

01

Creditors seeking to collect on a court judgment.

02

Individuals or organizations with a legal right to seize property or funds under a court order.

03

Legal representatives acting on behalf of creditors.

Fill

instructions levy blank

: Try Risk Free

People Also Ask about instructions levy printable

How to fill in CITB levy form?

Provide their names, addresses, CITB Registration Number and Companies House numbers overleaf. Please inform us of your total gross taxable payments made to all employees on the payroll. Please also include payments to any leavers, and furlough payments made under the HMRC Coronavirus Job Retention Scheme (CJRS).

What is CIL Form 2?

Form 2: Assumption of Liability This will outline the charge due, those parties that we consider to be liable to pay CIL and details of the payment procedure. Liability must be assumed by the applicant or liable party by completing Form 1, and in order to make any claim for an exemption to CIL.

What happens if I don't pay CITB levy?

CITB NI offer various methods of payment, however if you fail to make timely payment, CITB NI will add Statutory Interest at a rate of 8% from the date of the overdue assessment.

What is the CITB levy for 2023?

The 2023 Levy Return form will be posted out in Mid-May and available on the CITB online portal from early May, an email notification will be sent to Levy online users when available. The Levy rates for the 2022 & 2023 Levy Assessment are 0.35% for PAYE and 1.25% for Net CIS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete trial instructions for levy online?

Completing and signing instructions levy edit online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit instructions levy fill online?

The editing procedure is simple with pdfFiller. Open your instructions levy download in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the instructions levy online in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your mium instructions for levy in minutes.

What is FL Instructions for Levy?

FL Instructions for Levy refer to the guidelines and procedures provided by the Florida Department of Revenue outlining how to levy the assets of a taxpayer to satisfy unpaid debts or obligations.

Who is required to file FL Instructions for Levy?

Creditors and entities that are owed money by a taxpayer can file FL Instructions for Levy to initiate the process of seizing assets for debt collection.

How to fill out FL Instructions for Levy?

To fill out FL Instructions for Levy, one must complete the provided form with accurate information regarding the debtor, the amount owed, and details of the assets to be levied.

What is the purpose of FL Instructions for Levy?

The purpose of FL Instructions for Levy is to legally authorize the seizure of a taxpayer's assets to collect outstanding debts owed to creditors or tax authorities.

What information must be reported on FL Instructions for Levy?

The information that must be reported includes the taxpayer's name and address, the creditor's details, the amount of debt, and specifics regarding the assets subject to levy.

Fill out your florida instructions for levy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Florida Instructions For Levy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.