JM Form 4D 2013 free printable template

Get, Create, Make and Sign JM Form 4D

How to edit JM Form 4D online

Uncompromising security for your PDF editing and eSignature needs

JM Form 4D Form Versions

How to fill out JM Form 4D

How to fill out JM Form 4D

Who needs JM Form 4D?

Instructions and Help about JM Form 4D

That's administration Jamaica they are established on April 1, 2011, by the revenue administration Amendment Act 2011 consolidating activities of the former England Revenue Department IRD that's the origin assessment Department ta native and tax administration services departments TK XD since then they have become a semi-autonomous Revenue Authority sorrow effective November 3, 2014, and is now operating under a new governance structure and has a management board the Chairman is Mr. Norman MacDonald they report directly to the board and the financial secretary the teenage a seeking to transform its operations and through Human Resources processes of technology and physical infrastructure to accomplish TJ's result of the coming of world transactions TJ's management team include the Commissioner general and for Deputy Commissioner general's Commissioner general Mr. Inslee Powell is charged with the responsibility of providing strategic leadership and vision by advancing the direction and charting the way for an efficient and effective tax administration through innovative strategies and linkages to create a value that supports the government's taxation policies the Commissioner general also has overall responsibility for the daily operations of they and to provide centralized the direction and management to the operations strategic services legal support and management services division building coalitions with key stakeholders and ensuring that taxpayers have confidence in T AG and its operations including collection of the revenue do the administration and enforcement of revenue laws through excellent service delivery as well as the service principal adviser to the financial secretary on matters relating to the administration of tax laws and to contribute to the formulation of tax policies and the amendment of tax legislation the Deputy Commissioner general strategic services division Mr. Hank Williams has a responsibility for directing managing and coordinating the corporate and strategic planning and policy development functions of they Mr. Williams will also monitor and evaluate TJ's performance in relation to its corporate and strategic plans lead and guide the innovation and governance necessary to identify evaluate mitigate and monitor the perceived enterprise operational and strategic risk while ensuring that the risk management policies and strategies are in compliance with applicable international regulations and standards and the strategic imperatives of they as well as to oversee and monitor the development and delivery of programs to improve a voluntary compliance Deputy Commissioner general management services division Marlene Korea she leads the strategic direction and policies relating to the provision of corporate services for they are responsible for planning directing and monitoring the functions of the divisions comprising human resource management and development information and communication technology finance and accounts...

People Also Ask about

What is an S04 form Jamaica?

What is a P45 form in Jamaica?

What tax system does Jamaica use?

What is the concept of tax administration?

What happens if you don't have a P45?

What is P45 form used for?

Can I start a new job without a P45?

How do I file a p24 online?

What happens if you don't pay taxes in Jamaica?

How do I get my P45 from Jamaica?

Do you have to file taxes in Jamaica?

Can I file my tax return by myself?

Who is exempt from income tax in Jamaica?

What is a S04 form?

What is tax administration Jamaica?

What are the steps to file your own taxes?

How much is NHT tax in Jamaica?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit JM Form 4D online?

Can I create an eSignature for the JM Form 4D in Gmail?

Can I edit JM Form 4D on an Android device?

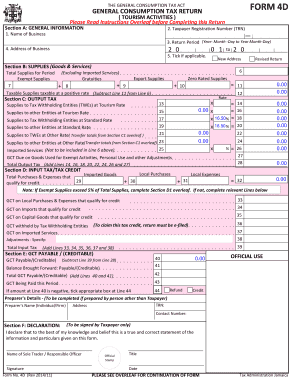

What is JM Form 4D?

Who is required to file JM Form 4D?

How to fill out JM Form 4D?

What is the purpose of JM Form 4D?

What information must be reported on JM Form 4D?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.