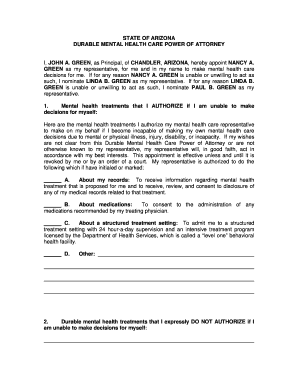

Depreciation Worksheet free printable template

Show details

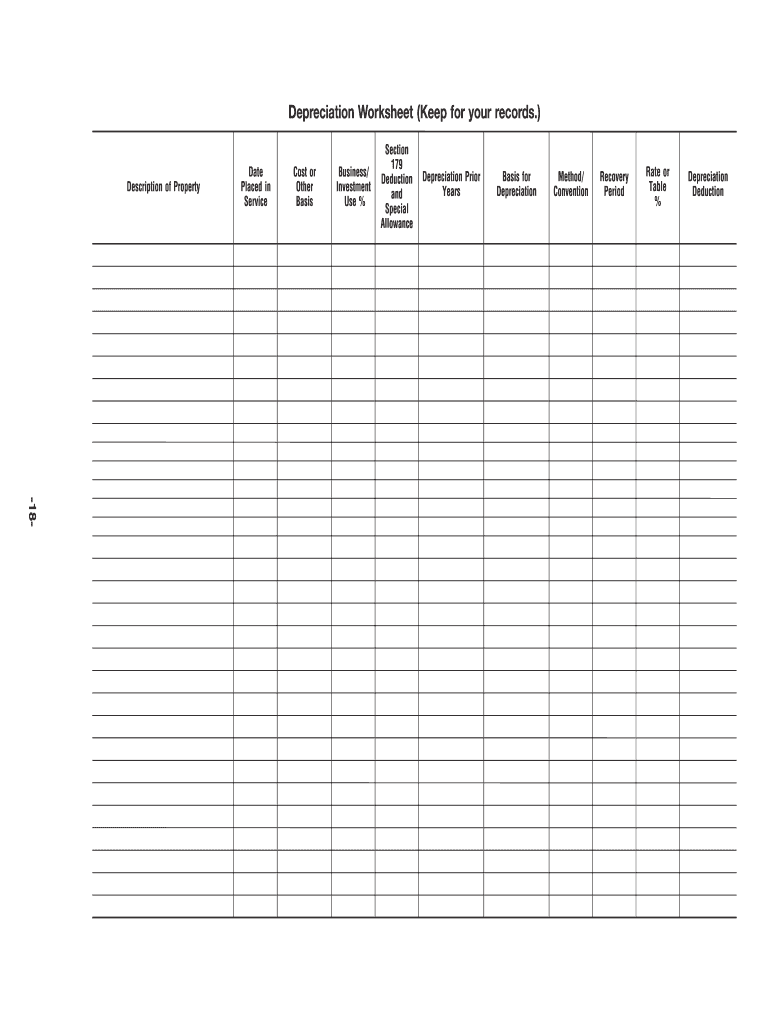

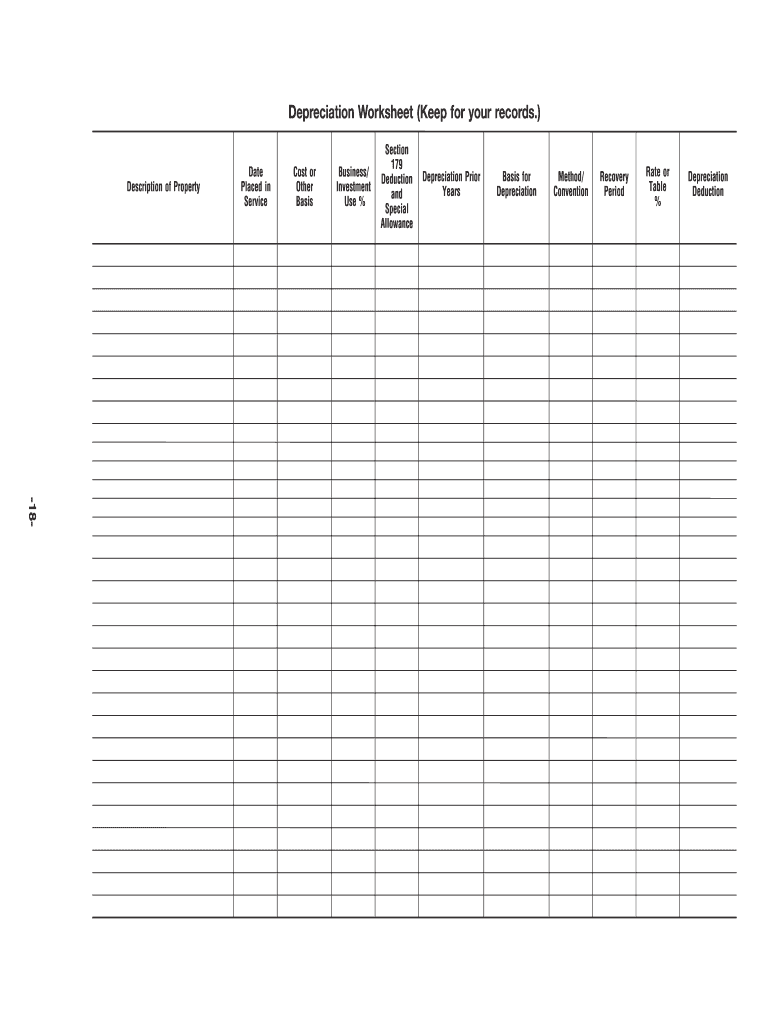

Depreciation Worksheet (Keep for your records.) Description of Property Date Placed in Service Cost or Other Basis Business/ Investment Use % Section 179 Deduction and Special Allowance Depreciation

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign depreciation worksheet pdf form

Edit your worksheet depreciation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal depreciation schedule worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing depreciation worksheet edit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit depreciation worksheet get form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 210707679 form

How to fill out Depreciation Worksheet

01

Gather all relevant information about the asset including purchase date, cost, and useful life.

02

Choose the depreciation method you want to use (e.g., straight-line, declining balance).

03

Enter the asset's purchase cost in the designated section of the worksheet.

04

Document the asset’s estimated useful life in years.

05

Calculate the annual depreciation expense based on the chosen method.

06

Record the accumulated depreciation over the years in the worksheet.

07

Keep track of any asset disposals or impairments and update the worksheet accordingly.

Who needs Depreciation Worksheet?

01

Businesses that own physical assets and want to accurately report their financial statements.

02

Accountants and financial analysts who need to calculate and track depreciation for tax purposes.

03

Organizations looking to manage their assets and plan for future expenditures.

Fill

depreciation detail listing worksheet

: Try Risk Free

People Also Ask about depreciation worksheet search

Do you calculate depreciation in the year of disposal?

Depreciation expense is recorded for property and equipment at the end of each fiscal year and also at the time of an asset's disposal.

What is the IRS depreciation schedule for property?

Depreciation commences as soon as the property is placed in service or available to use as a rental. By convention, most U.S. residential rental property is depreciated at a rate of 3.636% each year for 27.5 years. Only the value of buildings can be depreciated; you cannot depreciate land.

Do you have to take depreciation in year of sale?

When selling the property, however, the depreciation that has been taken must be recaptured and paid back to the government. This is because depreciation is considered to be a form of deferred income, and when the property is sold, the deferred income becomes taxable.

How do you report depreciation?

What IRS forms do I file in order to claim depreciation? To claim rental property depreciation, you'll file IRS Form 4562 to get your deduction. Review the instructions for Form 4562 if you're filing your tax return on your own or consult a qualified financial advisor or tax accountant for assistance.

Do you take depreciation in year of sale rental property?

The depreciation deduction lowers your tax liability for each tax year you own the investment property. It's a tax write off. But when you sell the property, you'll owe depreciation recapture tax. You'll owe the lesser of your current tax bracket or 25% plus state income tax on any deprecation you claimed.

Do you take depreciation in year of sale?

If you sold, scrapped, or otherwise disposed of an asset during the year, you can claim a depreciation deduction for the year of disposal, based on the depreciation convention you used.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send depreciation worksheet create for eSignature?

When you're ready to share your depreciation worksheet make, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in depreciation worksheet trial?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your irs depreciation worksheet to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit depreciation sheet on an iOS device?

Create, edit, and share depreciation worksheets from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is Depreciation Worksheet?

A Depreciation Worksheet is a tax form used to calculate and report the depreciation of an asset over time, detailing the depreciation method, useful life, and the amount of depreciation deducted for a given period.

Who is required to file Depreciation Worksheet?

Individuals and businesses that own depreciable assets and wish to claim depreciation expenses on their tax returns are required to file a Depreciation Worksheet.

How to fill out Depreciation Worksheet?

To fill out a Depreciation Worksheet, gather information on the asset such as purchase date, cost, estimated useful life, and choose a depreciation method. Then, enter these details into the worksheet to calculate the annual depreciation deduction for each asset.

What is the purpose of Depreciation Worksheet?

The purpose of the Depreciation Worksheet is to provide a structured format for calculating and documenting the depreciation of assets, facilitating accurate tax reporting and compliance with tax laws.

What information must be reported on Depreciation Worksheet?

The information that must be reported on a Depreciation Worksheet includes the asset description, purchase date, purchase price, depreciation method used, asset life, and the amount of depreciation claimed for each tax year.

Fill out your Depreciation Worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Depreciation Schedule Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to depreciation worksheet with answers

Related to depreciation list of assets pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.