Get the free Garnishment (NonWage) Notice

Show details

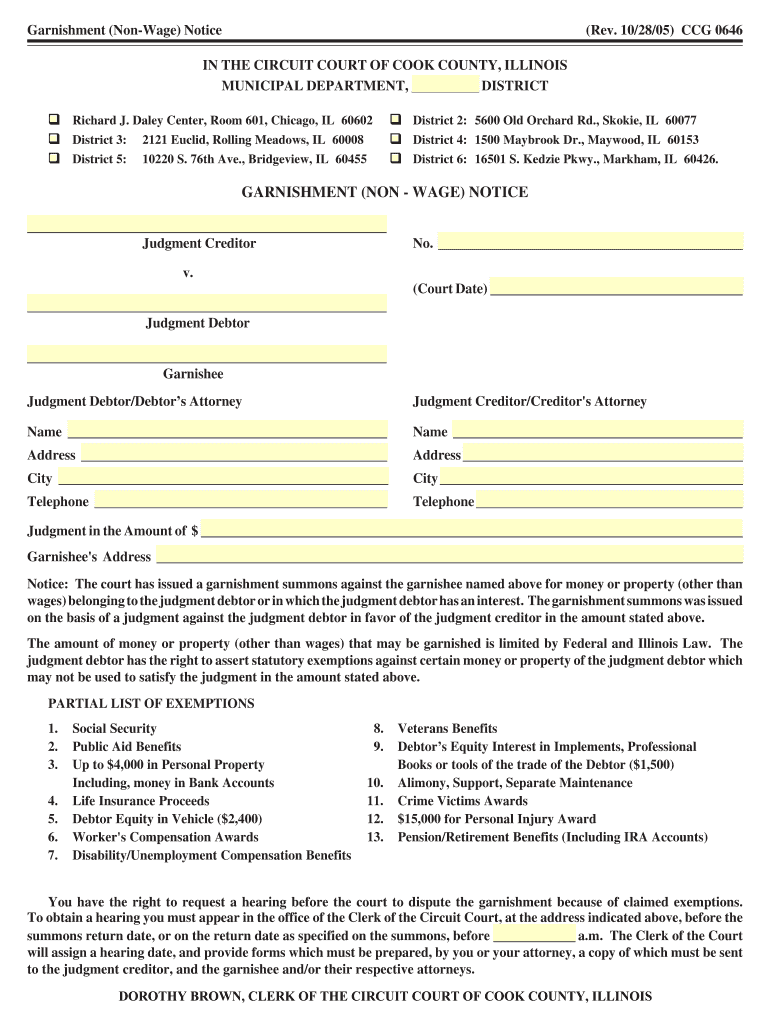

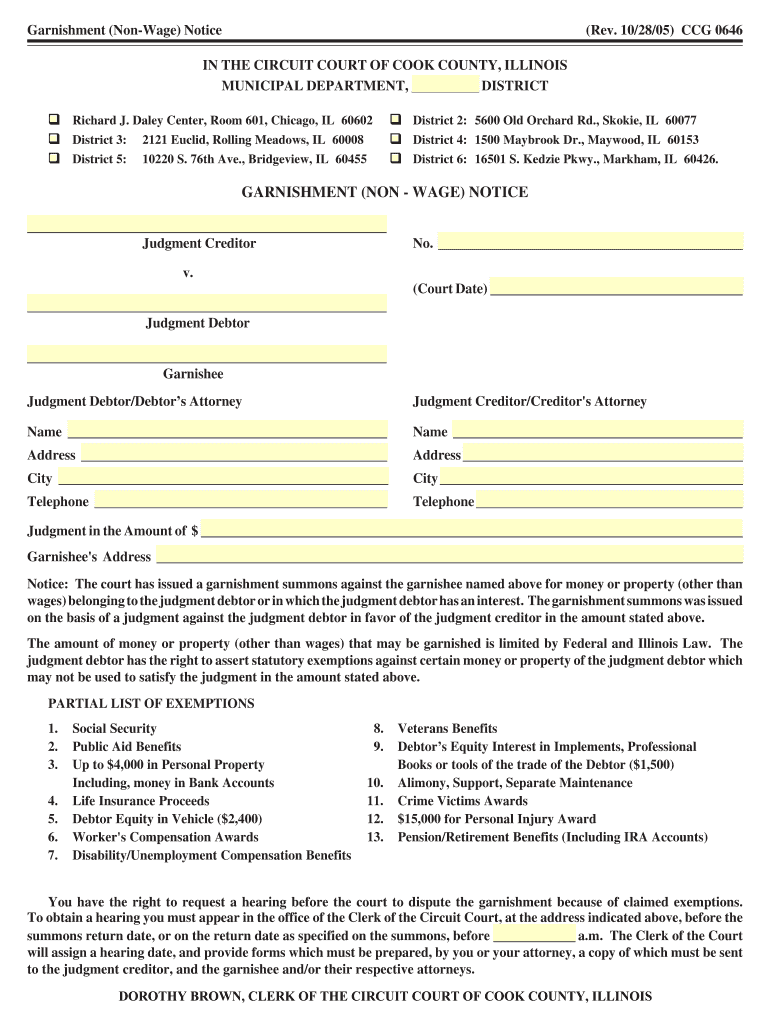

Print Form Garnishment (Nonage) Notice Clear Form (Rev. 10/28/05) CCG 0646 IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS MUNICIPAL DEPARTMENT, DISTRICT Richard J. Daley Center, Room 601, Chicago,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign garnishment nonwage notice

Edit your garnishment nonwage notice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your garnishment nonwage notice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit garnishment nonwage notice online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit garnishment nonwage notice. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out garnishment nonwage notice

How to fill out garnishment nonwage notice:

01

Begin by clearly identifying the parties involved in the garnishment process. This includes providing the name and contact information of the judgment creditor (the party seeking garnishment) and the judgment debtor (the party from whom wages are being garnished).

02

Next, specify the court case information, such as the case number and the court where the judgment was obtained. This ensures that the garnishment nonwage notice is associated with the correct legal case.

03

Include the date of the judgment and the total amount owed by the judgment debtor. This helps to establish the outstanding debt that is subject to wage garnishment.

04

Provide the necessary details about where the garnishment nonwage notice should be sent. This typically involves filling out the name and address of the employer who will be deducting wages from the judgment debtor.

05

Specify the specific amount or percentage of wages that should be garnished. This could be a fixed dollar amount or a percentage of the debtor's disposable earnings, depending on the laws of your jurisdiction.

06

If applicable, indicate any exemptions or limitations on the garnishment. Certain types of income, such as Social Security benefits or certain forms of public assistance, may be protected from garnishment under the law.

07

Sign and date the garnishment nonwage notice to confirm its authenticity and accuracy.

Who needs garnishment nonwage notice:

01

Judgment creditors who have obtained a court-ordered judgment against a debtor may need a garnishment nonwage notice. This notice serves as a formal request to the judgment debtor's employer to withhold a portion of the debtor's wages to satisfy the outstanding debt.

02

Judgment debtors who are subject to wage garnishment need to be aware of the garnishment nonwage notice. This allows them to understand the amount that will be deducted from their wages and take appropriate actions, such as seeking legal advice or negotiating a payment plan.

03

Employers receive and process garnishment nonwage notices to comply with the court order. It is important for employers to carefully review the notice and accurately withhold the specified amount from the employee's wages.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in garnishment nonwage notice?

With pdfFiller, the editing process is straightforward. Open your garnishment nonwage notice in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit garnishment nonwage notice in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing garnishment nonwage notice and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the garnishment nonwage notice in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your garnishment nonwage notice in minutes.

What is garnishment nonwage notice?

A garnishment nonwage notice is a legal document sent to an employer informing them of a court-ordered garnishment of an employee's nonwage assets.

Who is required to file garnishment nonwage notice?

Employers are required to file garnishment nonwage notice when they receive a court-ordered garnishment against an employee's nonwage assets.

How to fill out garnishment nonwage notice?

To fill out a garnishment nonwage notice, the employer must provide information about the court-ordered garnishment, employee's nonwage assets, and other relevant details.

What is the purpose of garnishment nonwage notice?

The purpose of garnishment nonwage notice is to inform the employer about the court-ordered garnishment of an employee's nonwage assets.

What information must be reported on garnishment nonwage notice?

The garnishment nonwage notice must include details about the court order, employee's nonwage assets, amount to be garnished, and other relevant information.

Fill out your garnishment nonwage notice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Garnishment Nonwage Notice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.