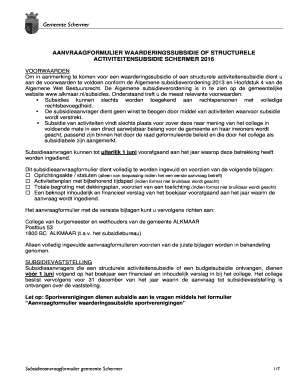

Get the free Partnership or Subchapter S Corporation – Owner Characteristics

Show details

This document serves as a questionnaire to collect information about the characteristics of self-employed individuals, business owners, and their business activities for statistical purposes as required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign partnership or subchapter s

Edit your partnership or subchapter s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your partnership or subchapter s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit partnership or subchapter s online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit partnership or subchapter s. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out partnership or subchapter s

How to fill out Partnership or Subchapter S Corporation – Owner Characteristics

01

Obtain the Partnership or Subchapter S Corporation form from the appropriate state or federal agency.

02

Begin by filling out the name of the entity and the primary address.

03

Provide the owner’s full name, including any business titles, if applicable.

04

Indicate the owner’s social security number or tax identification number.

05

Specify the ownership percentage that each owner holds in the partnership or corporation.

06

List the date on which the ownership began for each owner.

07

Include contact information for each owner, such as phone numbers and email addresses.

08

Review all information for accuracy and completeness.

09

Sign and date the form where required.

10

Submit the form as directed by the regulatory authority.

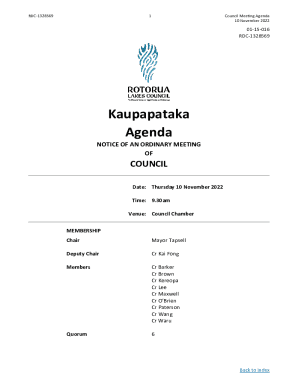

Who needs Partnership or Subchapter S Corporation – Owner Characteristics?

01

Any business entity considering a partnership or subchapter S corporation structure.

02

Business owners and partners who need to define ownership characteristics for legal and tax purposes.

03

Accountants and financial advisors involved in structuring business entities.

04

Legal professionals assisting clients in forming partnerships or S corporations.

Fill

form

: Try Risk Free

People Also Ask about

How does the ownership structure of a partnership differ from that of a corporation?

In a partnership, the company is owned by the general partners and, if applicable, limited partners. General partners make the call on how the daily operations run. In a corporation, the company is owned by its shareholders. They don't get involved in the business's decision-making, though.

Is an LLC a partnership or a corporation?

Other Ways to Determine if a Business is a Corporation Talk to the manager or owner to find out if the business has a board of directors or was formed by the filing of articles of incorporation. These are both indicators that a business is a corporation.

How to tell if a company is a corporation or partnership?

A partnership is a business structure where multiple people share ownership. This can be two or more people who decide they want to take the necessary legal steps to create a business. A corporation is an independent organization that has its own legal and financial structure.

What is the difference between a partnership and an S corporation?

Partnerships require two or more owners To be considered a partnership, the business needs at least two owners. Both S-corps and C-corps can have just one owner. A C-corp can have an unlimited number of owners, while an S-corp can have no more than 100 shareholders.

How do you tell if a company is a corporation or partnership?

The identification number assigned to a business entity by the California Secretary of State at the time of registration. A corporation entity number is a 7 digit number with a C at the beginning. A limited liability company and limited partnership entity number is a 12 digit number with no letter at the beginning.

What is a characteristic of an S corporation?

An S corporation is not a separate taxable entity. It files an information return but not an income tax return. The S corporation's income, losses, and other tax items pass through to its shareholders, who pay their share of the corporation's profits on their personal income tax return at the personal income tax rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

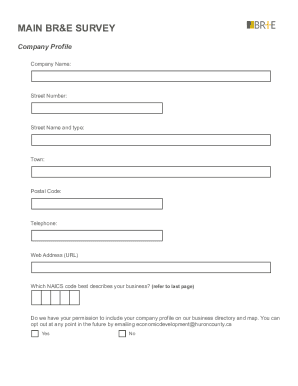

What is Partnership or Subchapter S Corporation – Owner Characteristics?

Partnership or Subchapter S Corporation – Owner Characteristics refer to the defining traits of the owners or shareholders involved in these business structures, such as residency, number of owners, and types of income.

Who is required to file Partnership or Subchapter S Corporation – Owner Characteristics?

All partnerships and Subchapter S corporations with owners or shareholders need to file the owner characteristics to the IRS and provide necessary details about their ownership structure.

How to fill out Partnership or Subchapter S Corporation – Owner Characteristics?

To fill out the Partnership or Subchapter S Corporation – Owner Characteristics, one must gather information about each owner, including their names, addresses, ownership percentage, and any other required identifying details, and input this data into the appropriate tax form.

What is the purpose of Partnership or Subchapter S Corporation – Owner Characteristics?

The purpose is to provide the IRS with essential information regarding the individuals or entities that own interests in the partnership or S corporation, which is crucial for tax compliance and reporting.

What information must be reported on Partnership or Subchapter S Corporation – Owner Characteristics?

The information that must be reported includes the names, addresses, taxpayer identification numbers, ownership percentages, and any specific agreements related to the ownership interests of each partner or shareholder.

Fill out your partnership or subchapter s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Partnership Or Subchapter S is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.