KY KRS Form 6000 2012 free printable template

Show details

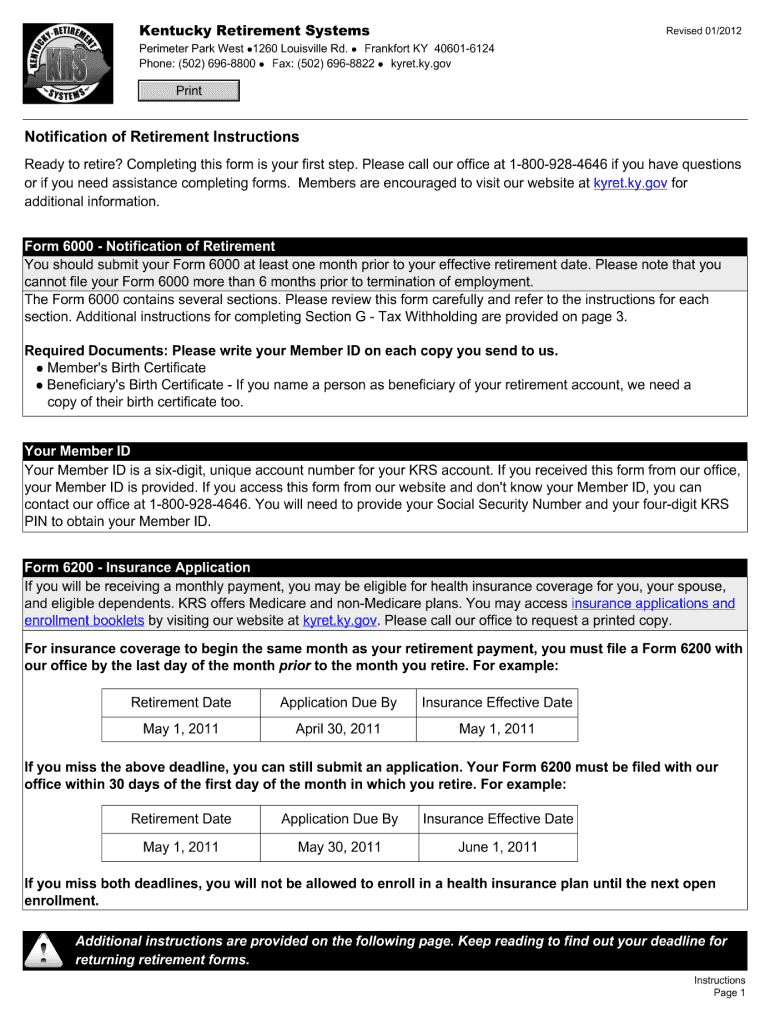

Kentucky Retirement Systems Perimeter Park West l1260 Louisville Rd. l Frankfort KY 40601-6124 Phone: (502) 696-8800 l Fax: (502) 696-8822 l yet.KY.gov Revised 10/2011 Print Notification of Retirement

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY KRS Form 6000

Edit your KY KRS Form 6000 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY KRS Form 6000 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY KRS Form 6000 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit KY KRS Form 6000. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY KRS Form 6000 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY KRS Form 6000

How to fill out KY KRS Form 6000

01

Begin by downloading the KY KRS Form 6000 from the official website.

02

Fill in the entity's name at the top of the form.

03

Provide the entity's Kentucky business identification number.

04

Enter the date of formation or incorporation.

05

Indicate the purpose of the business.

06

List the principal office address.

07

Include the registered agent's name and address.

08

Specify the duration of the entity if not perpetual.

09

Sign and date the form as required.

10

Submit the completed form along with any applicable fees to the Kentucky Secretary of State.

Who needs KY KRS Form 6000?

01

The KY KRS Form 6000 is required for businesses and entities that are forming or registering with the Kentucky Secretary of State.

02

It is necessary for corporations, limited liability companies (LLCs), and other entities seeking to legally operate in Kentucky.

Fill

form

: Try Risk Free

People Also Ask about

How do I cash out my Kentucky retirement?

In order to process a refund of their accumulated account balance, members must complete a Form 4525, Application for Refund of Member Contributions and Direct Rollover/Direct Payment Selection. The member's employer is also required to report the termination date on the monthly report to KPPA.

Can I borrow from my Kentucky state retirement?

Can I borrow money from my account with KPPA? No. There are no provisions in State statutes or regulations that allow KPPA to administer loans from member accounts.

How many years do you have to work for the state of Kentucky to retire?

The requirements for an Unreduced Benefit are: A nonhazardous member, age 57 or older, may retire with no reduction in benefits if the member's age and years of service equal 87 (Rule of 87). A nonhazardous member, age 65, with at least 60 months of service credit may retire at any time with no reduction in benefits.

Can you cash out pension when you quit?

To cash out your pension when leaving a job, there are two ways to move your old plan's balance to a new plan or to an IRA. You can: ask the old plan's trustee to directly transfer the balance to your new plan or an IRA, or.

What is a 6010 form for retirement in Kentucky?

The Form 6010, Final Estimated Retirement Allowance, is required to process the member's retirement benefits. If the member neglects to return a valid Form 6010 to the office by the last business day prior to the effective retirement date, it is likely the member will have a delay in their benefits.

What is the rule of 87 for retirement in Kentucky?

The amount of reduction will depend upon the member's age or years of service at retirement. For example, a member has 18 years of service and is age 52. If the member chooses to retire, their benefit will be reduced to 87% (6.5% for each year away from 20 years of service).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send KY KRS Form 6000 for eSignature?

When you're ready to share your KY KRS Form 6000, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get KY KRS Form 6000?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific KY KRS Form 6000 and other forms. Find the template you need and change it using powerful tools.

How do I fill out KY KRS Form 6000 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign KY KRS Form 6000. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

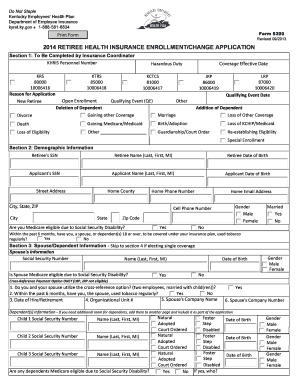

What is KY KRS Form 6000?

KY KRS Form 6000 is a form used in Kentucky to report employee wage information to the Kentucky Labor Cabinet.

Who is required to file KY KRS Form 6000?

Employers in Kentucky who have employees covered by unemployment insurance are required to file KY KRS Form 6000.

How to fill out KY KRS Form 6000?

To fill out KY KRS Form 6000, employers must provide details such as the employee's name, social security number, wages earned, and the employer's information. Instructions are provided on the form for proper completion.

What is the purpose of KY KRS Form 6000?

The purpose of KY KRS Form 6000 is to report the wage information of employees to ensure compliance with state unemployment insurance regulations.

What information must be reported on KY KRS Form 6000?

Information that must be reported includes the employee's name, social security number, total wages paid during the reporting period, and the employer's details.

Fill out your KY KRS Form 6000 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY KRS Form 6000 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.