Get the free Investment Funds to Junior ISA - Chelsea Financial Services

Show details

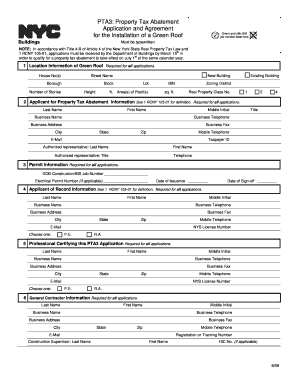

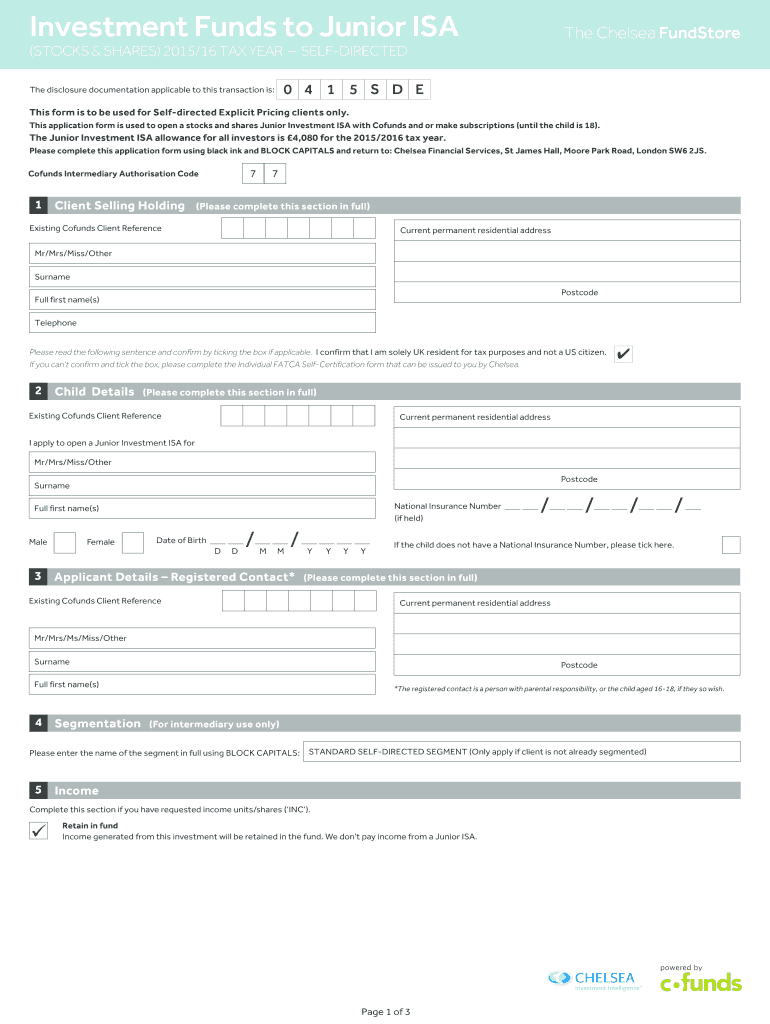

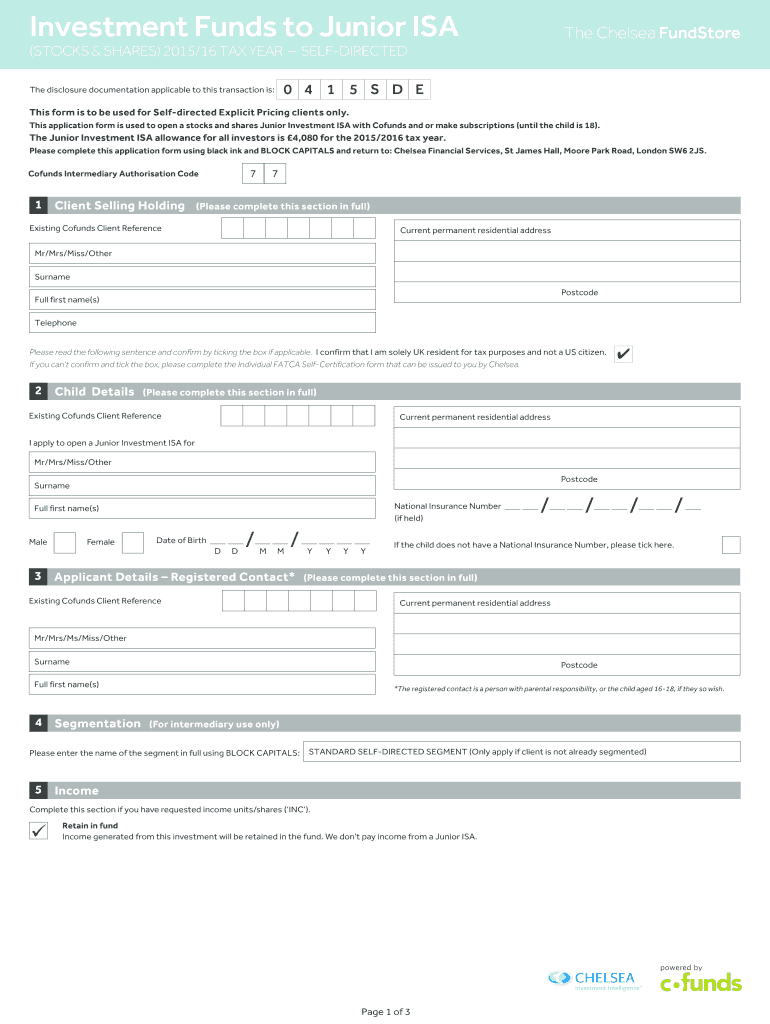

Investment Funds to Junior ISA The Chelsea Fund Store (STOCKS & SHARES) 2015/16 TAX YEAR SELF-DIRECTED The disclosure documentation applicable to this transaction is: 0 4 1 5 S D E This form is to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment funds to junior

Edit your investment funds to junior form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment funds to junior form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing investment funds to junior online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit investment funds to junior. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment funds to junior

How to fill out investment funds to junior:

01

Research investment options: Start by researching different investment funds that are suitable for juniors. Look for funds that have a good track record, low fees, and a suitable risk level for your junior's age and investment goals.

02

Open a custodial account: In order to invest on behalf of a junior, you will need to open a custodial account. This account will be held in the junior's name, but managed by an adult until the junior reaches the age of majority.

03

Complete the necessary paperwork: Fill out any required paperwork to open the custodial account. This may involve providing personal information, such as social security numbers, as well as signing agreements related to the account's management.

04

Determine the investment amount: Decide how much money you want to invest in the junior's fund. Consider the junior's investment goals, time horizon, and risk tolerance when making this decision.

05

Set up automatic contributions: To ensure a consistent investment strategy, consider setting up automatic contributions to the junior's investment fund. This can be done by linking a bank account to the custodial account and setting a regular contribution amount.

06

Monitor and adjust the investment: Keep an eye on the performance of the investment fund and make any necessary adjustments over time. This may involve rebalancing the portfolio or switching to a different fund if the current one is underperforming.

Who needs investment funds to junior:

01

Parents or guardians: Parents or guardians who want to invest money on behalf of their children can utilize investment funds for juniors. This allows them to build a savings or investment portfolio for their child's future financial needs.

02

Relatives or friends: Family members or friends may also want to contribute to a junior's investment fund as a way to support their future financial well-being. This can help the junior in achieving their long-term goals, such as education expenses or starting a business.

03

Institutions or organizations: Schools, charities, or other institutions may establish investment funds for juniors to provide financial support for their students or members. This can be in the form of scholarships, grants, or other benefits that help the juniors achieve their aspirations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my investment funds to junior in Gmail?

investment funds to junior and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify investment funds to junior without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including investment funds to junior. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I edit investment funds to junior on an iOS device?

You certainly can. You can quickly edit, distribute, and sign investment funds to junior on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is investment funds to junior?

Investment funds to junior is a financial vehicle designed to pool together funds from multiple investors to invest in various securities.

Who is required to file investment funds to junior?

Any entity that manages or administers an investment fund on behalf of junior investors is required to file investment funds to junior.

How to fill out investment funds to junior?

Investment funds to junior can be filled out electronically through the required regulatory platform, providing all necessary information and documents as per the guidelines.

What is the purpose of investment funds to junior?

The purpose of investment funds to junior is to provide junior investors with access to a diversified portfolio of investments managed by professionals.

What information must be reported on investment funds to junior?

Information such as the fund's performance, fees, investment strategy, and risk management processes must be reported on investment funds to junior.

Fill out your investment funds to junior online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Funds To Junior is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.