Get the free 7 Student Credit Card Solicitations

Show details

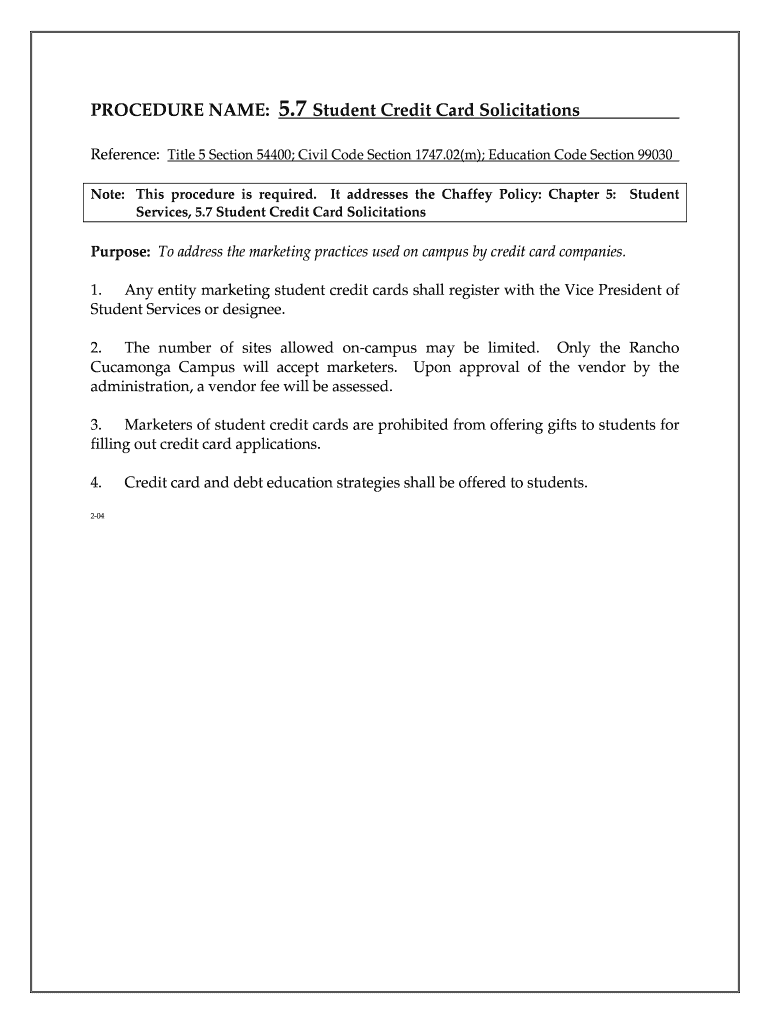

PROCEDURE NAME:5.7 Student Credit Card SolicitationsReference: Title 5 Section 54400; Civil Code Section 1747.02(m); Education Code Section 99030

Note: This procedure is required. It addresses the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 7 student credit card

Edit your 7 student credit card form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 7 student credit card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 7 student credit card online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 7 student credit card. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 7 student credit card

How to fill out a student credit card:

01

Research different credit card options: Start by comparing different credit cards specifically designed for students. Look for features such as low interest rates, no annual fees, and rewards programs that are suitable for your needs.

02

Check eligibility criteria: Each credit card provider may have different eligibility requirements. Ensure that you meet the minimum age requirement, usually 18 years or older. Additionally, some credit cards may require proof of enrollment in a college or university.

03

Gather necessary documents: Before filling out the application, gather all the necessary documents. This may include your identification documents (such as driver's license or passport), social security number, proof of enrollment, and any other documents required by the credit card issuer.

04

Fill out the application form: Carefully fill out the application form, providing accurate and honest information. Ensure that you accurately enter your personal details, contact information, and financial information. Double-check for any errors before submitting the application.

05

Provide financial information: As a student, you may not have a well-established credit history. In such cases, you can provide details about your income, including part-time jobs, scholarships, or allowances. If you have any existing bank accounts, providing the details can also help in the application process.

06

Read and understand the terms and conditions: Before submitting your application, carefully read and understand the terms and conditions of the credit card. Pay attention to interest rates, fees, grace periods, and repayment schedules. This will help you make informed decisions and avoid any surprises later on.

07

Submit the application: Once you have completed all the necessary steps, submit your credit card application. Some credit card issuers provide online applications, while others may require submission by mail or in person. Follow the instructions provided by the issuer to ensure a smooth application process.

Who needs a student credit card?

01

College or university students: A student credit card can be helpful for college or university students who want to begin building their credit history. It can also provide a financial safety net in case of emergencies or unexpected expenses.

02

Students studying abroad: For students studying in a foreign country, having a credit card can provide a convenient and secure payment method. It can also offer additional benefits such as foreign transaction fee waivers or travel rewards.

03

Students learning financial responsibility: A student credit card can serve as a valuable tool for learning financial responsibility. By using and managing a credit card wisely, students can develop good spending habits and build a positive credit history for their future financial goals.

04

Students with limited or no credit history: Since student credit cards are designed for individuals with limited or no credit history, they can be a great option for students looking to establish credit. By using a credit card responsibly, students can demonstrate their creditworthiness over time.

05

Students looking to earn rewards: Some student credit cards offer rewards programs that can benefit students who frequently make purchases. These rewards may include cashback, points, or discounts on specific categories like groceries or dining.

Overall, a student credit card can be a valuable financial tool for students who want to start building their credit history, learn financial responsibility, and enjoy the benefits that come with responsible credit card usage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 7 student credit card in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign 7 student credit card and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit 7 student credit card in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your 7 student credit card, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out 7 student credit card using my mobile device?

Use the pdfFiller mobile app to complete and sign 7 student credit card on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is 7 student credit card?

A student credit card is a credit card designed specifically for college students.

Who is required to file 7 student credit card?

College students who are looking to establish credit and manage their finances.

How to fill out 7 student credit card?

To fill out a student credit card application, you will need to provide personal information, such as your name, address, income, and school information.

What is the purpose of 7 student credit card?

The purpose of a student credit card is to help college students build credit and learn responsible financial habits.

What information must be reported on 7 student credit card?

On a student credit card application, you may need to report your income, address, school information, and other personal details.

Fill out your 7 student credit card online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

7 Student Credit Card is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.