Get the free SECTION 125 CAFETERIA PLAN ELECTION FORM: Employer Name: Employee Name: Plan Year: P...

Show details

SECTION 125 CAFETERIA PLAN ELECTION FORM: Employer Name: Employee Name: Plan Year: PALMA SCHOOL 70115 to 63016 SSNs: Address: Phone #: Birth Date: City: State: Zip: Email: Pay Cycle: Monthly 12 If

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section 125 cafeteria plan

Edit your section 125 cafeteria plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section 125 cafeteria plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing section 125 cafeteria plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit section 125 cafeteria plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

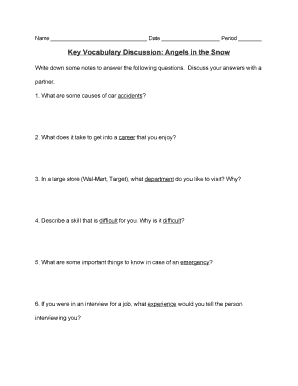

How to fill out section 125 cafeteria plan

How to fill out section 125 cafeteria plan:

01

Determine eligibility: First, you need to determine if you are eligible for a section 125 cafeteria plan. Generally, this plan is available to employees of companies that offer it as a benefit.

02

Obtain the necessary forms: Contact your employer or benefits administrator to obtain the necessary forms for enrolling in the cafeteria plan. These forms may include an enrollment form, a salary reduction agreement, and a list of eligible expenses.

03

Review your options: Take the time to review the different options available through the cafeteria plan. These options typically include health insurance, dental and vision coverage, dependent care assistance, and flexible spending accounts (FSAs) for medical expenses or dependent care.

04

Make your elections: Once you have reviewed the available options, indicate your selections on the enrollment form. This may involve choosing specific insurance plans, selecting contribution amounts for FSAs, and deciding how much to contribute towards dependent care expenses.

05

Complete the salary reduction agreement: If you elected to participate in the cafeteria plan's FSAs, you will need to complete a salary reduction agreement. This document authorizes your employer to withhold a portion of your salary on a pre-tax basis to fund your FSA contributions.

06

Submit the forms: After completing all the necessary forms, submit them to your employer or benefits administrator by the specified deadline. Ensure that you keep a copy of the forms for your records.

Who needs section 125 cafeteria plan:

01

Employers: Section 125 cafeteria plans are beneficial for employers as they allow them to offer a range of valuable benefits to their employees. By providing access to pre-tax savings accounts and various insurance options, employers can enhance their employee benefits package and attract talented individuals.

02

Employees: Employees who want to take advantage of pre-tax savings and flexibility in selecting their benefits should consider a section 125 cafeteria plan. These plans allow employees to customize their benefits to meet their individual needs, potentially saving them money on insurance premiums and eligible expenses.

03

Small businesses: Section 125 cafeteria plans can be particularly advantageous for small businesses. These plans can level the playing field by allowing small business employees to access the same benefits and savings options enjoyed by employees of larger corporations. Additionally, implementing a cafeteria plan can demonstrate that a small business values and cares about its employees' well-being.

Please note that individual circumstances may vary, and it's always advisable to consult with a benefits specialist or HR representative to fully understand the implications and requirements of a section 125 cafeteria plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is section 125 cafeteria plan?

A section 125 cafeteria plan allows employees to choose between receiving cash or benefits, such as health insurance, on a pre-tax basis.

Who is required to file section 125 cafeteria plan?

Employers who offer cafeteria plans to their employees are required to file section 125 cafeteria plan.

How to fill out section 125 cafeteria plan?

To fill out a section 125 cafeteria plan, employers must provide the necessary information including employee choices for benefits and contributions.

What is the purpose of section 125 cafeteria plan?

The purpose of a section 125 cafeteria plan is to allow employees to choose and pay for certain benefits on a pre-tax basis, ultimately saving money.

What information must be reported on section 125 cafeteria plan?

The section 125 cafeteria plan must report employee choices for benefits, contributions, and any changes made during the plan year.

How do I edit section 125 cafeteria plan online?

With pdfFiller, it's easy to make changes. Open your section 125 cafeteria plan in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the section 125 cafeteria plan electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your section 125 cafeteria plan in seconds.

How can I fill out section 125 cafeteria plan on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your section 125 cafeteria plan, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your section 125 cafeteria plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section 125 Cafeteria Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.