Get the free Electronic mortgage bdocumentb certification

Show details

US008626647B1 (12) United States Patent (10) Patent N0.2 Trimble, Jr. ET a . (54) US 8,626,647 B1 (45) Date of Patent: Jan. 7, 2014 ELECTRONIC MORTGAGE DOCUMENT 5,671,282 A 9/1997 Wolff et a1. .................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign electronic mortgage bdocumentb certification

Edit your electronic mortgage bdocumentb certification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your electronic mortgage bdocumentb certification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing electronic mortgage bdocumentb certification online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit electronic mortgage bdocumentb certification. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

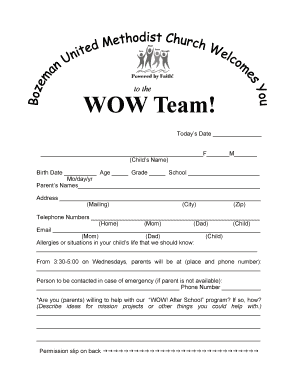

How to fill out electronic mortgage bdocumentb certification

How to fill out electronic mortgage document certification?

01

Start by carefully reading the instructions provided with the electronic mortgage document certification. It is important to understand the requirements and any specific guidelines mentioned.

02

Gather all the necessary documents and information that may be needed to complete the certification. This could include personal identification details, financial statements, and other relevant paperwork.

03

Open the electronic mortgage document certification form on a secure and trusted platform. Ensure that the platform is reliable and offers encryption for data protection.

04

Fill in your personal information accurately. This may include your full name, address, contact details, and social security number. Double-check the entered information for any errors or typos.

05

Provide details about the mortgage loan for which the certification is being filled out. This might include the loan amount, the mortgage lender's name, and other relevant loan terms.

06

Read each statement or question on the certification form carefully, and respond truthfully based on your knowledge and understanding. Be cautious and avoid any misrepresentation or misinformation.

07

If there are any additional sections or attachments required, make sure to complete them accurately and attach the relevant documents as instructed.

08

Review the filled electronic mortgage document certification thoroughly before submitting it. Check for any missing information, inaccuracies, or inconsistencies. Make necessary corrections if needed.

09

Sign the electronic certification using the designated digital signature method or e-signature tool provided on the platform. Ensure that your signature is legally binding and compliant with the electronic signature regulations.

10

Submit the completed electronic mortgage document certification as per the instructions provided. Keep a copy of the submitted certification for your records.

Who needs electronic mortgage document certification?

01

Individuals or borrowers applying for a mortgage loan, either for purchasing a property or refinancing an existing mortgage, may need electronic mortgage document certification. This certification ensures that the borrower has provided accurate and complete information regarding their loan application.

02

Mortgage lenders or financial institutions may require electronic mortgage document certification as part of their due diligence process. It helps them verify the borrower's eligibility, financial capacity, and compliance with regulations.

03

Real estate professionals, such as mortgage brokers, agents, or attorneys, involved in the mortgage loan process may also require electronic mortgage document certification. This certification allows them to fulfill their legal and professional obligations and ensure the accuracy of the information provided to lenders and clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is electronic mortgage document certification?

Electronic mortgage document certification is a process in which mortgage documents are verified and certified electronically to ensure authenticity and compliance with regulations.

Who is required to file electronic mortgage document certification?

Lenders, borrowers, and other parties involved in the mortgage process may be required to file electronic mortgage document certification.

How to fill out electronic mortgage document certification?

Electronic mortgage document certification can be filled out online through a secure portal provided by the mortgage lender or service provider.

What is the purpose of electronic mortgage document certification?

The purpose of electronic mortgage document certification is to streamline the mortgage process, reduce paperwork, and ensure legal compliance and authenticity of mortgage documents.

What information must be reported on electronic mortgage document certification?

Electronic mortgage document certification may include information such as loan amount, property details, borrower information, and signatures of parties involved.

How can I send electronic mortgage bdocumentb certification for eSignature?

When you're ready to share your electronic mortgage bdocumentb certification, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete electronic mortgage bdocumentb certification on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your electronic mortgage bdocumentb certification, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I fill out electronic mortgage bdocumentb certification on an Android device?

Use the pdfFiller Android app to finish your electronic mortgage bdocumentb certification and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your electronic mortgage bdocumentb certification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Electronic Mortgage Bdocumentb Certification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.