Get the free Trust and Estate Trade Use SA901 supplementary pages to declare details of trades wh...

Show details

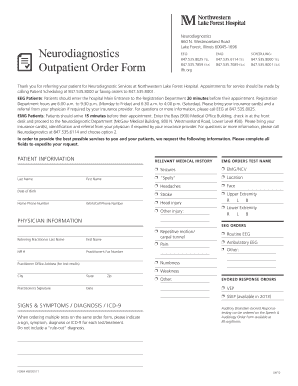

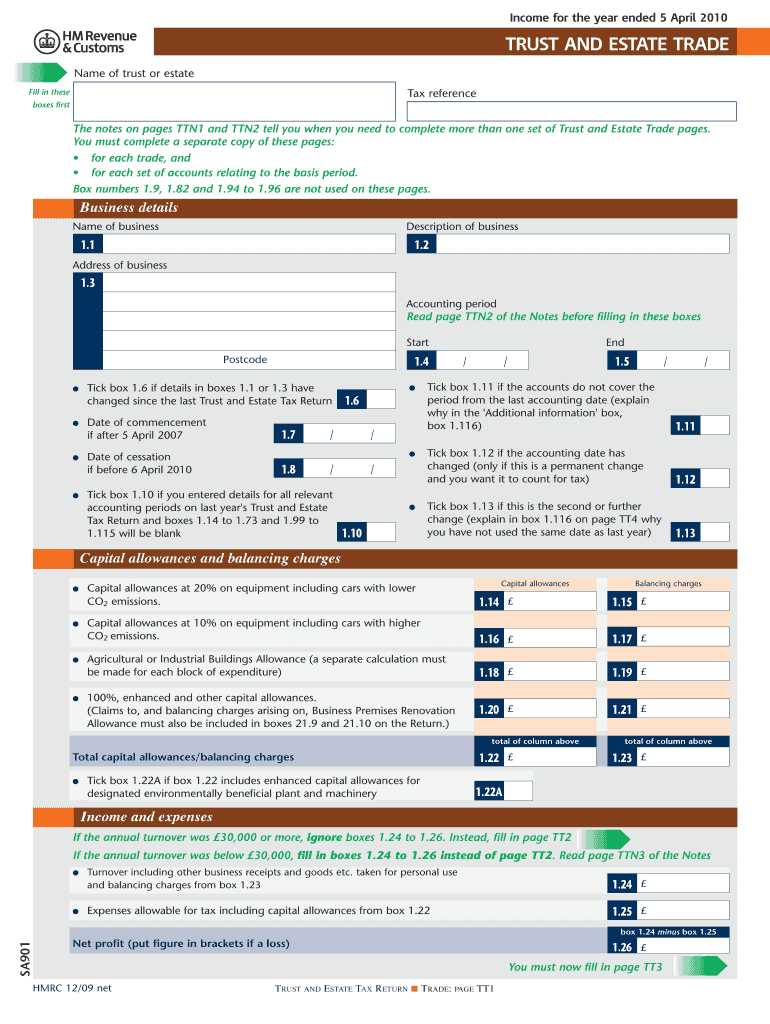

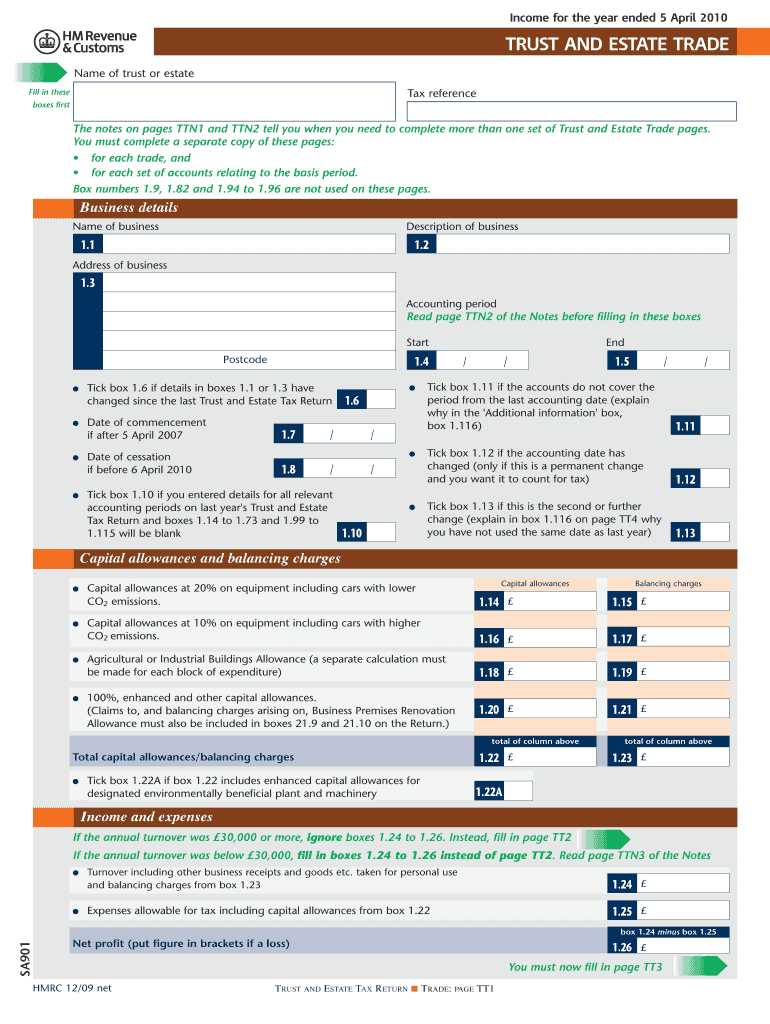

Income for the year ended 5 April 2010 TRUST AND ESTATE TRADE Name of trust or estate Fill in these Tax reference boxes first The notes on pages TTN1 and TTN2 tell you when you need to complete more

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trust and estate trade

Edit your trust and estate trade form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust and estate trade form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing trust and estate trade online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit trust and estate trade. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust and estate trade

How to fill out trust and estate trade:

01

Gather all necessary documents related to the trust and estate, such as the trust agreement, will, and any relevant financial statements or tax documents.

02

Review the trust and estate documents to understand the specific instructions and provisions outlined within them.

03

Identify and list all the assets and liabilities associated with the trust and estate, including real estate, investments, bank accounts, and debts.

04

Determine the fair market value of each asset as of the date of the trade. This may require obtaining appraisals or consulting with professionals.

05

Consult with legal and financial advisors to ensure compliance with any applicable laws, regulations, and tax obligations.

06

Consider any potential risks or tax implications associated with the trade and develop a plan accordingly.

07

Complete the necessary paperwork for the trade, which may involve filling out forms or drafting legal documents.

08

Obtain any required signatures or approvals from beneficiaries, trustees, or other relevant parties.

09

Submit the completed paperwork to the appropriate authorities or institutions involved in the trade, such as banks or investment firms.

10

Keep thorough records of the trade, including copies of all documents and communication related to the process.

Who needs trust and estate trade?

01

Individuals who have set up a trust as part of their estate planning to control the distribution of their assets after their death.

02

Executors or trustees who are responsible for managing and administering the trust and estate according to the wishes of the deceased.

03

Beneficiaries of a trust who may have a say in any trading decisions related to the assets held within the trust.

04

Legal or financial professionals who specialize in trust and estate planning and can provide guidance and expertise throughout the trade process.

05

Institutions or organizations involved in the trade, such as banks, investment firms, or tax authorities, who may require documentation or approval for the trade.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send trust and estate trade to be eSigned by others?

Once your trust and estate trade is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in trust and estate trade without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit trust and estate trade and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out trust and estate trade on an Android device?

Use the pdfFiller mobile app and complete your trust and estate trade and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is trust and estate trade?

Trust and estate trade refers to the buying and selling of assets held in a trust or estate.

Who is required to file trust and estate trade?

Individuals or entities who are responsible for managing a trust or estate are required to file trust and estate trade.

How to fill out trust and estate trade?

Trust and estate trade can be filled out by providing detailed information about the assets bought and sold within the trust or estate.

What is the purpose of trust and estate trade?

The purpose of trust and estate trade is to document the transactions involving assets held in a trust or estate.

What information must be reported on trust and estate trade?

Information such as the date of the transaction, the description of the asset, the purchase price, and the sale price must be reported on trust and estate trade.

Fill out your trust and estate trade online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust And Estate Trade is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.