Get the free Franklin Templeton Bank Trust FSB Profit Sharing

Show details

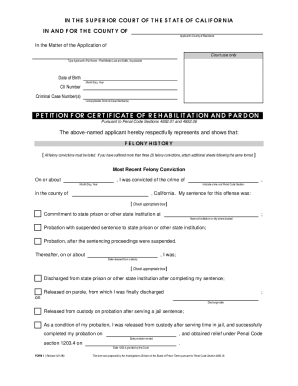

Franklin Templeton Bank & Trust, F.S.B. Profit Sharing Plan Designation of Beneficiary Form For assistance, please call your financial advisor or Franklin Templeton Retirement Services at 1800/5272020.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign franklin templeton bank trust

Edit your franklin templeton bank trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your franklin templeton bank trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing franklin templeton bank trust online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit franklin templeton bank trust. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out franklin templeton bank trust

How to fill out Franklin Templeton bank trust:

01

Gather necessary information: Before filling out the Franklin Templeton bank trust, gather all the required information such as personal details, financial information, and beneficiaries' information. This may include names, addresses, Social Security numbers, and contact details.

02

Review the trust agreement: Carefully read through the Franklin Templeton bank trust agreement to understand the terms and conditions. Make sure you are familiar with the responsibilities and obligations mentioned in the agreement.

03

Complete the personal information section: Start by filling out the personal information section of the trust document. This typically includes your full legal name, date of birth, address, and contact details. Ensure all the information provided is accurate and up to date.

04

Provide financial information: Fill in the financial information section of the trust, which may include details about your assets, liabilities, and income sources. Be thorough and precise while providing this information to avoid any future complications.

05

Designate beneficiaries: Clearly specify the beneficiaries who will benefit from the trust in the designated section. Include their full names, relationship to you, and their respective shares or percentages.

06

Appoint a trustee: Name a trustee who will manage and administer the trust according to your wishes. The trustee is responsible for making financial and distribution decisions outlined in the trust agreement. Ensure you have discussed this role with the person you intend to appoint as trustee.

07

Review and sign the document: Carefully review the completed Franklin Templeton bank trust document to ensure accuracy and compliance with your intentions. Seek legal advice if needed. Once satisfied, sign the document in the presence of witnesses as required by law.

Who needs Franklin Templeton bank trust?

01

Individuals with substantial assets: Franklin Templeton bank trust is suitable for individuals who possess significant assets and want to ensure proper management and distribution of their wealth.

02

Those concerned about estate planning: The trust provides an effective tool for estate planning, allowing individuals to have control over the distribution of their assets after their demise while minimizing potential probate complications.

03

High net worth families: Franklin Templeton bank trust can be advantageous for high net worth families looking to protect and preserve their wealth for future generations, as well as establish guidelines for how their assets should be managed.

04

Charitably inclined individuals: The trust allows individuals to make charitable donations or establish charitable foundations as part of their estate plan, ensuring their philanthropic goals are fulfilled.

05

Business owners: Business owners can utilize Franklin Templeton bank trust as a means to plan for the succession and continuity of their business. The trust can help preserve the business assets and outline the future management or ownership transfer.

It is crucial to consult a qualified financial advisor or estate planning attorney when considering a Franklin Templeton bank trust, as they can provide personalized guidance based on individual circumstances and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify franklin templeton bank trust without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your franklin templeton bank trust into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit franklin templeton bank trust online?

The editing procedure is simple with pdfFiller. Open your franklin templeton bank trust in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out franklin templeton bank trust on an Android device?

Use the pdfFiller mobile app and complete your franklin templeton bank trust and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is franklin templeton bank trust?

Franklin Templeton Bank Trust is a financial institution that offers trust services to individuals and businesses.

Who is required to file franklin templeton bank trust?

Individuals and businesses who have assets held in a trust administered by Franklin Templeton Bank Trust are required to file the necessary documents.

How to fill out franklin templeton bank trust?

To fill out the necessary forms for Franklin Templeton Bank Trust, individuals and businesses can contact their trust advisor or visit the bank's website for specific instructions.

What is the purpose of franklin templeton bank trust?

The purpose of Franklin Templeton Bank Trust is to help individuals and businesses manage their assets and investments through a trust structure.

What information must be reported on franklin templeton bank trust?

Information such as the assets held in the trust, investment strategies, and beneficiaries must be reported on Franklin Templeton Bank Trust documents.

Fill out your franklin templeton bank trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Franklin Templeton Bank Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.