Get the free LOAN ESTIMATE LE FEE SHEET - afrwholesalecom

Show details

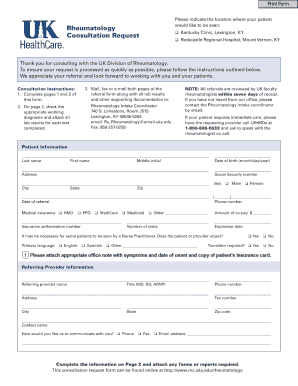

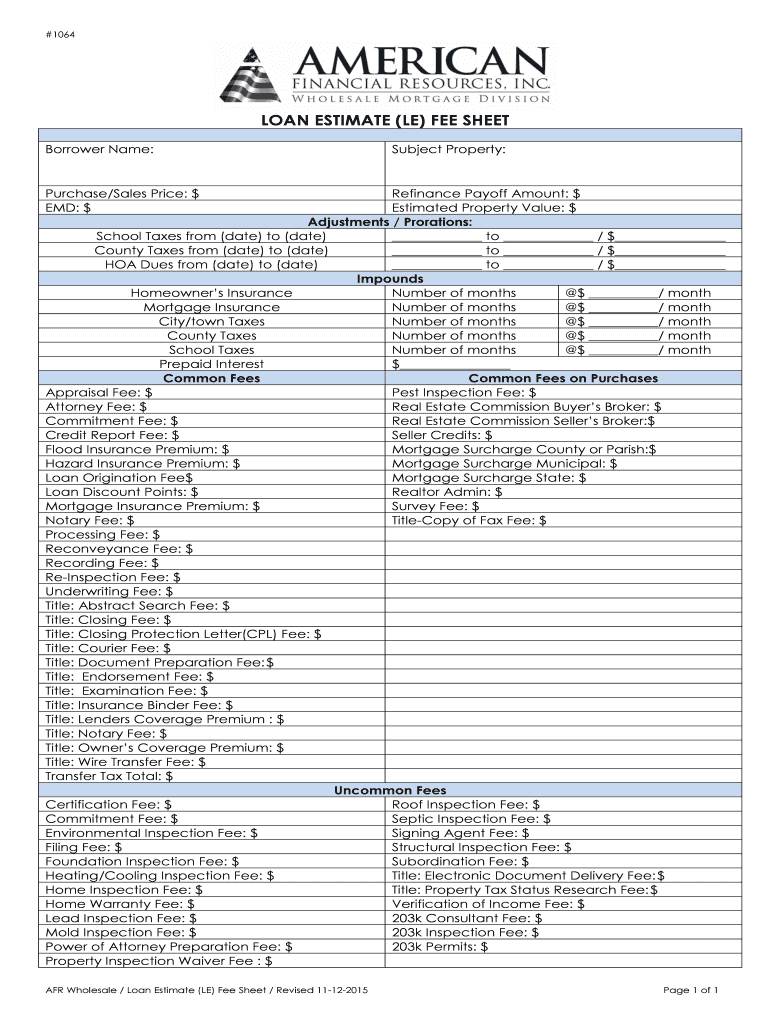

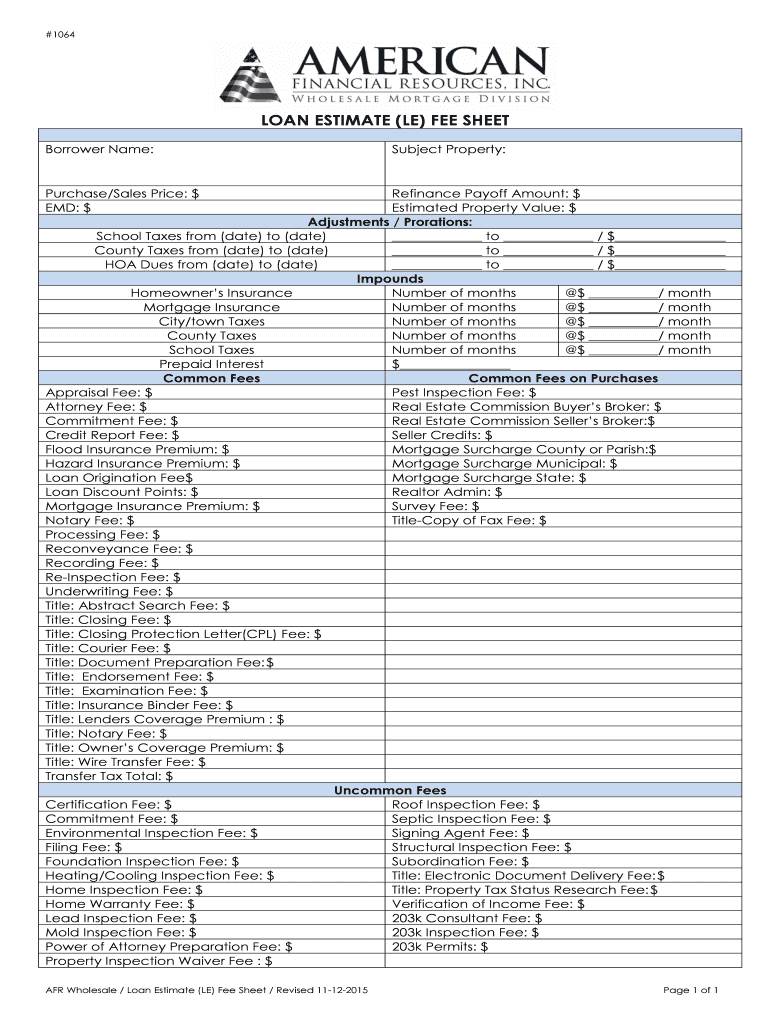

#1064 LOAN ESTIMATE (LE) FEE SHEET AFR Wholesale / Loan Estimate (LE) Fee Sheet / Revised 11122015 ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan estimate le fee

Edit your loan estimate le fee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan estimate le fee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan estimate le fee online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit loan estimate le fee. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan estimate le fee

How to fill out loan estimate le fee:

01

Begin by reviewing the loan estimate document provided by your lender. It will detail the loan terms, interest rate, and fees associated with the loan.

02

Take note of the loan estimate le fee, which stands for "loan estimate origination and lender fees." This fee includes charges for processing the loan application, underwriting, and administrative costs.

03

Determine whether you are comfortable with the le fee and consider comparing it with other lenders to ensure you are getting a competitive rate.

04

If you decide to proceed with the loan, gather all necessary documentation required by the lender. This might include pay stubs, bank statements, tax returns, and proof of identification.

05

Complete the loan application form accurately and provide all requested information. It is crucial to be honest and transparent to avoid any future complications.

06

Once you have submitted the loan application, the lender will review it along with your supporting documents.

07

After the review process, the lender will issue a loan estimate that includes the le fee and other associated costs. Analyze this estimate carefully to verify that all the fees are disclosed accurately.

08

If you have any questions or concerns regarding the loan estimate or the le fee, reach out to your lender for clarification. It is important to understand the terms before proceeding.

09

If you are satisfied with the loan terms and the le fee, you can proceed with the loan by providing any additional information or documents requested by the lender.

10

Finally, carefully review and sign all necessary loan documents when they are presented to you. Make sure you fully understand the terms and conditions of the loan before signing.

Who needs loan estimate le fee?

01

Individuals or entities seeking a mortgage loan are the ones who need loan estimate le fee.

02

Homebuyers who are in the process of applying for a mortgage or refinancing their existing loan will need to review and understand the loan estimate le fee.

03

Borrowers who want to compare loan offers from different lenders must pay attention to the le fee as it can vary among lenders.

04

People who want to ensure transparency in the loan process and be aware of the upfront costs associated with obtaining a loan should be interested in the loan estimate le fee.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit loan estimate le fee from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your loan estimate le fee into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit loan estimate le fee straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing loan estimate le fee right away.

How do I fill out loan estimate le fee using my mobile device?

Use the pdfFiller mobile app to fill out and sign loan estimate le fee on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is loan estimate le fee?

The Loan Estimate (LE) fee is a form that provides important details about a mortgage you have applied for, including the estimated interest rate, monthly payment amount, and closing costs.

Who is required to file loan estimate le fee?

Lenders are required to provide a Loan Estimate (LE) to potential borrowers within 3 business days of receiving a loan application.

How to fill out loan estimate le fee?

To fill out a Loan Estimate (LE) form, the lender will need information about the loan amount, interest rate, estimated monthly payments, and closing costs.

What is the purpose of loan estimate le fee?

The purpose of the Loan Estimate (LE) is to help borrowers understand the terms and costs associated with the mortgage they are applying for.

What information must be reported on loan estimate le fee?

The Loan Estimate (LE) must include details such as the loan amount, interest rate, monthly payments, closing costs, and any other fees or charges associated with the mortgage.

Fill out your loan estimate le fee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Estimate Le Fee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.