Get the free Application for Title Insurance - All New York Title Agency

Show details

Application for Title Insurance. Order Date: Sales Representative: Applicant: ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for title insurance

Edit your application for title insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for title insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for title insurance online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for title insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for title insurance

How to fill out an application for title insurance:

01

Begin by obtaining the necessary application form from a reputable title insurance company or agent. You can typically find these forms online or request one in person.

02

Provide your personal information, which typically includes your full name, address, contact number, and email address. Make sure to double-check the accuracy of the information provided.

03

Specify the type of property for which you are applying for title insurance. This could be a residential property, commercial property, vacant land, or even a condominium unit.

04

Provide details about the property, such as its address, legal description, and any relevant information about its history or prior ownership.

05

Disclose any liens or encumbrances on the property that you may be aware of. This could include mortgages, judgments, unpaid taxes, or other claims that could affect the property's title.

06

Include information about any additional insurance coverage or endorsements you may require, such as coverage for zoning issues, mineral rights, or survey matters.

07

Review the application thoroughly before submitting it, ensuring that all information provided is accurate and complete. Any discrepancies or missing information could potentially delay the issuance of the title insurance policy.

08

Sign the application form, certifying that the information provided is true and accurate to the best of your knowledge.

Who needs an application for title insurance?

01

Homebuyers: Individuals purchasing a new home or refinancing their current mortgage often need to complete an application for title insurance. This helps protect their investment by ensuring that the property's title is clear and free from any undisclosed issues or claims.

02

Real Estate Investors: Investors who regularly buy and sell properties may require title insurance for each transaction to safeguard against potential title defects that could arise in the future.

03

Lenders: Financial institutions, such as banks and mortgage lenders, typically require title insurance as a condition for providing a loan. This protects their interest in the property and ensures that the title is clear.

04

Developers and Builders: Those involved in new construction or development projects often need title insurance to protect their investment and provide assurance to potential buyers.

In conclusion, anyone involved in a real estate transaction or looking to protect their interest in a property should consider applying for title insurance. It is important to understand the process of filling out the application accurately and thoroughly to ensure the smooth issuance of the policy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in application for title insurance?

The editing procedure is simple with pdfFiller. Open your application for title insurance in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out the application for title insurance form on my smartphone?

Use the pdfFiller mobile app to fill out and sign application for title insurance on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete application for title insurance on an Android device?

Use the pdfFiller Android app to finish your application for title insurance and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

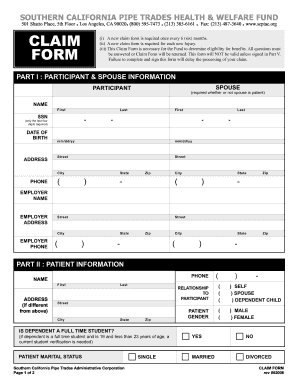

What is application for title insurance?

The application for title insurance is a form that is completed when purchasing a new property to protect the buyer and lender against any potential defects in the title.

Who is required to file application for title insurance?

The buyer or borrower is typically required to file an application for title insurance when purchasing a new property or refinancing a mortgage.

How to fill out application for title insurance?

The application for title insurance can be filled out by providing information about the property, the buyer or borrower, and any existing loans or liens on the property.

What is the purpose of application for title insurance?

The purpose of the application for title insurance is to ensure that the buyer and lender are protected against any unforeseen issues with the property's title.

What information must be reported on application for title insurance?

Information such as the property's legal description, the current owner, any existing liens or mortgages, and the purchase price must be reported on the application for title insurance.

Fill out your application for title insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Title Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.