Get the free TAX TREATY REPRESENTATION LETTER FOR STUDENTS AND TRAINEES CLAIMING EXEMPTION UNDER ...

Show details

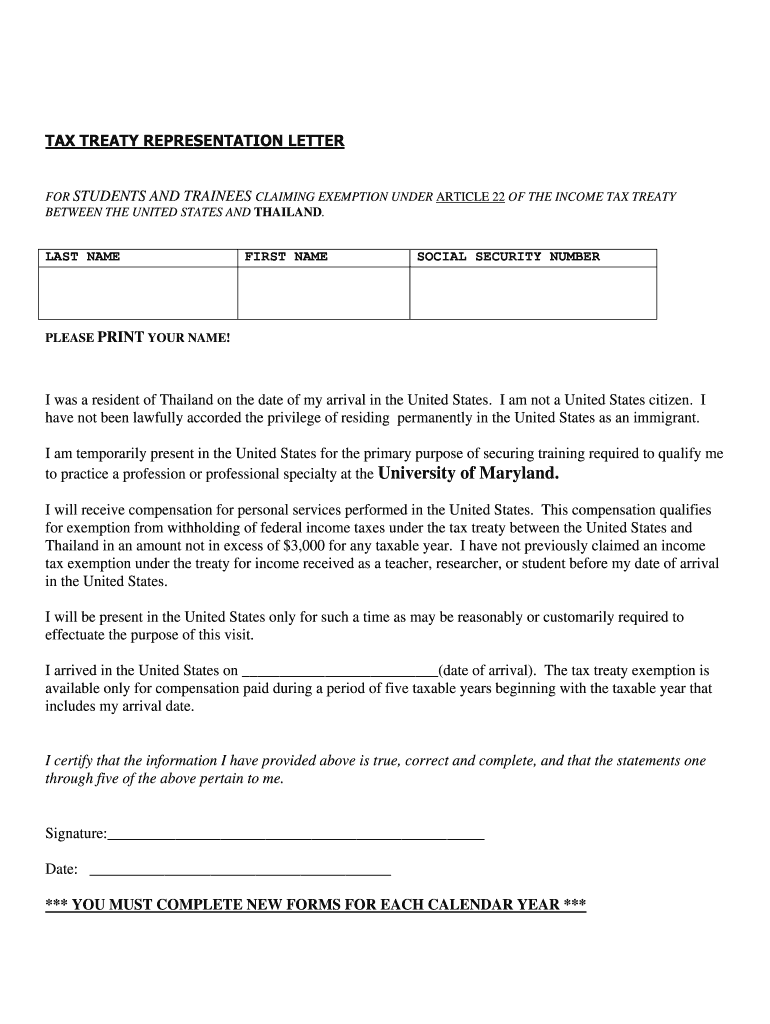

TAX TREATY REPRESENTATION LETTER FOR STUDENTS AND TRAINEES CLAIMING EXEMPTION UNDER ARTICLE 22 OF THE INCOME TAX TREATY BETWEEN THE UNITED STATES AND THAILAND. LAST NAME FIRST NAME SOCIAL SECURITY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax treaty representation letter

Edit your tax treaty representation letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax treaty representation letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax treaty representation letter online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax treaty representation letter. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax treaty representation letter

How to fill out a tax treaty representation letter:

01

Start by entering the current date at the top of the letter. This ensures that the letter is up to date and provides a reference for future purposes.

02

Address the letter to the appropriate tax authority or recipient. This could be a government agency, tax department, or any relevant authority that requires the tax treaty representation letter.

03

Clearly state the purpose of the letter. Make it clear that this letter is intended to serve as a representation of your eligibility for tax treaty benefits. Elaborate on the specific treaty that applies, if applicable.

04

Provide your personal information. Include your full name, contact details, and any additional information necessary to identify you as the taxpayer.

05

State your tax identification number. This is typically your social security number (SSN) or individual taxpayer identification number (ITIN). Ensure its accuracy as this is crucial for proper identification.

06

Mention the tax treaty article that supports your eligibility for tax benefits. Reference the specific article or provision of the tax treaty that applies to your situation. Provide a brief explanation or summary of how you qualify for the benefits outlined in the treaty.

07

Attach any supporting documents. Include copies of relevant documents such as your passport, visa, or any other documents that support your claim for tax treaty benefits. These documents serve as evidence of your eligibility.

08

End the letter by expressing your willingness to provide additional information or documentation if required. Include your signature and date to validate the letter.

Who needs a tax treaty representation letter:

01

Non-resident aliens: Non-resident aliens who are eligible for tax treaty benefits may need to provide a tax treaty representation letter to claim these benefits. This applies to individuals who are not U.S. citizens or residents but are subject to U.S. tax laws.

02

Individuals working abroad: If you are a U.S. citizen or resident working abroad and are eligible for tax treaty benefits, you may need a tax treaty representation letter to claim these benefits.

03

Foreign businesses: Foreign businesses operating in the U.S. or earning income from U.S. sources may also require a tax treaty representation letter to claim tax treaty benefits and avoid or reduce double taxation.

In summary, anyone who qualifies for tax treaty benefits and wishes to claim them should consider preparing a tax treaty representation letter. It serves as a formal document that outlines your eligibility for these benefits and can help ensure that you receive the appropriate tax treatment under the applicable tax treaty.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax treaty representation letter from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like tax treaty representation letter, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete tax treaty representation letter on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your tax treaty representation letter. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete tax treaty representation letter on an Android device?

On Android, use the pdfFiller mobile app to finish your tax treaty representation letter. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is tax treaty representation letter?

The tax treaty representation letter is a document that certifies your eligibility to claim benefits under a tax treaty between two countries.

Who is required to file tax treaty representation letter?

Individuals or entities who are residents of one country but earning income in another country may be required to file a tax treaty representation letter.

How to fill out tax treaty representation letter?

The tax treaty representation letter should be filled out with basic personal information, details of the specific tax treaty, and a declaration of eligibility for treaty benefits.

What is the purpose of tax treaty representation letter?

The purpose of the tax treaty representation letter is to confirm that the taxpayer meets the requirements set forth in the tax treaty and is entitled to any associated tax benefits.

What information must be reported on tax treaty representation letter?

The tax treaty representation letter should include personal details such as name, address, taxpayer identification number, details of income being earned, and reasons for claiming benefits under the tax treaty.

Fill out your tax treaty representation letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Treaty Representation Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.