Get the free Supplemental Retirement Account (SRA) Employee Payroll Deduction Form Agreement for ...

Show details

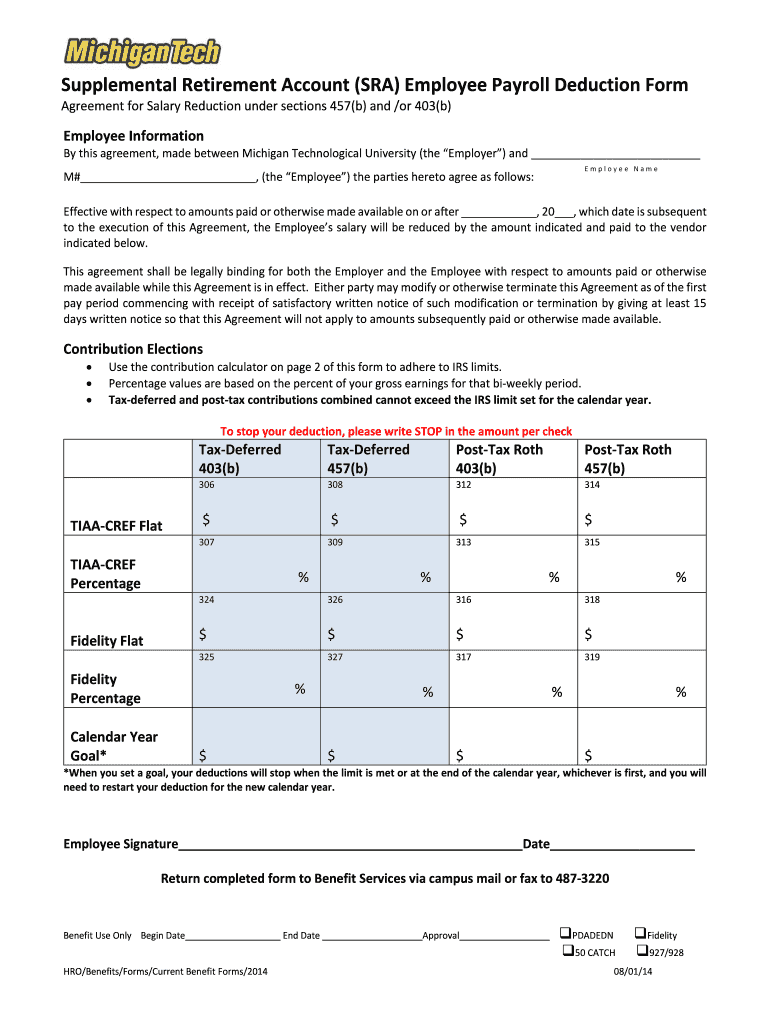

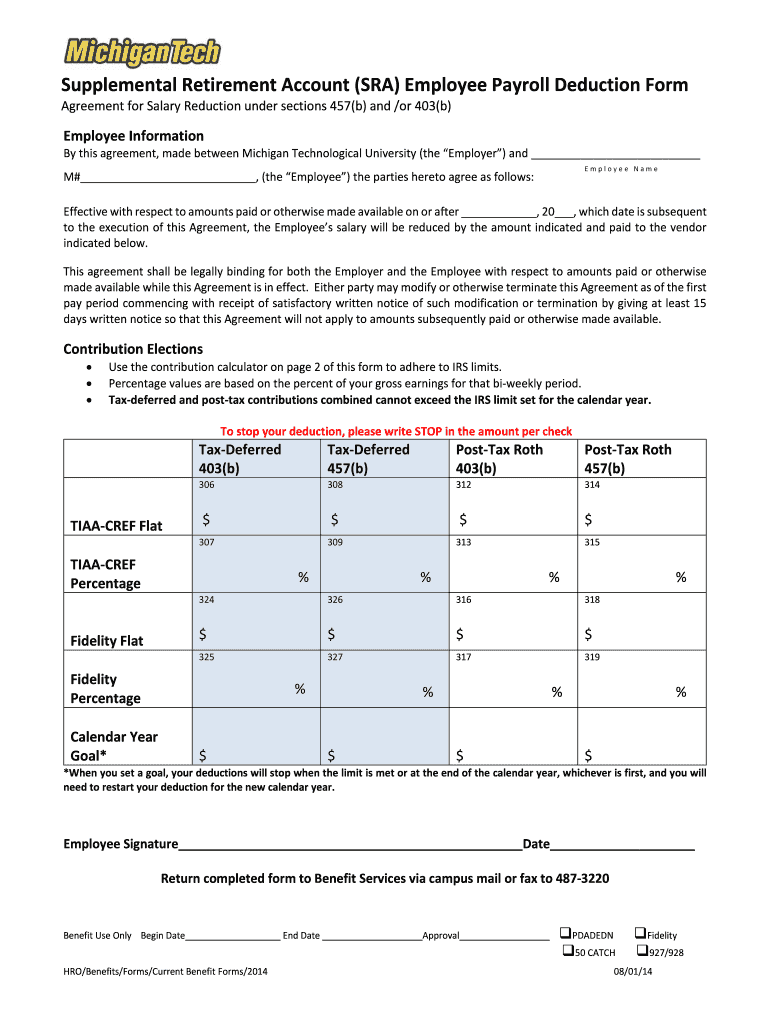

Supplemental Retirement Account (SRA) Employee Payroll Deduction Form Agreement for Salary Reduction under sections 457(b) and /or 403(b) Employee Information By this agreement, made between Michigan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplemental retirement account sra

Edit your supplemental retirement account sra form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplemental retirement account sra form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit supplemental retirement account sra online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit supplemental retirement account sra. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplemental retirement account sra

How to fill out supplemental retirement account (SRA)?

01

Begin by gathering all necessary documents. This includes your personal identification, such as your social security number and driver's license, as well as any relevant financial information, such as your current retirement account details.

02

Research and choose a financial institution that offers supplemental retirement accounts. Look for a reputable institution with a track record of success and good customer reviews.

03

Contact the chosen financial institution to inquire about their SRA application process. They will provide you with the necessary forms and guidance to begin the application.

04

Carefully read through the SRA application forms and instructions. Make sure you understand the terms, conditions, and requirements associated with the account.

05

Complete the application forms thoroughly and accurately. Provide all requested information, including your personal details, employment information, and investment preferences. Double-check the forms for any errors or missing information before submitting.

06

Attach any additional documents required by the financial institution. This may include proof of income, proof of address, or any other supporting documentation they request.

07

Review the completed application one final time. Ensure that all sections are properly filled out and that you have provided all necessary information.

08

Submit the application to the financial institution through the designated method outlined in the instructions. This may involve mailing the forms or submitting them online through a secure portal.

09

Wait for confirmation from the financial institution that your application has been received. They may provide you with a reference or confirmation number for future communication.

10

Keep a copy of the completed application and any supporting documents for your records. This will be important for reference in the future and for any potential inquiries or claims.

Who needs a supplemental retirement account (SRA)?

01

Individuals who feel their current retirement savings may not be sufficient. A supplemental retirement account can help individuals boost their retirement savings and provide an additional layer of financial security in their golden years.

02

Those who want to diversify their retirement portfolio. SRAs offer different investment options that may complement traditional retirement accounts, allowing individuals to spread their risk and potentially increase their returns.

03

People who have maxed out their contributions to other retirement accounts. Some individuals may have reached their maximum contributions to employer-sponsored retirement plans or individual retirement accounts (IRAs). An SRA can provide an additional avenue for retirement savings beyond these limitations.

04

Individuals who have experienced a significant life change. Changes such as job loss, divorce, or inheritance can impact retirement plans. An SRA can help individuals adjust their savings strategy and make up for any lost ground.

05

Those who want to take advantage of tax benefits. Depending on the country and tax regulations, SRAs may offer certain tax advantages. Consult with a financial advisor or tax professional to understand the specific tax implications of an SRA.

Remember, it is important to consult with a financial advisor or retirement planning expert to determine if a supplemental retirement account (SRA) is right for you. They can provide personalized advice based on your financial goals, risk tolerance, and overall retirement plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute supplemental retirement account sra online?

pdfFiller has made it simple to fill out and eSign supplemental retirement account sra. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit supplemental retirement account sra on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing supplemental retirement account sra right away.

How do I edit supplemental retirement account sra on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share supplemental retirement account sra from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is supplemental retirement account sra?

Supplemental Retirement Account (SRA) is a retirement savings plan that allows individuals to save additional money for retirement on a tax-deferred basis.

Who is required to file supplemental retirement account sra?

Individuals who want to save additional money for retirement on a tax-deferred basis may choose to open a Supplemental Retirement Account (SRA).

How to fill out supplemental retirement account sra?

To fill out a Supplemental Retirement Account (SRA), individuals need to contact their employer or financial institution that offers the plan, and follow the provided instructions for opening and contributing to the account.

What is the purpose of supplemental retirement account sra?

The purpose of a Supplemental Retirement Account (SRA) is to provide individuals with an additional avenue to save money for retirement in a tax-efficient manner.

What information must be reported on supplemental retirement account sra?

Information such as contributions made to the account, investment options chosen, and any withdrawals or distributions taken from the account must be reported on the Supplemental Retirement Account (SRA).

Fill out your supplemental retirement account sra online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplemental Retirement Account Sra is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.