Get the free Domestic asset protection trusts - National Law Foundation

Show details

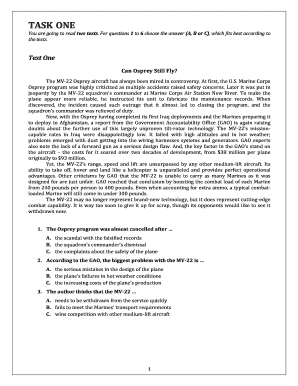

NEW ! National Law Foundation www.nlfcle.com 138Page Course Book, Audio Tape, Audio CDs and Videotape of Live 1.6Hour October 15, 2004, Presentation DOWN LOA D entire BOOK at w w w. NLFC .com DAVID

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign domestic asset protection trusts

Edit your domestic asset protection trusts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your domestic asset protection trusts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit domestic asset protection trusts online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit domestic asset protection trusts. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out domestic asset protection trusts

How to fill out domestic asset protection trusts:

01

Gather all relevant financial information: Start by collecting all the necessary documents and information related to your assets, including bank statements, property deeds, investment accounts, and any other pertinent financial records.

02

Consult with a legal professional: It is highly recommended to consult with an experienced attorney specializing in domestic asset protection trusts. They will guide you through the process, help you understand the legal requirements, and ensure that your trust is properly structured to meet your specific needs.

03

Identify your objectives and goals: Before filling out the trust documents, clearly define your objectives and goals for establishing a domestic asset protection trust. Determine what assets you wish to protect, the level of protection required, and how you want these assets to be managed.

04

Understand state-specific laws: Familiarize yourself with the laws governing domestic asset protection trusts in your state. Each state may have its own requirements and restrictions, so it's crucial to be aware of the specific regulations applicable to you.

05

Determine the type of trust: Choose the most suitable type of trust for your needs. Domestic asset protection trusts can take various forms, such as revocable or irrevocable trusts, and it's important to weigh the advantages and disadvantages of each option before making a decision.

06

Comply with formalities: Follow the legal formalities necessary to establish a domestic asset protection trust. This may include drafting the trust document, having it signed and witnessed according to state requirements, and filing any necessary paperwork with the appropriate authorities.

07

Fund the trust: Transfer your assets into the trust by changing the ownership or title of each asset to the trust's name. This process may involve updating property deeds, retitling bank accounts, and transferring other assets into the trust's control. Your attorney can guide you through this process to ensure it is done correctly.

Who needs domestic asset protection trusts?

01

High net worth individuals: Those with substantial assets are often more susceptible to lawsuits and legal claims. Establishing a domestic asset protection trust can help safeguard their wealth against potential creditors or claimants.

02

Business owners: Business owners may face personal liability for claims or lawsuits related to their businesses. A domestic asset protection trust can help shield personal assets from being exposed to these risks and protect them in case of business failure or legal issues.

03

Professionals in high-liability fields: Professionals working in fields with a high risk of malpractice claims, such as doctors, lawyers, or architects, can benefit from domestic asset protection trusts. These trusts can provide an added layer of protection in case of potential legal actions arising from their professional activities.

04

Individuals with family wealth: Families with significant wealth accumulated over generations may choose to establish a domestic asset protection trust to preserve their assets for future generations. By doing so, they can protect their wealth from potential risks and ensure its longevity.

05

Those concerned about personal liability: Even individuals with moderate assets may find value in establishing a domestic asset protection trust. It can provide peace of mind by safeguarding their assets and protecting them from potential creditors or unexpected legal claims.

Remember, consulting with a qualified professional is essential to navigate the legal complexities of establishing and filling out domestic asset protection trusts. This content serves as a general guide and should not be considered legal advice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my domestic asset protection trusts directly from Gmail?

domestic asset protection trusts and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I edit domestic asset protection trusts on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign domestic asset protection trusts. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How can I fill out domestic asset protection trusts on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your domestic asset protection trusts, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is domestic asset protection trusts?

Domestic asset protection trusts are legal arrangements that allow individuals to protect their assets from creditors and lawsuits.

Who is required to file domestic asset protection trusts?

Individuals who want to protect their assets from potential creditors or lawsuits may choose to set up a domestic asset protection trust.

How to fill out domestic asset protection trusts?

Filling out a domestic asset protection trust involves working with a qualified attorney who specializes in estate planning and asset protection to create the trust document and transfer assets into the trust.

What is the purpose of domestic asset protection trusts?

The purpose of domestic asset protection trusts is to shield assets from potential creditors or lawsuits, allowing individuals to safeguard their wealth for future generations.

What information must be reported on domestic asset protection trusts?

Information such as the assets transferred into the trust, the name of the trustee, and the beneficiaries of the trust must be reported on domestic asset protection trusts.

Fill out your domestic asset protection trusts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Domestic Asset Protection Trusts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.