Get the free PRUDENTIAL INCOME PORTFOLIOS PIP LIVING ANNUITY

Show details

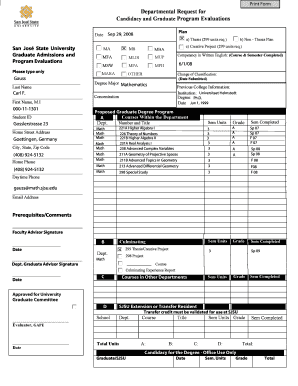

SA FORM PRUDENTIAL INCOME PORTFOLIOS (PIP) LIVING ANNUITY APPLICATION FORM INDIVIDUALS The Prudential Living Annuity is underwritten Portfolio Managers (South Africa) Life Ltd (Registration number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign prudential income portfolios pip

Edit your prudential income portfolios pip form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your prudential income portfolios pip form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit prudential income portfolios pip online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit prudential income portfolios pip. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out prudential income portfolios pip

How to fill out Prudential Income Portfolios (PIP):

01

Start by gathering all the necessary information, such as your personal details, financial statements, and investment goals. This will help you determine the appropriate investment strategy within the PIP platform.

02

Fill out the required paperwork, including the PIP account application and any additional forms. Ensure that you provide accurate and up-to-date information to avoid any delays in the account opening process.

03

Specify your investment objectives. Prudential offers different investment options within PIP, such as fixed income, equity, and balanced portfolios. Decide which portfolio aligns best with your goals and risk tolerance.

04

Determine the initial investment amount. Take into consideration the minimum investment requirement for PIP and ensure that you have the necessary funds available.

05

Consider setting up automatic contributions. PIP allows you to establish regular contributions to your account, which can help in building your investment over time. Determine the frequency and amount of these contributions based on your financial capacity.

06

Review and understand the fee structure associated with PIP. Prudential may charge certain fees, such as expense ratios and management fees, for maintaining your account. Familiarize yourself with these fees to make informed investment decisions.

Who needs Prudential Income Portfolios (PIP):

01

Investors seeking diversification: PIP offers a range of investment options across different asset classes, providing investors with the opportunity to diversify their portfolios. This can help reduce overall risk and potentially enhance investment returns.

02

Individuals looking for professional management: PIP provides access to professional investment managers who actively manage the portfolios. This can be beneficial for investors who do not have the time or expertise to actively manage their investments.

03

Those seeking income generation: As the name suggests, PIP focuses on generating income for investors. If you are looking for regular income streams from your investments, PIP can be an appropriate choice.

Note: It is important to consult with a financial advisor or Prudential representative to fully understand the process of filling out PIP and to determine if it aligns with your financial goals and risk tolerance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get prudential income portfolios pip?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the prudential income portfolios pip in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute prudential income portfolios pip online?

pdfFiller has made filling out and eSigning prudential income portfolios pip easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out prudential income portfolios pip on an Android device?

Use the pdfFiller mobile app to complete your prudential income portfolios pip on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is prudential income portfolios pip?

The Prudential Income Portfolios (PIP) is a portfolio of income-producing assets managed by Prudential Financial.

Who is required to file prudential income portfolios pip?

Investors who hold assets in the Prudential Income Portfolios are required to file PIP.

How to fill out prudential income portfolios pip?

To fill out Prudential Income Portfolios PIP, investors must consult with their financial advisor or refer to the official guidelines provided by Prudential Financial.

What is the purpose of prudential income portfolios pip?

The purpose of Prudential Income Portfolios PIP is to provide investors with a diversified portfolio of income-producing assets.

What information must be reported on prudential income portfolios pip?

Investors must report details of the assets held in the Prudential Income Portfolios as well as any income generated from those assets.

Fill out your prudential income portfolios pip online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Prudential Income Portfolios Pip is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.