Get the free Business valuation regulation and compliance - CPA Australia - cpaaustralia com

Show details

Business valuation regulation and compliance NEW program NE Technical Online Understand the important issues to consider when conducting a valuation. Business valuations are carried out for a wide

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business valuation regulation and

Edit your business valuation regulation and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business valuation regulation and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business valuation regulation and online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business valuation regulation and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business valuation regulation and

How to fill out business valuation regulation and?

01

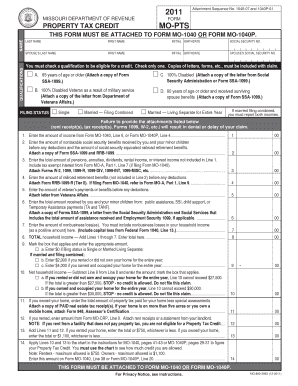

Review the regulations: Start by carefully reading and understanding the business valuation regulations that apply to your specific industry or jurisdiction. Pay attention to the requirements, guidelines, and forms provided.

02

Collect necessary information: Gather all the relevant financial data and documentation needed to complete the business valuation regulation. This may include financial statements, tax returns, balance sheets, income statements, and any other supporting documents required.

03

Engage a professional: Consider hiring a professional business valuator who specializes in regulatory compliance to assist with the process. Their expertise can ensure accurate and reliable valuation reports that meet the specific requirements of the regulation.

04

Follow the prescribed format: Many business valuation regulations have specific templates or formats that must be followed. Ensure that you correctly input the requested information, including financial figures, market analysis, and any other relevant data points.

05

Perform valuation calculations: Use the appropriate valuation methods and calculations as required by the regulation. This may involve assessing the business's assets, liabilities, cash flow, market conditions, and industry trends. Ensure that you accurately document your calculations and explain the rationale behind the chosen approach.

06

Address compliance requirements: Some business valuation regulations may have additional compliance requirements, such as independent audits, confirming qualifications of valuers, or submitting the valuation report to regulatory bodies. Be sure to comply with these additional obligations as outlined in the regulation.

Who needs business valuation regulation and?

01

Business owners and investors: Business valuation regulations are essential for business owners and investors who need to accurately determine the value of their companies or investments. This information is crucial for strategic decision-making, transactions, mergers, acquisitions, and even for tax purposes.

02

Financial institutions and lenders: Lending institutions often require business valuation reports to assess the worth of a business when providing loans or financing. This helps them evaluate the risk associated with lending funds and determine appropriate terms and conditions.

03

Regulatory bodies and government agencies: Government agencies may require business valuation reports to ensure compliance with specific regulations. These reports can be used to monitor market activities, assess tax liabilities, enforce antitrust laws, or determine fair compensation in litigation cases.

04

Legal professionals and accountants: Lawyers and accountants can utilize business valuation regulations to support legal proceedings, such as divorce settlements, partnership disputes, estate planning, or shareholder buyouts. A proper valuation provides an objective assessment of the business's fair market value, enabling informed decision-making.

05

Potential buyers or sellers: When buying or selling a business, having a business valuation done in accordance with applicable regulations can provide credibility and confidence to potential buyers or sellers. It helps both parties understand the true value of the business and negotiate fair terms for the transaction.

Overall, business valuation regulations serve as a framework for determining the value of a business in a standardized and transparent manner. Their application is essential for various stakeholders involved in risk assessment, decision-making, legal compliance, and financial transactions related to businesses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business valuation regulation and in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your business valuation regulation and as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make edits in business valuation regulation and without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your business valuation regulation and, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the business valuation regulation and in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your business valuation regulation and directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is business valuation regulation?

Business valuation regulation refers to the rules and guidelines that govern how companies determine and report the value of their business or assets.

Who is required to file business valuation regulation?

Businesses of all sizes and industries may be required to file business valuation regulation, depending on the regulations in their jurisdiction or industry standards.

How to fill out business valuation regulation?

Business valuation regulation forms typically require companies to provide detailed information about their financial statements, assets, liabilities, revenue, expenses, and other relevant data.

What is the purpose of business valuation regulation?

The purpose of business valuation regulation is to ensure transparency and accuracy in determining the value of a company or its assets, which can have implications for financial reporting, taxation, mergers and acquisitions, and other business transactions.

What information must be reported on business valuation regulation?

Information required on business valuation regulation forms may include financial statements, asset appraisals, revenue projections, market data, and other relevant information to support the valuation of the business or assets.

Fill out your business valuation regulation and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Valuation Regulation And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.