Get the free NOTICE EACH COVERAGE PART OF ASSET MANAGEMENT PROTECTOR

Show details

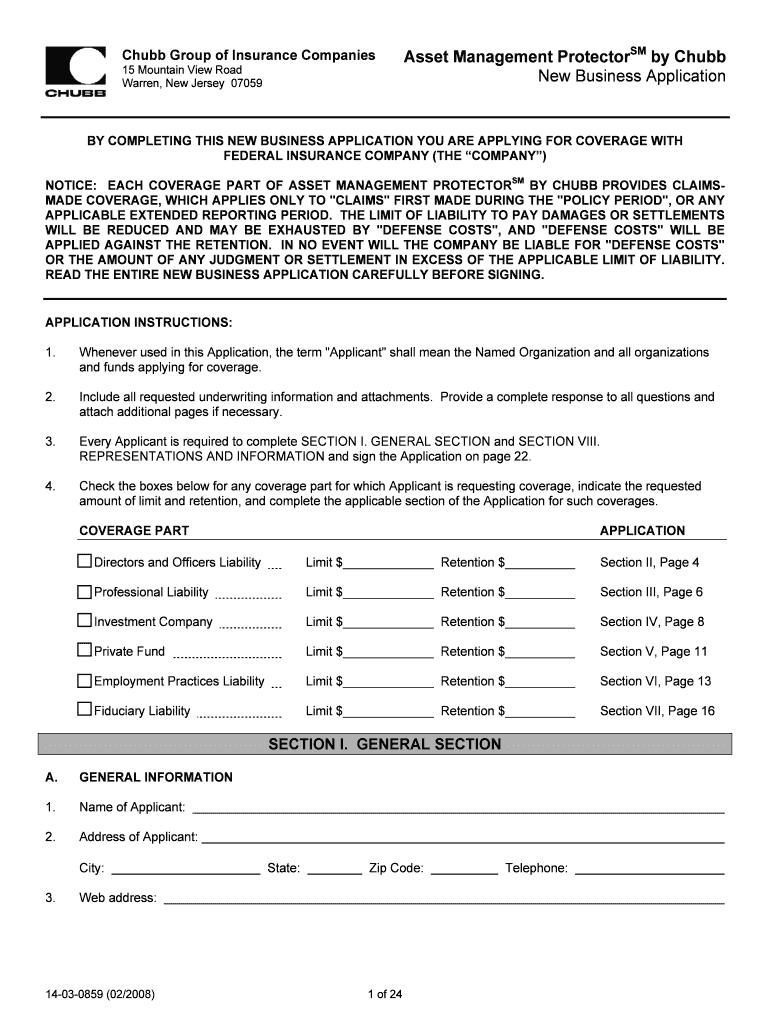

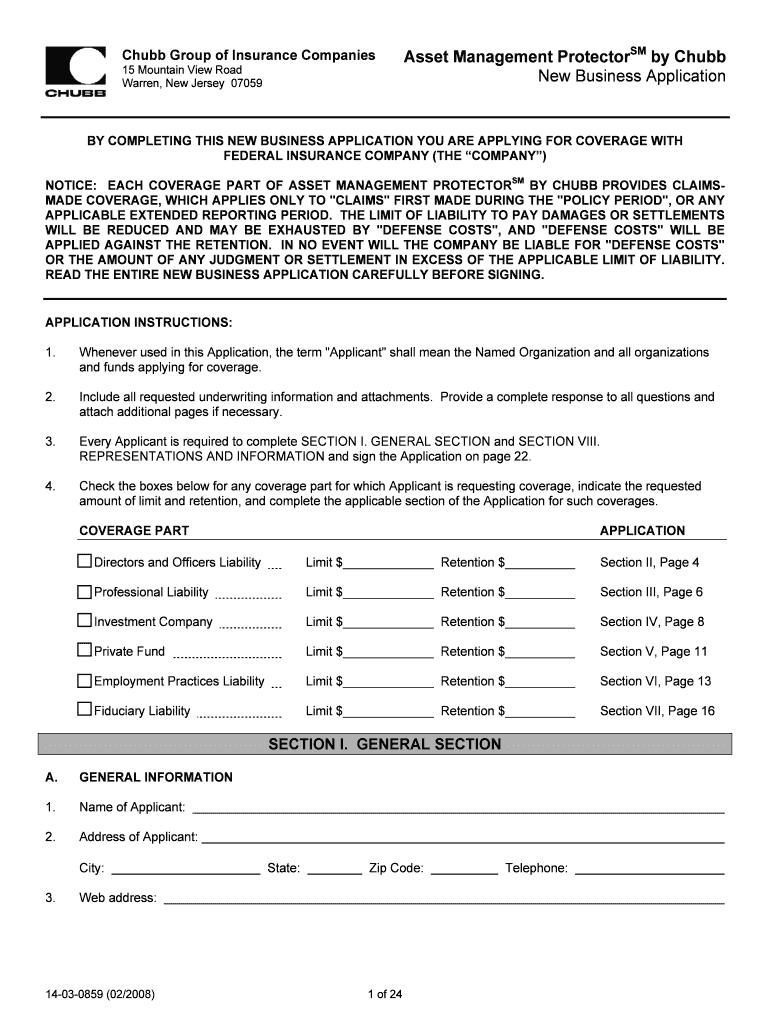

Chubb Group of Insurance Companies 15 Mountain View Road Warren, New Jersey 07059 Asset Management Protectors by Chubb New Business Application BY COMPLETING THIS NEW BUSINESS APPLICATION YOU ARE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice each coverage part

Edit your notice each coverage part form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice each coverage part form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice each coverage part online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notice each coverage part. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice each coverage part

How to fill out notice each coverage part:

01

Start by carefully reading through your insurance policy to understand the different coverage parts and their requirements for notice. Each coverage part may have its own specific notice requirements, so it is important to review them separately.

02

Identify the coverage parts that apply to your situation. For example, if you have an auto insurance policy, you may have coverage parts such as liability coverage, collision coverage, or comprehensive coverage.

03

Take note of any time limits for providing notice. Some policies may require immediate notice of an incident, while others may allow for a certain period of time. It is crucial to comply with these time limits to ensure your coverage is not jeopardized.

04

Gather all relevant information about the incident or claim. This may include details such as the date and time of the incident, the parties involved, any witnesses, and any relevant documentation or evidence.

05

Contact your insurance company as soon as possible to notify them of the incident and provide the necessary information. Be prepared to provide specific details about the incident and the coverage part you are notifying them about.

06

Follow any additional instructions or requirements provided by your insurance company. They may ask for further documentation, such as a police report or photographs, to support your claim. Make sure to comply with these requests promptly and accurately.

Who needs notice each coverage part:

01

Policyholders who have multiple coverage parts within their insurance policy should provide notice for each relevant coverage part separately. This ensures that the insurance company is aware of the specific incident and can process the claim accordingly.

02

Those who have experienced an incident or loss that falls under a specific coverage part should provide notice for that coverage part. This is necessary to initiate the claims process and seek reimbursement or coverage for the damages or losses incurred.

03

It is important to notify each coverage part individually, as the requirements, terms, and conditions may vary for each part. Failing to provide notice for a specific coverage part may result in denial of coverage or delays in claim processing.

In summary, filling out notice each coverage part involves understanding the requirements for each part, providing timely and accurate information about the incident, and following any additional instructions provided by your insurance company. It is crucial to notify each relevant coverage part separately to ensure proper claim processing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in notice each coverage part?

The editing procedure is simple with pdfFiller. Open your notice each coverage part in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit notice each coverage part in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your notice each coverage part, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit notice each coverage part straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit notice each coverage part.

What is notice each coverage part?

Notice each coverage part is a requirement for insurance policies that specifies when and how the insured must inform the insurer about a potential claim that may be covered by the policy.

Who is required to file notice each coverage part?

The insured party or policyholder is required to file notice each coverage part in case of a potential claim that may be covered by the policy.

How to fill out notice each coverage part?

Notice each coverage part can typically be filled out by contacting the insurance company directly or through the insurance agent or broker associated with the policy.

What is the purpose of notice each coverage part?

The purpose of notice each coverage part is to ensure that the insurer is promptly informed about potential claims, allowing them to investigate and process the claim in a timely manner.

What information must be reported on notice each coverage part?

The information required to be reported on notice each coverage part includes details of the potential claim, the policy number, date of loss or occurrence, and any other relevant information requested by the insurer.

Fill out your notice each coverage part online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Each Coverage Part is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.