Get the free INTEREST WITH NO TAX DEDUCTED CANCELLATION OF REGISTRATION

Show details

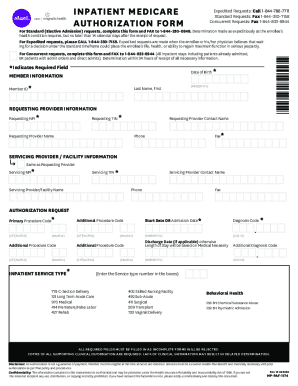

INTEREST WITH NO TAX DEDUCTED CANCELLATION OF REGISTRATION Skip ton Building Society Principal Office, The Bailey, Skip ton North Yorkshire BD23 1DN t: 03458 501700 f: 01756 705700 DX21757 Skip ton

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign interest with no tax

Edit your interest with no tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your interest with no tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit interest with no tax online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit interest with no tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out interest with no tax

How to fill out interest with no tax?

01

Determine if you are eligible for tax-free interest: In order to fill out interest with no tax, you first need to ensure that you meet the eligibility criteria set by the tax authorities. Depending on your country and tax laws, there may be certain limits or exemptions for tax-free interest. Gather all the necessary information and documents to verify your eligibility.

02

Research tax-free savings accounts: Many countries offer tax-free savings accounts or specific investment vehicles that provide tax benefits on interest earned. Research the options available to you and understand the requirements and limitations associated with each account. This will help you choose the best option that aligns with your financial goals and tax-saving objectives.

03

Open a tax-free savings account: Once you have identified the suitable tax-free savings account, follow the required steps to open it. This may involve visiting a bank or financial institution, completing relevant paperwork, providing identification documents, and making an initial deposit. Ensure that you understand the terms and conditions associated with the account and any restrictions on withdrawals or contributions.

04

Invest in tax-exempt bonds or funds: Another way to earn tax-free interest is by investing in tax-exempt bonds or funds. These investments typically provide interest income that is exempt from federal or state taxes. Research and consult with a financial advisor to understand the available options, risks, and potential returns before investing.

05

Report your tax-free interest income: While the interest you earn may be tax-free, it is still important to report this income accurately to the tax authorities. Familiarize yourself with the reporting requirements specific to your jurisdiction and ensure that you correctly fill out any required forms or declarations related to your tax-free interest income.

Who needs interest with no tax?

01

Individuals in lower income brackets: People with lower income brackets might benefit from interest with no tax, as it allows them to earn additional income without the burden of paying taxes on it. This can help them save money and improve their financial situation.

02

Retirees or pensioners: Retirees or pensioners who rely on fixed income sources, such as pensions or investments, may find interest with no tax particularly attractive. It can provide them with additional income without increasing their tax obligations, enabling them to better manage their finances during retirement.

03

Students or young adults: Students or young adults who are just starting their careers may find tax-free interest advantageous as it can help them accumulate savings or invest in their future without the need to pay taxes on the earnings. This can be especially beneficial when saving for education expenses or a down payment on a home.

04

Individuals planning for long-term goals: People with long-term financial goals, such as saving for a house, retirement, or children's education, may prioritize tax-free interest to maximize their savings. By avoiding taxes on the interest earned, they can grow their investments faster and reach their goals more efficiently.

Overall, anyone who wants to minimize their tax burden or maximize their savings can benefit from interest with no tax. However, it's important to consider individual financial circumstances, goals, and eligibility requirements before making decisions related to tax-free interest.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find interest with no tax?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the interest with no tax in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete interest with no tax online?

pdfFiller has made it simple to fill out and eSign interest with no tax. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I sign the interest with no tax electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your interest with no tax in seconds.

What is interest with no tax?

Interest with no tax refers to income generated from interest-bearing accounts or investments that are not subject to taxation.

Who is required to file interest with no tax?

Individuals or entities who earn interest income that is not taxed are required to report it on their tax returns.

How to fill out interest with no tax?

To fill out interest with no tax, individuals need to accurately report the amount of interest income earned on their tax returns.

What is the purpose of interest with no tax?

The purpose of interest with no tax is to ensure that all income, including untaxed interest, is accurately reported to the tax authorities.

What information must be reported on interest with no tax?

The information that must be reported on interest with no tax includes the amount of interest income earned and any supporting documentation.

Fill out your interest with no tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Interest With No Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.