Get the free Strategic Tax Planning, LLC Tax Consulting Tax Preparation Trust Services Asset Prot...

Show details

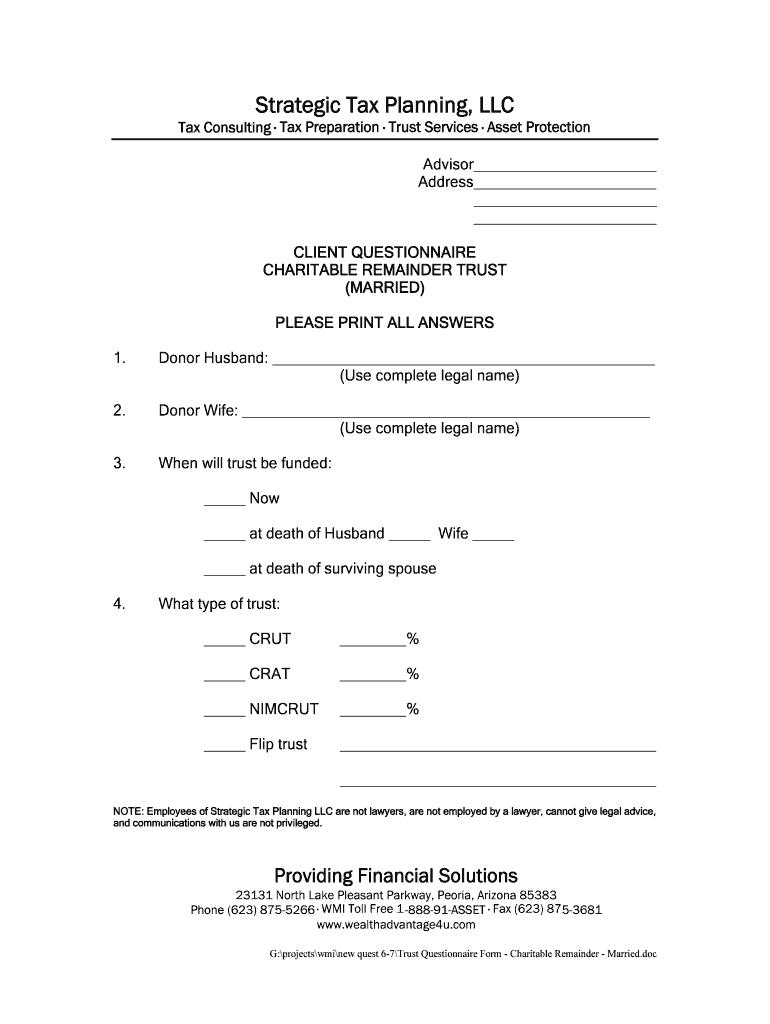

Strategic Tax Planning, LLC Tax Consulting Tax Preparation Trust Services Asset Protection Advisor Address CLIENT QUESTIONNAIRE CHARITABLE REMAINDER TRUST (MARRIED) PLEASE PRINT ALL ANSWERS 1. Donor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign strategic tax planning llc

Edit your strategic tax planning llc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your strategic tax planning llc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing strategic tax planning llc online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit strategic tax planning llc. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out strategic tax planning llc

How to fill out strategic tax planning LLC:

01

Research and understand the benefits: Before filling out the strategic tax planning LLC, it is important to understand why it is necessary and beneficial. Strategic tax planning can help individuals and businesses minimize their tax liabilities, optimize their financial resources, and ensure compliance with tax laws.

02

Business structure: Determine the appropriate business structure for your LLC. This can depend on various factors such as the size of your business, the number of owners, and the desired level of liability protection. Common options include sole proprietorships, partnerships, and corporations. Consult with legal and financial professionals to choose the best structure for your specific needs.

03

Obtain an Employer Identification Number (EIN): An EIN is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify your business for tax purposes. It is required for most LLCs, especially those with employees. You can apply for an EIN online through the IRS website.

04

Decide on the tax classification: LLCs have flexibility in choosing their tax classification. By default, a single-member LLC is classified as a disregarded entity for tax purposes, while a multi-member LLC is classified as a partnership. However, LLCs can also elect to be taxed as a corporation or an S corporation if it aligns better with their business goals. Consider consulting with a tax professional to determine the most advantageous tax classification for your LLC.

05

Maintain proper records and documentation: It is crucial to maintain accurate and organized records of income, expenses, and other financial transactions related to your LLC. This will help ensure accurate tax reporting and facilitate the preparation of financial statements. Keep receipts, invoices, bank statements, and other relevant documents in a safe and organized manner.

06

File necessary tax forms: LLCs may have different filing requirements depending on their tax classification and activities. Typically, LLCs are required to file an annual tax return with the IRS. Single-member LLCs can file Schedule C along with their personal tax return, while multi-member LLCs may need to file Form 1065 (Partnership Return). Additionally, ensure compliance with state and local tax requirements, such as sales tax or payroll tax.

Who needs strategic tax planning LLC:

01

Small business owners: Small business owners can benefit greatly from strategic tax planning LLC. By implementing effective tax strategies, they can reduce their tax liabilities, retain more profits, and reinvest in their business growth. Strategic tax planning can also help in navigating complex tax laws and regulations, ensuring compliance and avoiding penalties.

02

Entrepreneurs and startups: Strategic tax planning LLC can be especially valuable for entrepreneurs and startups. As they establish their businesses and make important financial decisions, they can structure their operations in a tax-efficient manner, consider tax credits or incentives available, and plan for future tax obligations.

03

High-net-worth individuals: Individuals with substantial assets or high income can also benefit from strategic tax planning LLC. By optimizing their tax strategies, they can minimize taxes on investments, estate planning, and other financial activities. Strategic tax planning can also help in succession planning and preserving wealth for future generations.

Remember, it is always advisable to seek professional advice from tax experts or certified public accountants to ensure accurate and compliant tax planning and filing for your strategic tax planning LLC.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify strategic tax planning llc without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like strategic tax planning llc, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I execute strategic tax planning llc online?

Easy online strategic tax planning llc completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the strategic tax planning llc in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your strategic tax planning llc in seconds.

What is strategic tax planning llc?

Strategic tax planning llc is a type of tax planning service provided by a limited liability company specializing in creating tax strategies for individuals and businesses to minimize their tax liabilities.

Who is required to file strategic tax planning llc?

Any individual or business that has utilized the services of a strategic tax planning llc and has benefited from their tax strategies may be required to file taxes accordingly.

How to fill out strategic tax planning llc?

To fill out a strategic tax planning llc form, individuals or businesses must gather their financial information, review the tax strategies implemented by the company, and report any relevant information on their tax returns.

What is the purpose of strategic tax planning llc?

The purpose of strategic tax planning llc is to help individuals and businesses minimize their tax liabilities legally by leveraging tax strategies and deductions provided by the company.

What information must be reported on strategic tax planning llc?

Information such as income, deductions, credits, and other relevant tax-related details must be reported on a strategic tax planning llc form.

Fill out your strategic tax planning llc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Strategic Tax Planning Llc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.