Get the free Voluntary Additional Retirement - wisconsinedu

Show details

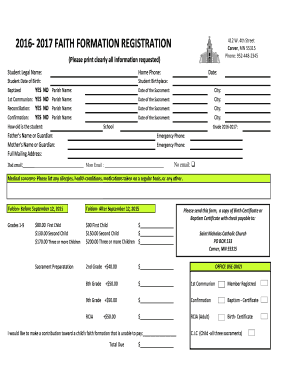

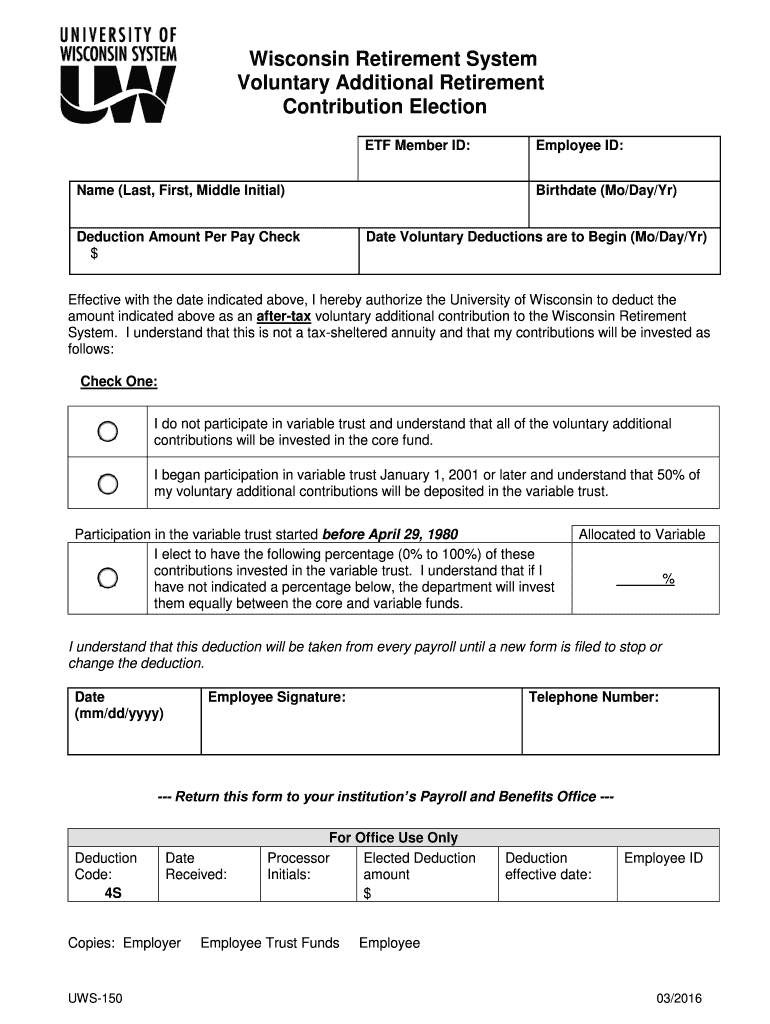

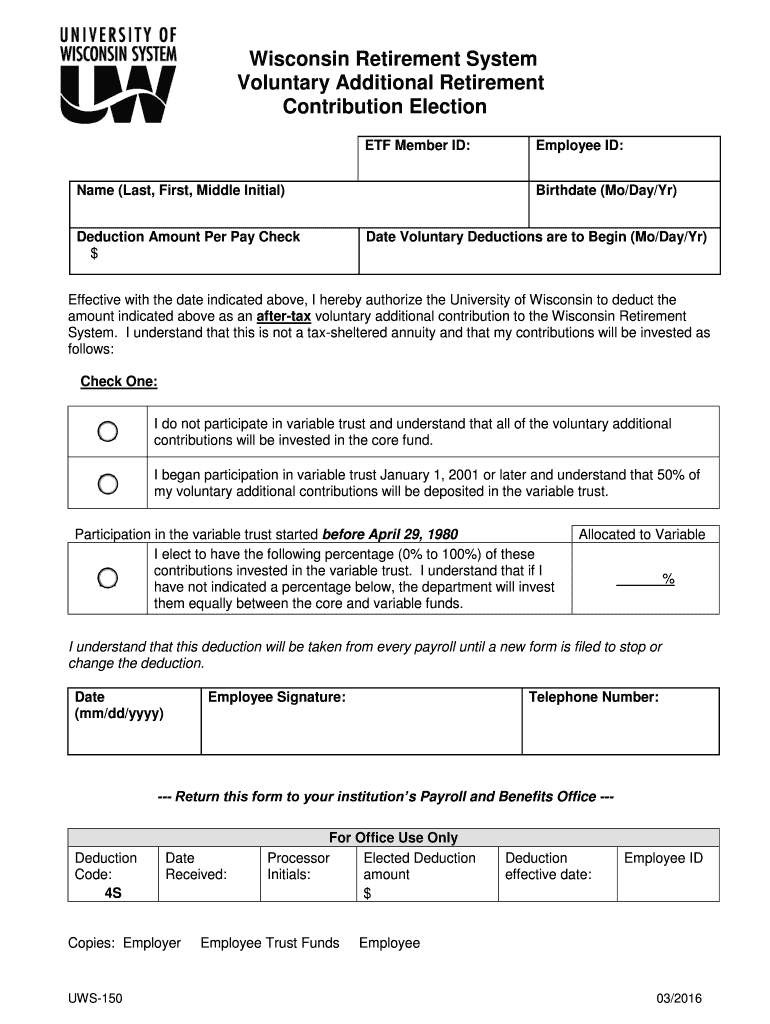

Wisconsin Retirement System Voluntary Additional Retirement Contribution Election ETF Member ID: Name (Last, First, Middle Initial) Deduction Amount Per Pay Check $ Employee ID: Birthdate (Mo/Day/Yr)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign voluntary additional retirement

Edit your voluntary additional retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voluntary additional retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing voluntary additional retirement online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit voluntary additional retirement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out voluntary additional retirement

How to fill out voluntary additional retirement:

01

Determine eligibility: Before filling out the application for voluntary additional retirement, ensure that you meet the eligibility criteria set by your employer or the retirement plan provider. These criteria may include factors such as age, years of service, or specific job titles.

02

Obtain the necessary forms: Contact your employer or retirement plan provider to secure the appropriate forms needed to apply for voluntary additional retirement. These forms may be available online or through a human resources department.

03

Review the instructions: Carefully read through the instructions provided with the forms. Understanding the instructions will help you accurately complete the application and avoid any potential mistakes or delays.

04

Gather required information: Collect all the necessary information required for the application. This typically includes personal details such as full name, contact information, social security number, date of birth, and employment history.

05

Evaluate retirement plan options: If your employer offers multiple retirement plan options, carefully review the available choices before making a decision. Consider factors such as contribution levels, investment options, and any additional benefits or features provided by each plan.

06

Calculate your additional contribution: Determine the amount of additional funds you wish to contribute to your retirement savings. This may involve reviewing your current financial situation and long-term goals to determine an appropriate contribution level.

07

Fill out the application form: Using the provided forms, fill out the application accurately and legibly. Pay attention to any required fields and ensure the information provided is correct and up-to-date. Double-check the form for completeness before submitting it.

08

Seek professional advice, if needed: If you are uncertain about any aspect of filling out the voluntary additional retirement application, consider seeking advice from a financial advisor or retirement planning professional. They can provide guidance based on your specific circumstances to help you make informed decisions.

Who needs voluntary additional retirement:

01

Individuals planning for retirement: Voluntary additional retirement is relevant for individuals who are actively planning for their retirement and looking to boost their savings beyond the minimum requirements. It allows you to increase your retirement nest egg by making additional contributions voluntarily.

02

Employees with disposable income: Those who have sufficient disposable income and are looking for tax-efficient ways to save for retirement may find voluntary additional retirement options beneficial. By contributing additional funds, individuals can take advantage of potential tax advantages and potentially increase their overall retirement savings.

03

Employees interested in employer matching: Some employers may offer matching contributions for voluntary additional retirement plans, meaning they will match a portion of your additional contributions. If your employer provides this perk, participating in voluntary additional retirement can be especially advantageous as it essentially doubles your savings.

04

Individuals with specific retirement goals: If you have specific retirement goals, such as retiring early or having a certain level of financial security during retirement, participating in voluntary additional retirement can help you achieve those goals. By contributing more funds, you can potentially expedite your retirement savings and work towards your desired financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my voluntary additional retirement directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your voluntary additional retirement along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get voluntary additional retirement?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the voluntary additional retirement in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete voluntary additional retirement on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your voluntary additional retirement. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is voluntary additional retirement?

Voluntary additional retirement refers to retirement contributions made by an individual above and beyond the mandatory retirement contributions.

Who is required to file voluntary additional retirement?

Individuals who wish to make additional contributions to their retirement account are required to file voluntary additional retirement.

How to fill out voluntary additional retirement?

To fill out voluntary additional retirement, individuals need to complete the required forms from their retirement account provider and submit the necessary documentation.

What is the purpose of voluntary additional retirement?

The purpose of voluntary additional retirement is to allow individuals to save more money for retirement and increase their savings over time.

What information must be reported on voluntary additional retirement?

The information reported on voluntary additional retirement forms typically includes the amount of additional contributions, the individual's personal information, and any other relevant financial details.

Fill out your voluntary additional retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voluntary Additional Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.