Get the free Investment Information

Show details

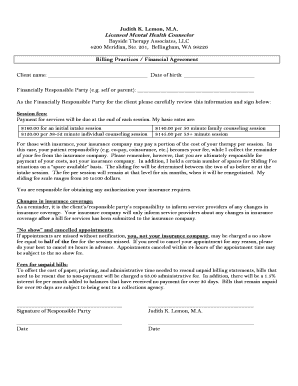

Investment Information: Fall/Winter 201516 Division: B, C, & 30+ Team Fee: $5,500 General Information: $1000 nonrefundable deposit due with application by September 12, 2015, Balance must be paid

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment information

Edit your investment information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing investment information online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit investment information. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment information

How to fill out investment information?

01

Start by gathering all the necessary documents and information related to your investments. This may include statements from investment accounts, details of any stocks or bonds you own, and any other relevant investment documents.

02

Begin filling out the investment information form by providing your personal details such as your name, address, and contact information. Ensure that these details are accurate and up to date.

03

Next, you will likely be asked to provide information about your investment goals and objectives. Think about your short-term and long-term financial aspirations and be specific about what you hope to achieve through your investments.

04

The form may also ask for details about your risk tolerance. This is an important aspect as it helps investment professionals understand your comfort level with taking risks. Assess your risk appetite and indicate whether you are conservative, moderate, or aggressive in your investment approach.

05

Fill in the investment information section with details about your existing investments. This may include the types of investments you currently hold, the amount invested, and any performance information available. Be as accurate and thorough as possible to provide a complete picture of your investment portfolio.

06

In some cases, the form may inquire about your investment experience and knowledge. If you have prior experience investing in different asset classes or financial markets, share this information to help the investment advisor or institution gauge your familiarity with investment strategies.

07

The investment information form may also request your financial information, such as your annual income, net worth, and liquid assets. This provides a snapshot of your financial situation and helps advisors determine suitable investment options for you.

Who needs investment information?

01

Individuals seeking financial advice or guidance often need investment information. Whether you are planning for retirement, saving for a specific goal, or simply looking to grow your wealth, having accurate and comprehensive investment information is essential.

02

Investment managers and financial advisors also require investment information to assess a client's situation and provide appropriate recommendations. By understanding your investment goals, risk tolerance, and existing portfolio, these professionals can create customized strategies tailored to your specific needs.

03

Financial institutions, such as banks or brokerage firms, need investment information from their customers to comply with regulations and to maintain accurate records. This information helps them better understand their client base and offer suitable investment products and services.

Overall, investment information is necessary for individuals, investment professionals, and financial institutions to make informed decisions, provide personalized advice, and ensure legal and regulatory compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is investment information?

Investment information includes details about financial assets, such as stocks, bonds, mutual funds, and real estate, owned by an individual or organization.

Who is required to file investment information?

Individuals or organizations with financial assets exceeding a certain threshold set by the governing body are required to file investment information.

How to fill out investment information?

Investment information can be filled out using the designated form provided by the governing body, where details of each financial asset, including value and type, must be accurately reported.

What is the purpose of investment information?

The purpose of investment information is to track and monitor financial assets owned by individuals or organizations to ensure compliance with regulations and tax laws.

What information must be reported on investment information?

Details such as the type of financial asset, value, location, and ownership must be reported on investment information.

Can I create an electronic signature for the investment information in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your investment information in seconds.

How can I edit investment information on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing investment information, you need to install and log in to the app.

How do I edit investment information on an iOS device?

Create, modify, and share investment information using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your investment information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.