Who needs the ST-12 form?

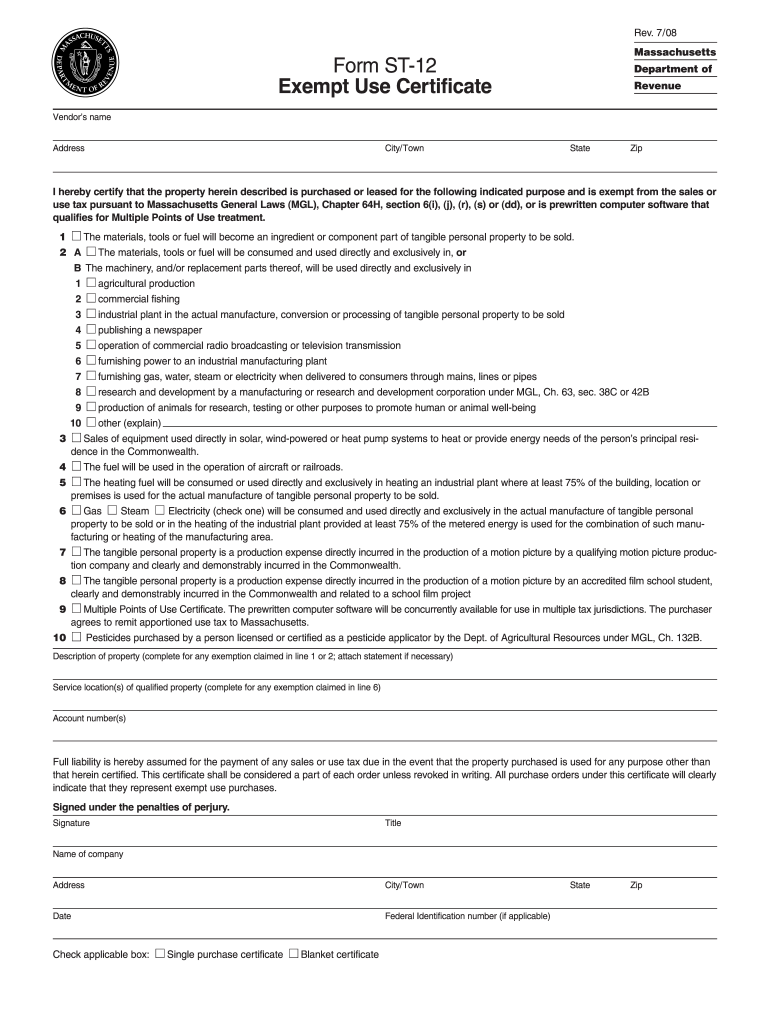

This is the Exempt Use Certificate approved for filing with the Massachusetts Department of Revenue. The form must be completed by the purchaser in order to claim exemption from sales tax on purchases of otherwise taxable items. An Exemption Certificate can be filed only to request exemption from tax on a purchase of tangible property or services which will serve as an exempt purpose as indicated on the form.

What is the purpose the St-12 Form?

The Exempt Use Certificate form is necessary if the retailer (purchaser) is buying goods for resale, as it certifies that all the qualifications established to making sales tax-free purchases in Massachusetts have been met. To be valid, the certificate must be verified by the vendor from whom the purchase is being made.

Is the Certificate accompanied by any other forms?

When the purchaser is providing the exemption certificate for the vendor verification, there is no need to accompany the form by any other documents. However, when the purchase is made, appropriate confirmation of the deal, for instance, an invoice, a receipt, etc. can be added.

How do I fill out the form?

The Exempt Use Certificate is a one-page form that requires collaborative filling out by the purchaser and the vendor. It must provide the vendors’ name and address, the purpose of the property’s sale or lease, a description of the property, the service location of the property, and account numbers.

Finally the purchaser must indicate their company and its address, FIN, indicate their own name and title, date and sign the form.

Who should keep the completed ST-12 Exempt Use Certificate?

The parties (the vendor and the purchaser) must retain their copies of the Certificate for at least three years.