Get the free Form 5308 - gpo

Show details

This form is used to request permission to change the plan or trust year for a pension benefit plan.

We are not affiliated with any brand or entity on this form

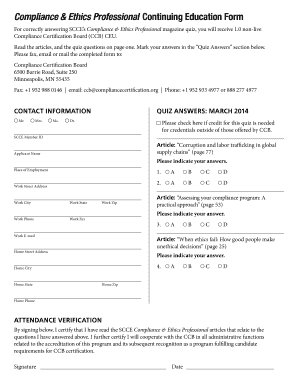

Get, Create, Make and Sign form 5308 - gpo

Edit your form 5308 - gpo form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 5308 - gpo form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 5308 - gpo online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 5308 - gpo. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 5308 - gpo

How to fill out Form 5308

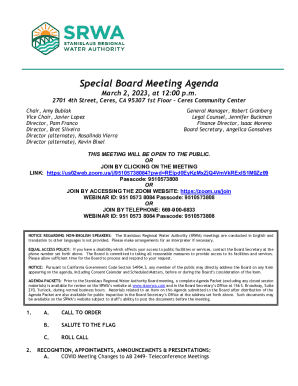

01

Obtain Form 5308 from the IRS website or your local IRS office.

02

Fill in your name, address, and taxpayer identification number at the top of the form.

03

Indicate the type of request you are submitting in the appropriate section.

04

Provide any additional information required in the designated areas.

05

Sign and date the form at the bottom to certify that the information provided is accurate.

06

Review the form for completeness and make copies for your records.

07

Submit the completed form to the appropriate IRS address as specified in the instructions.

Who needs Form 5308?

01

Individuals or business entities requesting a penalty relief under the section 5308 provisions.

02

Taxpayers who have received a notice from the IRS regarding a tax issue that requires clarification.

03

Professionals or tax advisers assisting clients with specific tax-related requests.

Fill

form

: Try Risk Free

People Also Ask about

What is an 8879 form used for?

Use this Form 8879 (Rev. January 2021) to authorize e-file of your Form 1040, 1040-SR, 1040-NR, 1040-SS, or 1040- X, for tax years beginning with 2019. Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO).

Can I electronically file form 8822 online?

Print and mail the form. Ensure that all the information is legible and accurate. Then, mail the printed form to the IRS using the address provided in the instructions. It's essential to keep a copy of the filled form for your records. As of now, Form 8822 cannot be filed electronically.

What is 8898?

If you are a citizen or resident alien of the United States and you've either become a bona fide resident of a U.S. territory or stopped being one, you might need to file IRS Form 8898.

What is the IRS form for 401k distribution?

You'll receive a Form 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. from the payer of your 401(k) distribution. A copy of that form is also sent to the IRS.

What is the 8888 form used for?

Use Form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United States. This form can also be used to buy up to $5,000 in paper series I savings bonds with your refund.

What is the IRS form for pension payments?

Purpose of form. Complete Form W-4P to have payers withhold the correct amount of federal income tax from your periodic pension, annuity (including commercial annuities), profit-sharing and stock bonus plan, or IRA payments. Federal income tax withholding applies to the taxable part of these payments.

What is form 8898?

Use Form 8898 to notify the IRS that you became or ceased to be a bona fide resident of a U.S. territory in ance with section 937(c).

Who must file the IRS form 8995?

Form 8995 is the IRS tax form that owners of pass-through entities — sole proprietorships, partnerships, LLCs, or S corporations — use to take the qualified business income (QBI) deduction, also known as the pass-through or Section 199A deduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

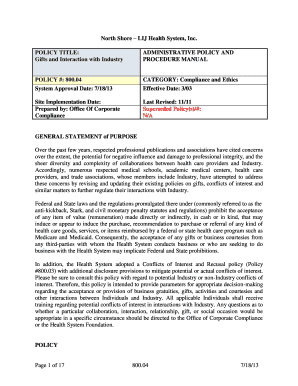

What is Form 5308?

Form 5308 is a tax form used by certain individuals and entities to report specific information related to their tax obligations, particularly in relation to retirement plans.

Who is required to file Form 5308?

Typically, Form 5308 is required to be filed by employers or plan administrators who sponsor certain types of retirement plans, such as pension plans, and must submit this form to the IRS.

How to fill out Form 5308?

To fill out Form 5308, one must provide information such as the name of the plan, the type of plan, the plan sponsor's details, and other relevant financial data as required by the IRS instructions on the form.

What is the purpose of Form 5308?

The purpose of Form 5308 is to provide the IRS with details regarding the compliance of pension plans with applicable laws, as well as to report any necessary information for tax purposes.

What information must be reported on Form 5308?

Information that must be reported on Form 5308 includes the plan's name, type, IRS plan number, details of the plan administrator, and specific financial data related to the plan's fiscal year.

Fill out your form 5308 - gpo online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 5308 - Gpo is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.