Get the free COMPUTATION OF CORPORATE FIDUCIARY COMPENSATION - lucas-co-probate-ct

Show details

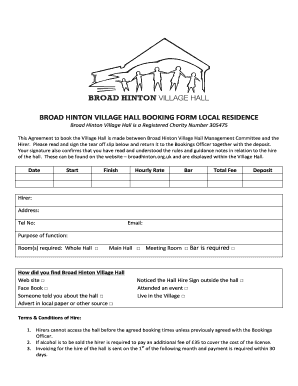

Reset Form PROBATE COURT OF LUCAS COUNTY, OHIO JUDGE JACK R. SULLENBERGER TRUST OF, CASE NO. COMPUTATION OF CORPORATE FIDUCIARY COMPENSATION LOCAL RULE 74.2 (A) For purposes of this rule a Corporate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign computation of corporate fiduciary

Edit your computation of corporate fiduciary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your computation of corporate fiduciary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit computation of corporate fiduciary online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit computation of corporate fiduciary. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out computation of corporate fiduciary

How to fill out computation of corporate fiduciary:

01

Gather all necessary financial information: Start by collecting all the relevant financial data related to the corporation. This includes income statements, balance sheets, and other financial reports. Make sure you have accurate and up-to-date information to ensure an accurate computation.

02

Determine the taxable income: Calculate the corporation's taxable income by subtracting any allowable deductions from the total revenue. Consider expenses such as salaries, operating costs, and interest payments. It's essential to comply with relevant tax laws and regulations while making these calculations.

03

Apply the applicable tax rate: Determine the appropriate tax rate for the corporation based on the tax laws of the relevant jurisdiction. This rate may vary depending on the corporation's size, industry, and taxable income bracket. Check the latest tax regulations or consult with a tax professional for accurate information.

04

Calculate the tax liability: Multiply the taxable income by the applicable tax rate to determine the corporation's tax liability. This amount represents the total tax owed by the corporation to the respective tax authorities.

05

Consider any tax credits or incentives: Evaluate if there are any tax credits or incentives available for the corporation. Some jurisdictions offer tax breaks or credits to specific industries or for specific activities. Account for these credits in the computation to reduce the final tax liability.

06

Prepare the necessary forms and documentation: Once the computation is complete, ensure that the corporation fills out all the required tax forms accurately and completely. Attach any supporting documentation, financial statements, or schedules as required. Double-check everything to avoid errors or omissions that could lead to penalties or audits.

Who needs computation of corporate fiduciary?

The computation of corporate fiduciary is primarily needed by corporations and businesses subject to corporate tax. It is mandatory for these entities to calculate and report their tax liabilities accurately to fulfill their compliance requirements. Additionally, the computation may also be required for financial planning purposes, evaluating profitability, or providing financial information to stakeholders or investors. It is recommended to seek guidance from tax professionals or accountants to ensure the accuracy and compliance of the computation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my computation of corporate fiduciary directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your computation of corporate fiduciary as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in computation of corporate fiduciary?

The editing procedure is simple with pdfFiller. Open your computation of corporate fiduciary in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the computation of corporate fiduciary in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your computation of corporate fiduciary in seconds.

What is computation of corporate fiduciary?

Computation of corporate fiduciary is the calculation of a corporation's fiduciary duties and responsibilities in managing assets on behalf of shareholders or beneficiaries.

Who is required to file computation of corporate fiduciary?

Any corporation that acts as a fiduciary for its shareholders or beneficiaries is required to file computation of corporate fiduciary.

How to fill out computation of corporate fiduciary?

Computation of corporate fiduciary can be filled out by providing detailed information on the corporation's financial activities, investments, and any fees or commissions charged for fiduciary services.

What is the purpose of computation of corporate fiduciary?

The purpose of computation of corporate fiduciary is to ensure that corporations are fulfilling their fiduciary responsibilities in a transparent and accountable manner.

What information must be reported on computation of corporate fiduciary?

Information such as financial statements, investment strategies, fees charged, and any conflicts of interest must be reported on computation of corporate fiduciary.

Fill out your computation of corporate fiduciary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Computation Of Corporate Fiduciary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.