Get the free FLEXlBLE PREMlUM RETlREMENT ANNUlTY - Navy Mutual - navymutual

Show details

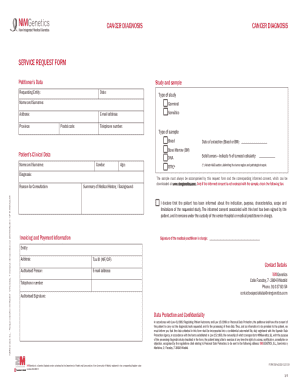

What Is A Flexible Premium Retirement Annuity? A Flexible Premium Retirement Annuity (FPGA) from Navy Mutual is a nonqualified, fixed annuity contract which provides several valuable wealth accumulation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexlble premlum retlrement annulty

Edit your flexlble premlum retlrement annulty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexlble premlum retlrement annulty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit flexlble premlum retlrement annulty online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit flexlble premlum retlrement annulty. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flexlble premlum retlrement annulty

How to fill out a flexible premium retirement annuity:

01

Gather all the necessary information: Before filling out the form, make sure you have all the required information like your personal details, employment history, financial information, and beneficiary details. This will help streamline the process.

02

Understand the terms and conditions: Read through the terms and conditions of the annuity carefully to ensure you understand the product. Familiarize yourself with key features, investment options, surrender charges, and any potential tax implications. If you have any questions, reach out to the annuity provider for clarification.

03

Complete the application form: Fill out the application form accurately and legibly. Double-check all the information you provide to avoid any mistakes. Pay special attention to sections that require financial details, payment options, and beneficiary designations.

04

Consider additional options: Some flexible premium retirement annuities offer optional riders or benefits that you can select based on your needs. These may include features like enhanced death benefits, long-term care provisions, or income guarantees. Evaluate these options carefully and decide if they align with your retirement goals.

05

Seek professional advice: If you are unsure about any aspect of the annuity or need personalized guidance, consider consulting with a financial advisor or retirement specialist. They can provide expert advice, help you understand the pros and cons, and ensure the annuity aligns with your overall financial plan.

Who needs a flexible premium retirement annuity:

01

Individuals looking to secure a regular income stream during retirement: A flexible premium retirement annuity allows you to contribute premium payments over time, which can then be converted into regular income upon reaching retirement age. This can be beneficial for those who want to ensure a steady cash flow during their retirement years.

02

People seeking tax advantages: Retirement annuities often provide tax benefits. Contributions to these annuities are typically tax-deferred, meaning you won't pay taxes on the growth until you start withdrawing funds. This can be advantageous for individuals looking to reduce their tax liability.

03

Individuals with long-term retirement goals: A flexible premium retirement annuity is designed for long-term retirement planning. If you have a substantial time horizon until retirement, this annuity can give your investments more time to grow and potentially provide a larger nest egg for your retirement years.

Remember, before committing to any financial product, it's crucial to evaluate your individual circumstances, financial goals, and risk tolerance. Consider speaking with a financial professional to determine if a flexible premium retirement annuity aligns with your overall retirement plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute flexlble premlum retlrement annulty online?

pdfFiller has made it simple to fill out and eSign flexlble premlum retlrement annulty. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit flexlble premlum retlrement annulty on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing flexlble premlum retlrement annulty.

How do I fill out the flexlble premlum retlrement annulty form on my smartphone?

Use the pdfFiller mobile app to complete and sign flexlble premlum retlrement annulty on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is flexible premium retirement annuity?

Flexible premium retirement annuity is a type of annuity that allows individuals to contribute varying amounts of money towards their retirement savings.

Who is required to file flexible premium retirement annuity?

Individuals who wish to secure a retirement income stream for their future are required to file flexible premium retirement annuities.

How to fill out flexible premium retirement annuity?

To fill out a flexible premium retirement annuity, individuals need to provide personal information, select investment options, and determine contribution amounts.

What is the purpose of flexible premium retirement annuity?

The purpose of flexible premium retirement annuity is to help individuals save for retirement and secure a steady income stream during their golden years.

What information must be reported on flexible premium retirement annuity?

Information such as personal details, investment selections, contribution amounts, and beneficiary designations must be reported on flexible premium retirement annuities.

Fill out your flexlble premlum retlrement annulty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexlble Premlum Retlrement Annulty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.