Get the free Flexible Spending Account FSA Care and Care Claim Form

Show details

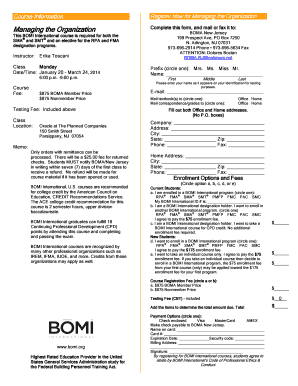

FlexibleSpendingAccount(FSA) HealthCareandDependentCareClaimForm Personal Information EmployeeName CompanyName Headdress AddressChange Yes No SocialSecurityNumber ForQuickClaimProcessing: FullyComplete&SignthisClaimForm

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexible spending account fsa

Edit your flexible spending account fsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexible spending account fsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit flexible spending account fsa online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit flexible spending account fsa. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flexible spending account fsa

How to Fill Out Flexible Spending Account (FSA):

01

Gather necessary information: Before filling out the FSA, make sure you have all the required information at hand. This includes your personal details, such as full name, address, and social security number, as well as any dependent information if applicable.

02

Determine your contribution amount: Decide how much you want to contribute to your FSA for the upcoming year. Keep in mind that the maximum contribution limit may change annually, so check with your employer or the FSA provider for the current limit.

03

Estimate your eligible expenses: Understand the types of expenses that are eligible for reimbursement through your FSA. Common eligible expenses include medical and dental costs, prescription medications, certain over-the-counter items, and dependent care expenses. Estimate your anticipated expenses for the year to determine your contribution amount accurately.

04

Enroll in the FSA: Contact your employer or visit the FSA provider's website to enroll in the program. You may be required to complete an enrollment form or make your selections online. Pay attention to the enrollment deadlines and ensure that you submit your form or make your selections within the specified timeframe.

05

Submit necessary documentation: To receive reimbursement for eligible expenses, you must provide supporting documentation. This typically includes receipts or invoices that clearly detail the service or product, the date of the expense, and the amount paid. Keep track of your eligible expenses throughout the year and organize the required documentation.

06

Understand the FSA rules: Familiarize yourself with the specific rules and regulations of your FSA. For example, there may be restrictions on rollover of funds, deadlines for spending the funds, and certain limitations on eligible expenses. Being aware of these rules will help you effectively utilize your FSA benefits.

Who Needs Flexible Spending Account (FSA)?

01

Employees with healthcare expenses: An FSA is beneficial for individuals who anticipate having out-of-pocket healthcare costs throughout the year. If you regularly pay for medical or dental expenses, prescription medications, or other eligible healthcare items, having an FSA can help you save money by using pre-tax dollars.

02

Parents or guardians with dependent care expenses: If you have children or dependents who require daycare or other eligible dependent care services, an FSA can help you cover these costs with pre-tax dollars. This can provide significant financial relief for parents or guardians with dependent care responsibilities.

03

Individuals seeking tax savings: Utilizing an FSA allows individuals to contribute pre-tax dollars, effectively reducing their taxable income. This can lower your overall tax liability and potentially save you money during the tax filing season.

In conclusion, anyone who expects to have eligible healthcare or dependent care expenses and wants to save on taxes should consider a Flexible Spending Account (FSA). By properly understanding and filling out the necessary documentation, you can effectively utilize your FSA and maximize your savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is flexible spending account fsa?

A flexible spending account (FSA) is a tax-advantaged financial account that allows employees to set aside a portion of their earnings to pay for qualified medical or dependent care expenses.

Who is required to file flexible spending account fsa?

Employees who wish to participate in a flexible spending account (FSA) offered by their employer are required to file the necessary paperwork to set up the account.

How to fill out flexible spending account fsa?

To fill out a flexible spending account (FSA), employees typically need to provide personal information, such as their name, social security number, and desired contribution amount. They may also need to indicate which expenses they plan to use the funds for.

What is the purpose of flexible spending account fsa?

The purpose of a flexible spending account (FSA) is to provide employees with a way to save money on eligible expenses by allowing them to contribute pre-tax dollars to the account.

What information must be reported on flexible spending account fsa?

Flexible spending account (FSA) participants must report their contributions, expenses, and any reimbursements received from the account on their tax returns.

How can I edit flexible spending account fsa from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your flexible spending account fsa into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute flexible spending account fsa online?

pdfFiller has made filling out and eSigning flexible spending account fsa easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete flexible spending account fsa on an Android device?

Use the pdfFiller app for Android to finish your flexible spending account fsa. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your flexible spending account fsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexible Spending Account Fsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.