Get the free Credit card application - kiwibankconz

Show details

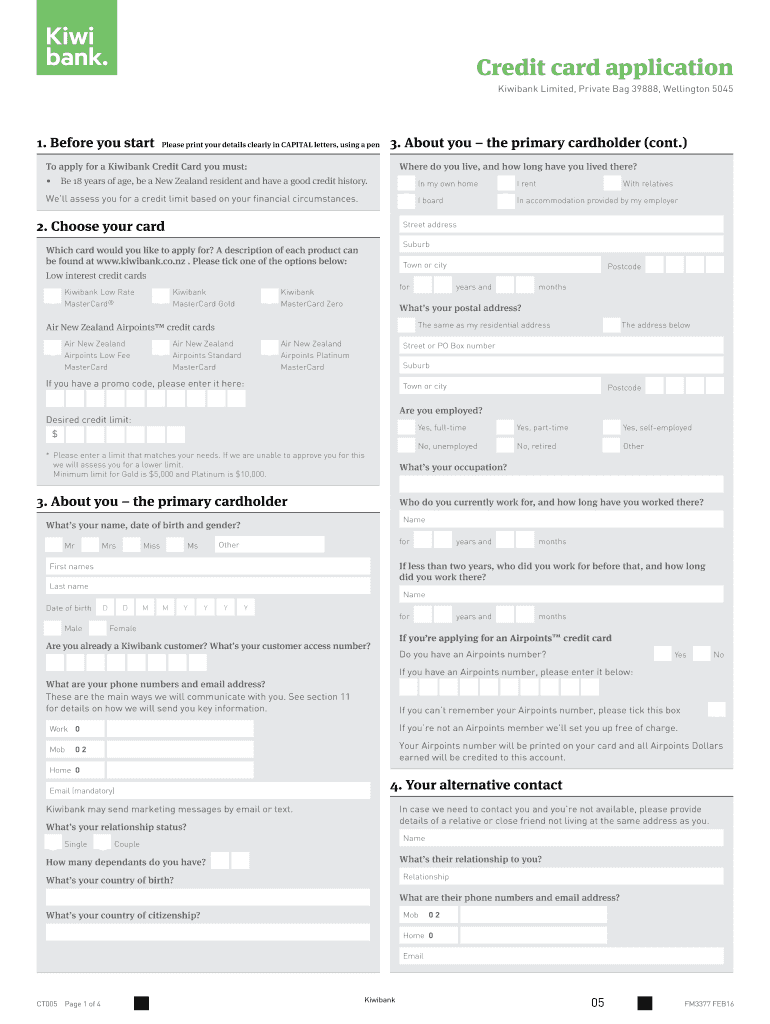

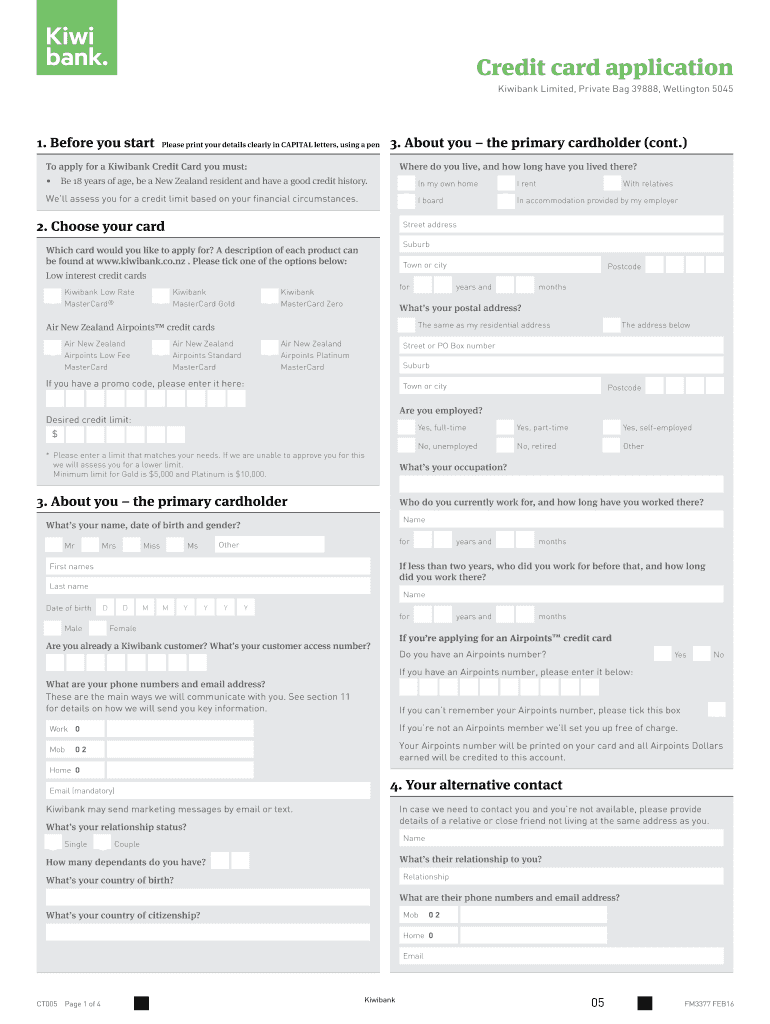

Credit card application Kiwi bank Limited, Private Bag 39888, Wellington 5045 1. Before you start Please print your details clearly in CAPITAL letters, using a pen 3. About you the primary cardholder

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card application

Edit your credit card application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit card application online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit card application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card application

How to fill out a credit card application:

01

Gather necessary information: Before starting the application, make sure you have all the required information handy. This includes your personal details, such as your name, address, phone number, and social security number, as well as your employment information, income details, and any existing credit card accounts.

02

Research different credit card options: Prior to filling out the application, it's essential to research and compare different credit cards to find the one that suits your needs. Consider factors like interest rates, annual fees, rewards programs, and any special offers or benefits associated with the card.

03

Carefully read the application form: Take your time to thoroughly read through the credit card application form. Make sure you understand all the terms and conditions, including the fees and interest rates, before providing your consent.

04

Provide accurate personal information: Fill in your personal information accurately and honestly. Mistakes or incorrect details can lead to your application being rejected or delayed. Double-check your contact information to ensure there are no errors.

05

Include your financial details: The credit card application will ask for your financial information, such as your income, employment status, and monthly expenses. Be honest and include all the necessary details requested.

06

Choose a credit limit: Determine the credit limit you desire. This is the maximum amount you can charge on the card. Opt for a credit limit that aligns with your spending habits and financial capacity.

07

Review and submit: Once you have completed the entire application form, carefully review all the information you have provided. Ensure there are no mistakes or omissions. Submit the application electronically or via mail, following the instructions provided.

Who needs a credit card application:

01

Individuals without a credit card: If you currently don't have a credit card and would like to access the benefits and convenience they offer, you need a credit card application.

02

Those seeking to build credit history: A credit card application is necessary for individuals who want to establish a credit history. Positive credit history is crucial for future loans, mortgages, and other financial transactions.

03

People looking for financial flexibility: If you want the freedom to make purchases and payments on credit, a credit card application is essential. Credit cards allow you to access funds that you can repay each month or over time.

04

Travelers and online shoppers: Credit cards are commonly used for making travel reservations, hotel bookings, and online purchases. If you frequently travel or shop online, having a credit card can be highly beneficial.

05

Individuals seeking rewards and perks: Many credit cards offer rewards programs, such as cashback, airline miles, or points for purchases. If you want to earn rewards or take advantage of special perks, applying for a credit card can help you access these benefits.

Remember, acquiring a credit card comes with responsibilities. It's crucial to use credit cards responsibly, make timely payments, and avoid accumulating excessive debt.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card application without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including credit card application, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for the credit card application in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your credit card application in seconds.

How do I fill out credit card application using my mobile device?

Use the pdfFiller mobile app to complete and sign credit card application on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is credit card application?

A credit card application is a request submitted by an individual seeking to obtain a credit card from a financial institution.

Who is required to file credit card application?

Anyone who wishes to apply for a credit card is required to file a credit card application.

How to fill out credit card application?

To fill out a credit card application, one must provide personal information such as name, address, income, and employment details, as well as consent to a credit check.

What is the purpose of credit card application?

The purpose of a credit card application is to apply for and potentially obtain a credit card for personal use, which allows for convenient electronic payments and the ability to borrow money up to a certain limit.

What information must be reported on credit card application?

Information that must be reported on a credit card application includes personal details, income, employment status, and consent for a credit check.

Fill out your credit card application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.