Get the free Living Trust - Charitable Remainder Annuity

Show details

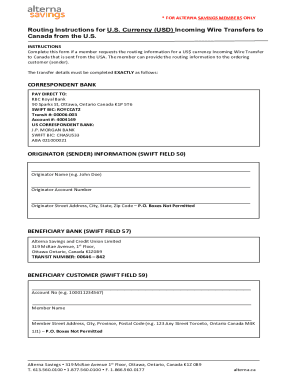

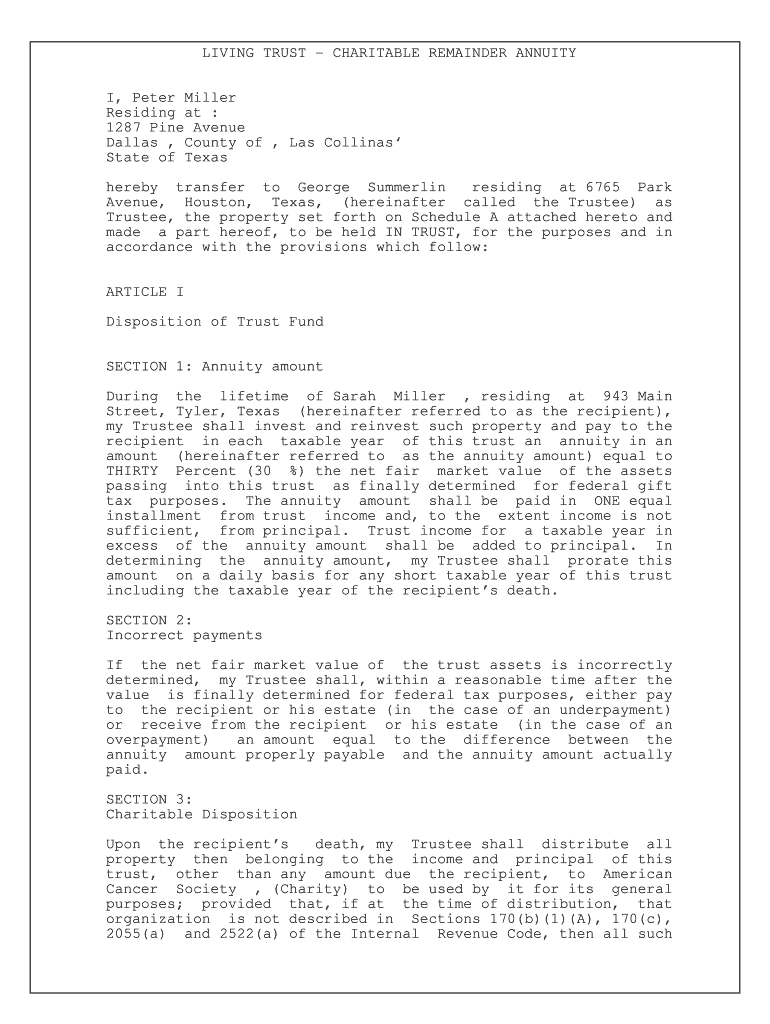

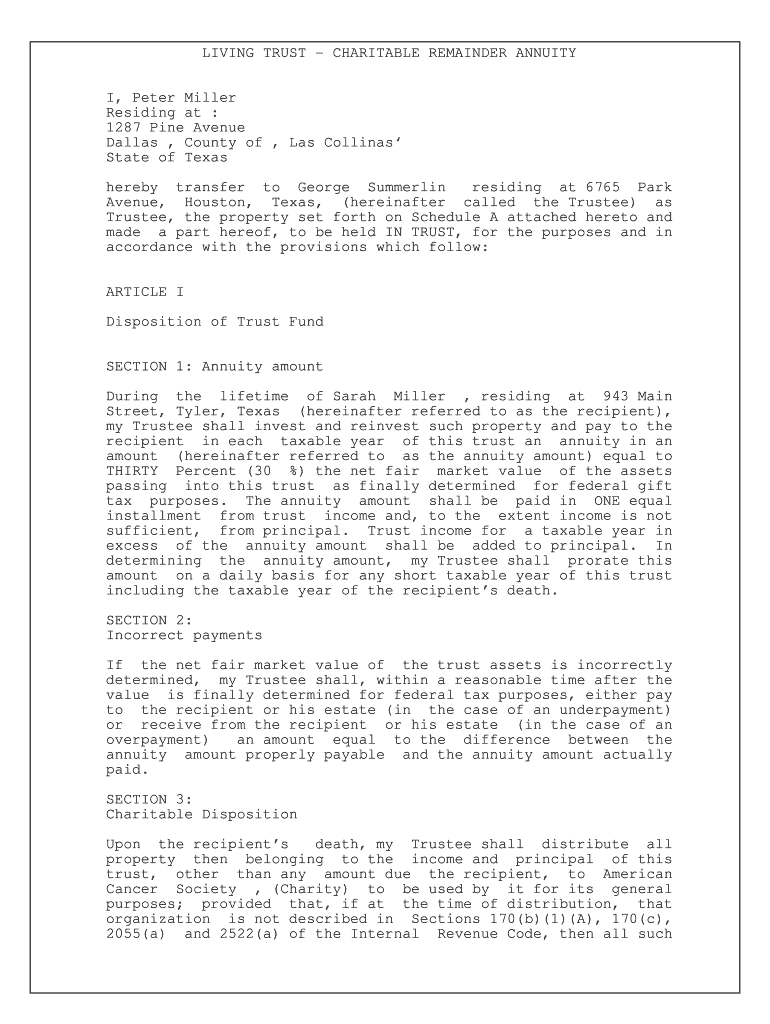

LIVING TRUST CHARITABLE REMAINDER ANNUITY I Peter Miller Residing at 1287 Pine Avenue Dallas County of Las Collinas State of Texas hereby transfer to George Summerlin residing at 6765 Park Avenue Houston Texas hereinafter called the Trustee as Trustee the property set forth on Schedule A attached hereto and made a part hereof to be held IN TRUST for the purposes and in accordance with the provisions which follow ARTICLE I Disposition of Trust Fund SECTION 1 Annuity amount During the lifetime...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign living trust - charitable

Edit your living trust - charitable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your living trust - charitable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing living trust - charitable online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit living trust - charitable. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out living trust - charitable

How to fill out Living Trust - Charitable Remainder Annuity

01

Begin by gathering all necessary personal and financial information.

02

Identify the charitable organization(s) you want to support with the trust.

03

Decide on the amount or percentage of your assets you wish to allocate to the trust.

04

Choose the annuity payment structure, including the payment amount and frequency.

05

Select a trustee who will manage the trust according to your instructions.

06

Draft the trust document, including all relevant details about the trust terms.

07

Fund the trust by transferring the specified assets into it.

08

Ensure the trust is compliant with applicable state and federal laws.

09

Consult with a legal or financial advisor to review and finalize the trust.

Who needs Living Trust - Charitable Remainder Annuity?

01

Individuals looking to provide charitable support while also receiving income during their lifetime.

02

Those seeking tax benefits by donating assets to charity while retaining an annuity income.

03

Persons who want to effectively manage their estate planning and charitable intentions.

04

Investors wanting to ensure their financial security while contributing to philanthropic causes.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a charitable remainder trust and a charitable remainder annuity trust?

Charitable remainder annuity trusts (CRATs) distribute a fixed annuity amount each year, and additional contributions are not allowed. Charitable remainder unitrusts (CRUTs) distribute a fixed percentage based on the balance of the trust assets (revalued annually), and additional contributions can be made.

What is the difference between a charitable lead annuity trust and a charitable remainder trust?

CRATs distribute a fixed dollar amount (based on a percentage that is calculated when the trust is first funded), while CRUTs distribute a fixed percentage of trust assets every year (with the dollar amount increasing or decreasing along with the value of the trust assets).

What is the difference between a trust and an annuity?

Unlike charitable remainder trusts, charitable lead trusts are not held to the same mandatory time limit of 20 years if you select the fixed term option. Also, there is no required minimum or maximum payment to the charitable beneficiaries, so long as payments are made at least annually.

Is a charitable remainder trust the same as a charitable gift annuity?

A charitable remainder trust (CRT) provides income like a charitable gift annuity. What makes it different is that you have many options when establishing a CRT, including choosing the investment model so your trust can grow the way you want it to.

What are the downsides of a charitable remainder trust?

Disadvantages The charitable remainder trust is irrevocable, meaning that with very few exceptions, it cannot be changed once it is created. It usually requires a donation of substantial assets to make sense. Legally, you no longer have control of the assets in the trust.

What is the 5 rule for charitable remainder trust?

A charitable remainder unitrust (CRUT) pays a percentage of the value of the trust each year to noncharitable beneficiaries. The payments generally must equal at least 5% and no more than 50% of the fair market value of the assets, valued annually.

What is the purpose of a CLAT?

CLATs provide a gift tax efficient way to transfer wealth to heirs while benefiting charities. An example of a CLAT at work best demonstrates its potential benefits: Assume Jane contributes $1,000,000 to a CLAT that lasts for 10 years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Living Trust - Charitable Remainder Annuity?

A Living Trust - Charitable Remainder Annuity is a type of trust that allows an individual to contribute assets to a charitable organization while retaining the right to receive income from those assets for a specified period or for their lifetime.

Who is required to file Living Trust - Charitable Remainder Annuity?

Individuals who create a charitable remainder annuity trust are typically required to file, especially if they intend to claim tax deductions or if the trust has taxable income.

How to fill out Living Trust - Charitable Remainder Annuity?

To fill out a Living Trust - Charitable Remainder Annuity, one must provide details about the grantor, the charity, the annuity terms, and the assets being contributed. It's advisable to consult with a legal professional for specific requirements.

What is the purpose of Living Trust - Charitable Remainder Annuity?

The purpose of a Living Trust - Charitable Remainder Annuity is to provide a steady income to the grantor while ultimately benefiting a charitable organization, thus blending personal financial planning with philanthropy.

What information must be reported on Living Trust - Charitable Remainder Annuity?

Information that must be reported includes the identities of the grantor and beneficiaries, valuation of the trust assets, the terms of the annuity, and any income generated by the trust.

Fill out your living trust - charitable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Living Trust - Charitable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.