Get the free Business Entity Information - Color Claims

Show details

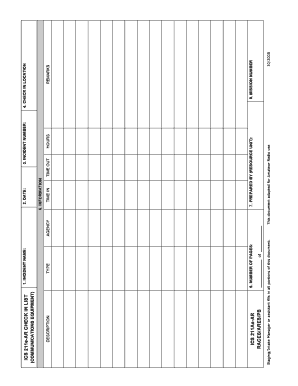

Entity Details Secretary of State, Nevada 1 of 2 http://nvsos.gov/sosentitysearch/PrintCorp.aspx?lx8nvqeJ3AvAlKzJP... Business Entity Information Status: Type: Active Domestic Corporation Qualifying

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business entity information

Edit your business entity information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business entity information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business entity information online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business entity information. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business entity information

How to Fill Out Business Entity Information:

01

Gather all relevant documents and information required for business entity registration, such as legal name, address, contact information, and tax identification number.

02

Determine the appropriate type of business entity you wish to register, such as a sole proprietorship, partnership, limited liability company (LLC), or corporation. Research the legal requirements and benefits of each entity type before making a decision.

03

Complete the necessary forms provided by the appropriate governmental agency, such as the Secretary of State's office or the Internal Revenue Service (IRS). These forms typically include fields for your business name, address, ownership information, and other essential details. Double-check for accuracy and ensure that all required fields are filled out properly.

04

Provide supporting documentation as required, such as articles of incorporation, partnership agreements, or operating agreements, depending on the entity type you chose. These documents may need to be notarized or filed separately from the main registration forms.

05

Pay any applicable fees associated with the registration process. The fees can vary depending on your location and the type of entity being registered. Follow the payment instructions provided by the governmental agency and retain proof of payment.

06

Submit the completed registration forms, supporting documentation, and payment to the appropriate governmental agency. Some agencies may accept online submissions, while others require physical copies sent either by mail or in person. Ensure that you submit all required materials within the designated time frame.

07

Wait for confirmation of successful registration. Once the registration process is complete, you may receive a certificate of formation or incorporation, which officially establishes your business entity. Keep this certificate in a safe place, as you may need it for future legal or financial purposes.

08

Maintain accurate and up-to-date business entity information. It is crucial to inform the relevant authorities promptly if any changes occur regarding your business, such as a change in address, ownership, or contact information.

09

Regularly review your business entity information to ensure its accuracy and compliance with any legal requirements. Failure to keep the information current and accurate may result in penalties or loss of certain benefits associated with the chosen entity type.

Who Needs Business Entity Information:

01

Entrepreneurs and business owners planning to start a new company or organization.

02

Existing business owners looking to update or modify their entity type or registration information.

03

Individuals seeking to avail of legal and financial benefits provided by specific business entity types, such as limited liability protection or tax advantages.

04

Investors, partners, or lenders requiring accurate and verifiable information about the business entity they are associating with.

05

Governmental agencies, financial institutions, or regulatory bodies responsible for monitoring and overseeing businesses in their jurisdiction.

06

Legal professionals or consultants assisting clients in the establishment, operation, or dissolution of business entities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is business entity information?

Business entity information refers to the details and data regarding a specific business organization, such as its name, address, ownership structure, and financial information.

Who is required to file business entity information?

All registered business entities, including corporations, partnerships, and LLCs, are required to file business entity information with the relevant government authorities.

How to fill out business entity information?

Business entity information can typically be filled out online through a government portal or by submitting specific forms that include the required details about the organization.

What is the purpose of business entity information?

The purpose of business entity information is to provide transparency about the ownership, structure, operations, and financial standing of a business organization for regulatory and public knowledge.

What information must be reported on business entity information?

The information reported on business entity information may include the business name, address, type of entity, ownership details, financial data, and any other information required by the governing authorities.

How can I send business entity information to be eSigned by others?

To distribute your business entity information, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute business entity information online?

Filling out and eSigning business entity information is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the business entity information in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your business entity information in minutes.

Fill out your business entity information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Entity Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.