IL Senior Citizen Exemption Certificate of Error free printable template

Get, Create, Make and Sign senior exemption error form

Editing exemption certificate error online

Uncompromising security for your PDF editing and eSignature needs

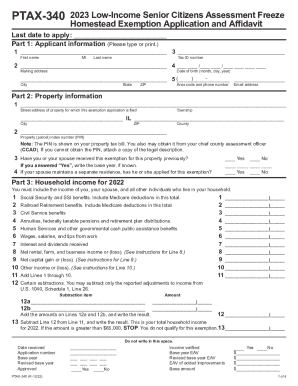

How to fill out exemption error application form

How to fill out IL Senior Citizen Exemption Certificate of Error Application

Who needs IL Senior Citizen Exemption Certificate of Error Application?

Video instructions and help with filling out and completing senior citizen exemption certificate error

Instructions and Help about exemption error form

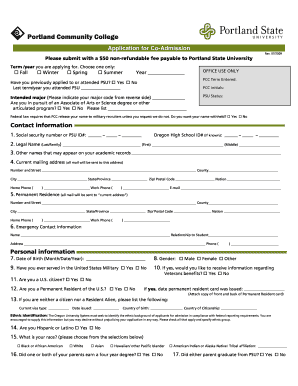

Hello from Carter Property Group this is Paul and today this video is going to go through the steps of applying for the 2015 homeowners exemption first we'll go to Cook County assessor or com and under exemptions choose the drop-down option for exemption description you'll see each of the exemptions that are available to Cook County homeowners we're going to go over the homeowner exemption there's two drop-down menus even further into the process the first is an application which is a downloadable PDF file and the second is some additional information on how to receive the homeowners' exemption, so you want to make note of both of these if you click the PDF file it'll open up it asks for some basic information so the property identification number or property index number homeowner property address city state and zip day time phone number it requires you to assert that you've lived in the property for the past calendar year so from January 1st 2015 to the present that you're living in the property you're asserting that with your signature here you'll date it and then there's another piece of information that needs to come along with it, so you must include a copy of a recent property tax bill and a copy of one of the following valid forms of residency with this application and that would be an Illinois driver's license or an Illinois identification card obviously it must have the same address on it so if you print this out through the print box button at the top of the screen you should be all set to have the form fill it out along with the copies of the tax bill and your Illinois driver's license, so that's how you don't apply for the 2015 — homeowner exemption thanks for tuning in we'll talk to you soon have a good day you

People Also Ask about

At what age do seniors stop paying property taxes in Illinois?

How much is the senior freeze in Illinois?

How do I get senior tax exemption in Illinois?

What is the senior freeze exemption in Illinois?

Does Illinois have a property tax freeze for elderly?

Who qualifies for homeowners exemption in Illinois?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

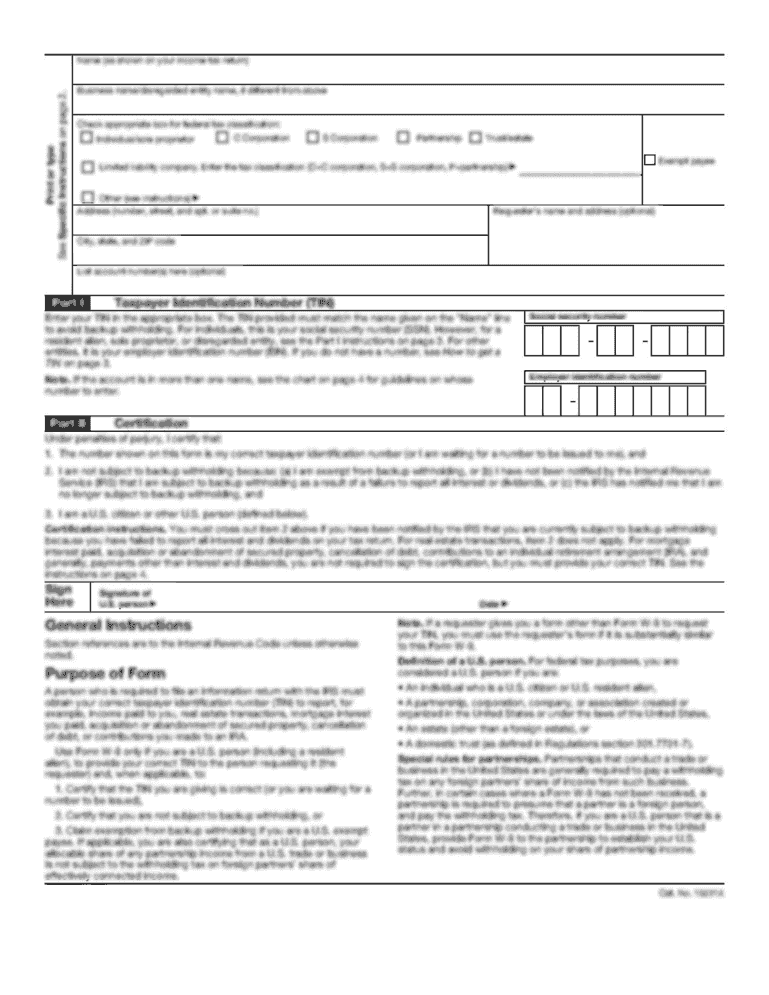

Can I create an electronic signature for signing my senior citizen exemption certificate in Gmail?

How can I fill out senior citizen exemption certificate on an iOS device?

How do I edit senior citizen exemption certificate on an Android device?

What is IL Senior Citizen Exemption Certificate of Error Application?

Who is required to file IL Senior Citizen Exemption Certificate of Error Application?

How to fill out IL Senior Citizen Exemption Certificate of Error Application?

What is the purpose of IL Senior Citizen Exemption Certificate of Error Application?

What information must be reported on IL Senior Citizen Exemption Certificate of Error Application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.