Get the free generation skipping tax

Show details

Generation Skipping Trusts

In the natural order of things, parents tend to leave their assets to their children. The children, in turn, leave assets to their children. When this happens, assets may

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign generation skipping trust form

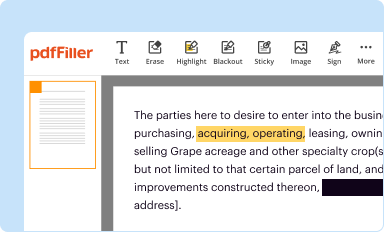

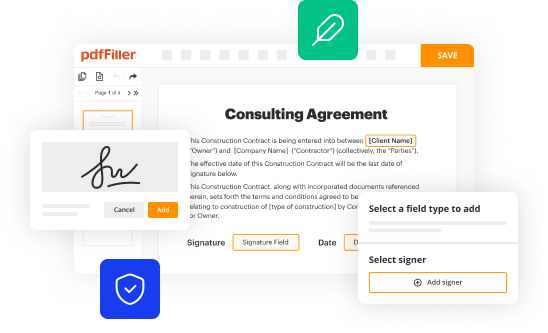

Edit your generation skipping tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

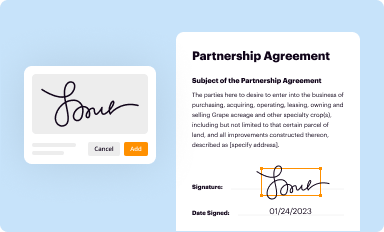

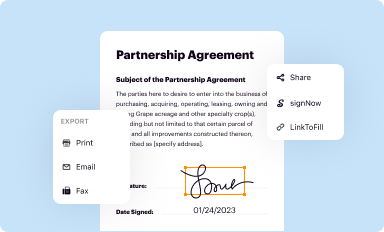

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your generation skipping tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing generation skipping tax form online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit generation skipping tax form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out generation skipping tax form

How to fill out generation skipping trust form:

01

Gather all necessary information and documents, such as the names and contact information of the grantor, trustee, and beneficiaries, as well as the trust provisions and any relevant tax identification numbers.

02

Review the specific requirements and instructions provided with the generation skipping trust form, as these may vary depending on the jurisdiction or organization issuing the form.

03

Complete the form accurately and thoroughly, making sure to provide all requested information and to follow any formatting or filing instructions.

04

If necessary, consult with an attorney or financial advisor experienced in estate planning or trusts to ensure that you are properly filling out the form and meeting all legal and tax requirements.

Who needs generation skipping trust form:

01

Individuals who wish to transfer wealth or assets to beneficiaries who are at least two generations younger than themselves.

02

Families who want to minimize estate taxes by utilizing the generation skipping transfer (GST) tax exemption.

03

Those who desire to preserve assets for future generations and protect them from potential creditors or estate taxes.

04

Individuals looking to create a long-term financial strategy that includes avoiding the potential negative effects of estate tax on multiple generations.

Fill

form

: Try Risk Free

People Also Ask about

What is a Form 706 GS D 1?

The Form 706-GS(D-1) is used by trustees to report certain distributions from a trust that are subject to the generation-skipping transfer tax (GSTT). A skip person is someone related to the transferor by blood, marriage or adoption, who is one or more generations below the transferor.

How do you create a generation-skipping trust?

How Does a Generation Skipping Trust Work? ing to U.S. generation skipping trust rules, the beneficiary must be two or more generations younger than the trustor. Mentioned before, this means that the beneficiary must either be the grandchild of the trustor, or anyone who is at least 37 ½ years younger.

What is the form for generation skipping transfer?

What Is Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return? The generation-skipping transfer tax is an additional tax on a transfer of property that skips a generation, known as a generation-skipping transfer for short.

What is an example of a generation-skipping trust?

It can happen intentionally. For example, if you skip the living parent (your child) and leave an inheritance directly to your grandchild. It can happen unintentionally, as when an inheritance is in a trust for your child, and your child dies after you, but before receiving the full amount in the trust.

Is a generation-skipping trust a good idea?

For many grandparents, it might make sense to get a generation-skipping trust, which is one of the cleanest ways to give money directly to your grandchildren without having that money go through their parents (your children) first. This is also a way to pay the estate or inheritance tax just once.

What is the basic of a generation-skipping trust?

A generation-skipping trust (GST) is a legally binding agreement in which assets are passed down to the grantor's grandchildren—or anyone at least 37½ years younger—bypassing the next generation of the grantor's children.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send generation skipping tax form to be eSigned by others?

Once you are ready to share your generation skipping tax form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I edit generation skipping tax form on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit generation skipping tax form.

How do I edit generation skipping tax form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share generation skipping tax form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is generation skipping tax?

Generation skipping tax (GST) is a federal tax that applies to transfers of money or property to beneficiaries who are more than one generation younger than the donor, such as grandchildren. It is designed to prevent individuals from avoiding estate and gift taxes by transferring assets directly to their grandchildren or other remote descendants.

Who is required to file generation skipping tax?

Anyone who makes a direct transfer of assets to a skip person—defined as someone who is at least two generations below the transferor—may be required to file GST tax forms. This typically includes individuals with significant assets that they wish to pass on to their grandchildren or further descendants.

How to fill out generation skipping tax?

To fill out generation skipping tax, individuals must complete IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. This form requires detailed information about the gifts made, the value of the gifts, and the relationship between the transferor and each recipient.

What is the purpose of generation skipping tax?

The purpose of generation skipping tax is to ensure that wealth is taxed at each generational level and to limit the ability of individuals to bypass estate and gift taxes that would ordinarily apply to transfers across generations.

What information must be reported on generation skipping tax?

The information that must be reported includes the total value of all gifts made to skip persons, the identity of the skip persons, the relationship of the skip persons to the transferor, and any exemptions or deductions being claimed for the gifts.

Fill out your generation skipping tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Generation Skipping Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.