Get the free DON’T LET LIVING TRUSTS CAUSE PROBLEMS FOR OWNERS OF CLOSELY-HELD BUSINESSES

Show details

DON T LET LIVING TRUSTS CAUSE PROBLEMS FOR OWNERS OF CLOSELY-HELD BUSINESSES CALIFORNIA ASSOCIATION OF ATTORNEY-CPAS and TAX SECTION CALIFORNIA STATE BAR Pasadena California Presentation by William C. Staley 818-936-3490 www. staleylaw. com September 23 2009 16335. doc 092309 1611 TABLE OF CONTENTS Living Trusts Are Useful Estate Planning Tools. 1 The Feuding Spouses Problem. 1 Buy-Sell Agreements. 2 Community Property Law vs. Corporate Law. 5 Shares Held by Individuals. 6 Shares Held in...

We are not affiliated with any brand or entity on this form

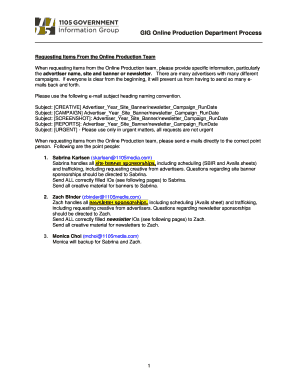

Get, Create, Make and Sign dont let living trusts

Edit your dont let living trusts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dont let living trusts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dont let living trusts online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dont let living trusts. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dont let living trusts

How to fill out DON’T LET LIVING TRUSTS CAUSE PROBLEMS FOR OWNERS OF CLOSELY-HELD BUSINESSES

01

Understand the purpose of a living trust and its benefits for estate planning.

02

Identify the specific assets that will be included in the living trust.

03

Consult with a qualified estate planning attorney who understands the implications for closely-held businesses.

04

Clearly outline the management succession plan for the business in the trust document.

05

Ensure that all business interests and ownership stakes are correctly transferred into the trust.

06

Communicate with family members and business partners about the living trust plan to ensure everyone is informed.

07

Review and update the trust regularly to account for any changes in business structure or ownership.

08

Consider potential tax implications and liabilities associated with the living trust.

Who needs DON’T LET LIVING TRUSTS CAUSE PROBLEMS FOR OWNERS OF CLOSELY-HELD BUSINESSES?

01

Owners of closely-held businesses who want to ensure smooth transitions of ownership.

02

Individuals looking to minimize probate complications for business assets.

03

Business owners wanting to maintain control over their business even after their passing.

04

Families who need to secure their business interests for future generations.

05

Heirs and beneficiaries who may inherit closely-held businesses and need clarity on ownership and management.

Fill

form

: Try Risk Free

People Also Ask about

How do trusts affect businesses?

Trusts are established to provide legal protection for your assets. A trust, in the case of business owners, can be a tool that enables business owners to prevent beneficiaries and potential creditors (including previous spouses) from gaining direct access to assets within the trust.

What unique estate planning problems are common to owners of closely held businesses?

For these reasons, owners of closely held businesses should consider specialized estate planning techniques to address issues such as succession planning, taxes, and liquidity needs.

What is an issue in estate planning?

In the law of trusts and estates , an issue is a lineal descendant of an individual. For example, a person's grandchild will be considered an issue.

What are the disadvantages of estate planning?

Disadvantages of Estate Planning: Cost: Estate planning can be expensive, especially if you create a detailed plan. Time: Estate planning can be time-consuming, as it requires gathering financial and legal documents, making important decisions, and reviewing and updating your plan regularly.

What are the two general situations that an estate plan lays out?

In addition to ensuring financial security and wealth distribution for your loved ones, estate planning offers two key benefits: ensuring your family is taken care of and mitigating family disputes.

What is the main reason family businesses fail to have adequate estate planning?

Only about 25% of family businesses have formal succession plans, even though the goal of most family business owners is to transfer the business to another generation. One reason for avoiding wills and succession plans is that nobody wants to think about the death of a family member (or one's self).

What are the limitations of a living trust?

Disadvantages of a Living Trust Limitations on asset transfers: Once you move your assets into a trust, you must follow the trust document's instructions on assignments. No tax avoidance. Potential for legal disputes.

What was the problem with trusts?

"Beneficiaries often have the belief that all assets in the trust are their personal assets (which they are not) and that the trust is their piggy bank." Tensions may also arise when beneficiaries don't fully understand why the trust was created and what they should (and shouldn't) expect to receive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DON’T LET LIVING TRUSTS CAUSE PROBLEMS FOR OWNERS OF CLOSELY-HELD BUSINESSES?

Don’t Let Living Trusts Cause Problems for Owners of Closely-Held Businesses refers to the potential legal and operational issues that can arise when a closely-held business is transferred into a living trust. This can lead to complications with control, management, and the perception of business continuity.

Who is required to file DON’T LET LIVING TRUSTS CAUSE PROBLEMS FOR OWNERS OF CLOSELY-HELD BUSINESSES?

Typically, individuals who establish a living trust that includes a closely-held business will need to file documentation that outlines the structure and management of the trust. This often includes business owners who wish to ensure a smooth transition of ownership.

How to fill out DON’T LET LIVING TRUSTS CAUSE PROBLEMS FOR OWNERS OF CLOSELY-HELD BUSINESSES?

To fill out the required documents, owners should provide comprehensive details about the business, including its structure, ownership stakes, management roles, and how the trust is intended to operate the business. Consulting with a legal advisor is highly recommended.

What is the purpose of DON’T LET LIVING TRUSTS CAUSE PROBLEMS FOR OWNERS OF CLOSELY-HELD BUSINESSES?

The purpose is to inform business owners about the implications of placing their business into a living trust and to provide guidance on how to manage potential issues related to control and succession planning.

What information must be reported on DON’T LET LIVING TRUSTS CAUSE PROBLEMS FOR OWNERS OF CLOSELY-HELD BUSINESSES?

The information that needs to be reported includes the names of the trust beneficiaries, the business ownership interests being placed into the trust, management structure, operational procedures, and any limitations on distributions or control.

Fill out your dont let living trusts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dont Let Living Trusts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.