NY RP-305 2012 free printable template

Show details

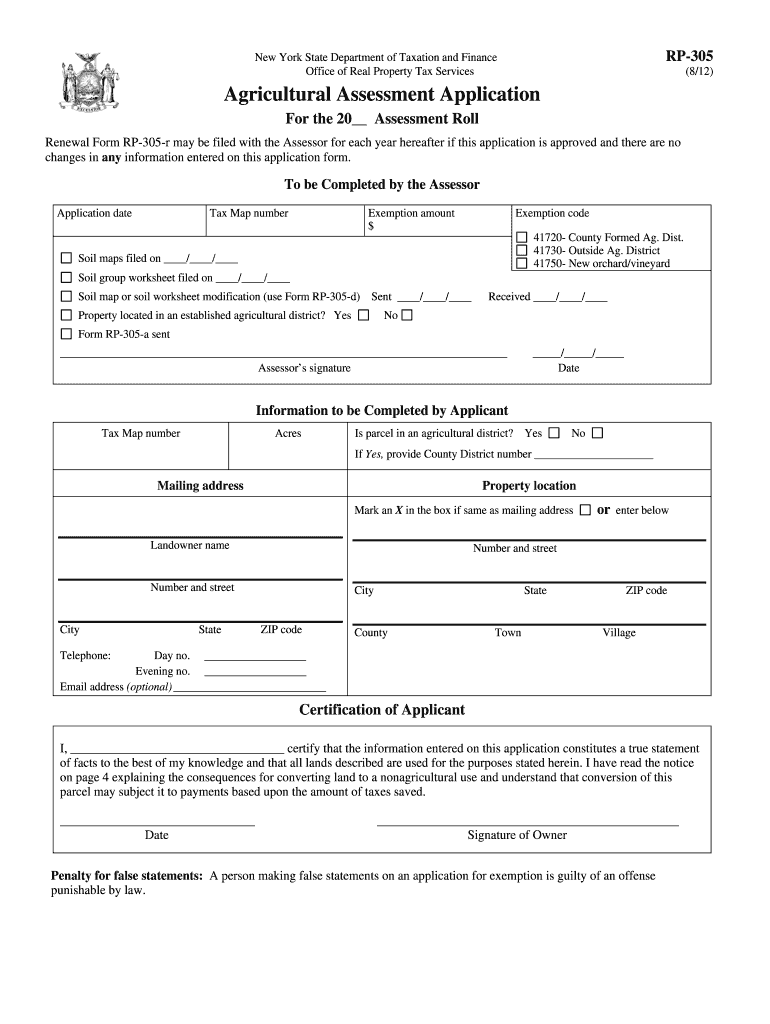

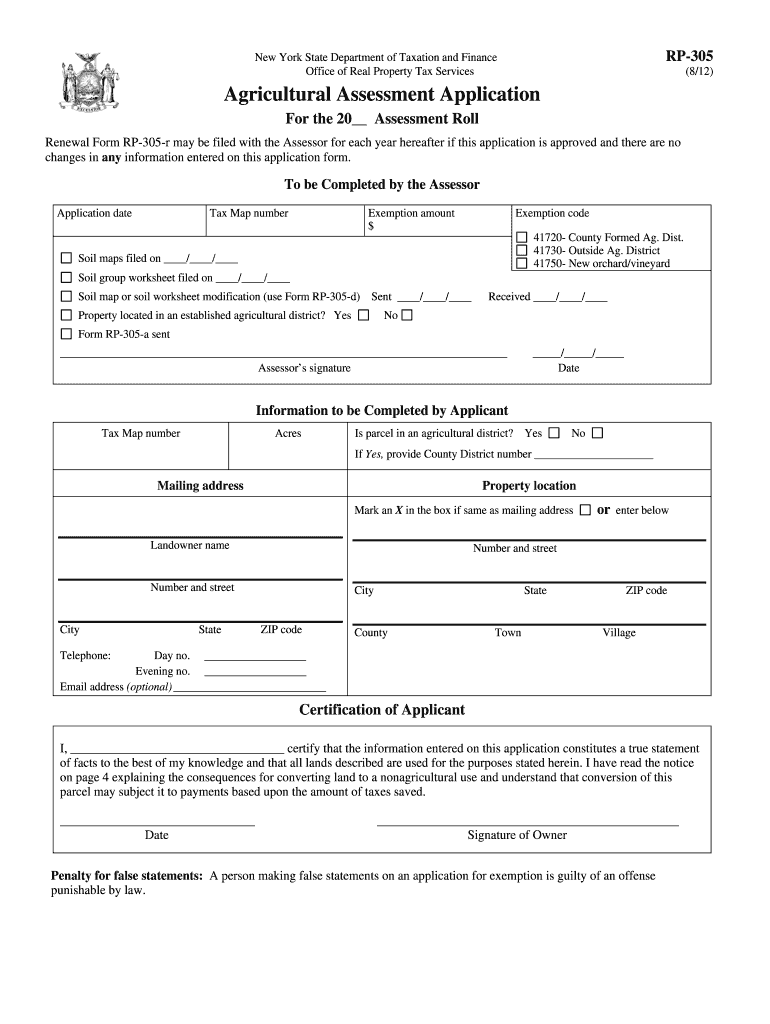

New York State Department of Taxation and Finance Office of Real Property Tax Services RP-305 (8/12) Agricultural Assessment Application For the 20 Assessment Roll Renewal Form RP-305-r may be filed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY RP-305

Edit your NY RP-305 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY RP-305 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY RP-305 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY RP-305. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY RP-305 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY RP-305

How to fill out NY RP-305

01

Gather necessary information: Collect all relevant property details and necessary documents.

02

Download the NY RP-305 form: Obtain the latest version of the NY RP-305 from the New York State Department of Taxation and Finance website.

03

Fill in the property details: Complete sections for property address, type of property, and ownership information accurately.

04

Provide the appropriate exemptions: Indicate any tax exemptions you believe you are eligible for and provide supporting information.

05

Review the form: Ensure all information is correct and double-check for any missing fields.

06

Sign the form: Ensure that the form is signed by the appropriate party, confirming that the information provided is accurate to the best of their knowledge.

07

Submit the form: Send the completed NY RP-305 form to the appropriate local tax office by the specified deadline.

Who needs NY RP-305?

01

Anyone who is buying or transferring real property in New York State may need to file the NY RP-305 form to report certain information regarding the transaction.

02

Property owners seeking tax exemptions may also need to complete this form to ensure they receive the appropriate benefits.

Fill

form

: Try Risk Free

People Also Ask about

How do I become tax exempt in NY?

Exemptions from Withholding You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and. You do not expect to have a New York income tax liability for this year.

What does the IRS require to be considered a farm?

One such definition is found in IRC Section 2032A(e)(4) relative to estate tax valuation; it reads as follows: The term “farm” includes stock, dairy, poultry, fruit, furbearing animal, and truck farms, plantations, ranches, nurseries, ranges, greenhouses or other similar structures used primarily for the raising of

How do I get agricultural tax exemption in NY?

To receive the exemption, the landowner must apply for agricultural assessment and attach Form RP-305-e to that application. New York tax law exempts certain items used in farm production from state and local sales and use taxes.

What are the farm tax benefits in NY?

Farm workforce retention credit You may be eligible for this credit of $1,200 per eligible farm employee if you are an eligible farmer whose federal gross income from farming for the tax year is at least two-thirds of excess federal gross income.

What qualifies as a farm to the IRS?

You are in the business of farming if you culti- vate, operate, or manage a farm for profit, either as owner or tenant. A farm includes livestock, dairy, poultry, fish, fruit, and truck farms. It also includes plantations, ranches, ranges, and or- chards and groves.

What classifies you as a farm?

USDA defines a farm as any place that produced and sold—or normally would have produced and sold—at least $1,000 of agricultural products during a given year. USDA uses acres of crops and head of livestock to determine if a place with sales less than $1,000 could normally produce and sell at least that amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NY RP-305 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your NY RP-305 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find NY RP-305?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the NY RP-305 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute NY RP-305 online?

Completing and signing NY RP-305 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

What is NY RP-305?

NY RP-305 is a form used in New York State for reporting property tax exemptions.

Who is required to file NY RP-305?

Property owners who are seeking property tax exemptions in New York State are required to file NY RP-305.

How to fill out NY RP-305?

To fill out NY RP-305, property owners must provide detailed information about the property, ownership, and the basis for the exemption being requested.

What is the purpose of NY RP-305?

The purpose of NY RP-305 is to enable property owners to apply for and receive property tax exemptions, which can reduce their property tax burden.

What information must be reported on NY RP-305?

Information that must be reported on NY RP-305 includes the property address, owner details, exemption type, and any supporting documentation for the exemption.

Fill out your NY RP-305 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY RP-305 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.