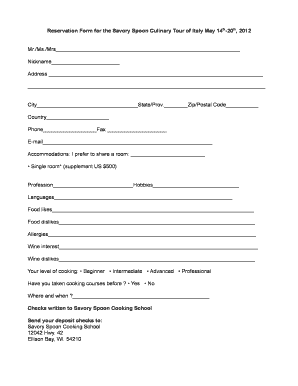

Get the free TRUST BENEFICIARIES - co miami oh

Show details

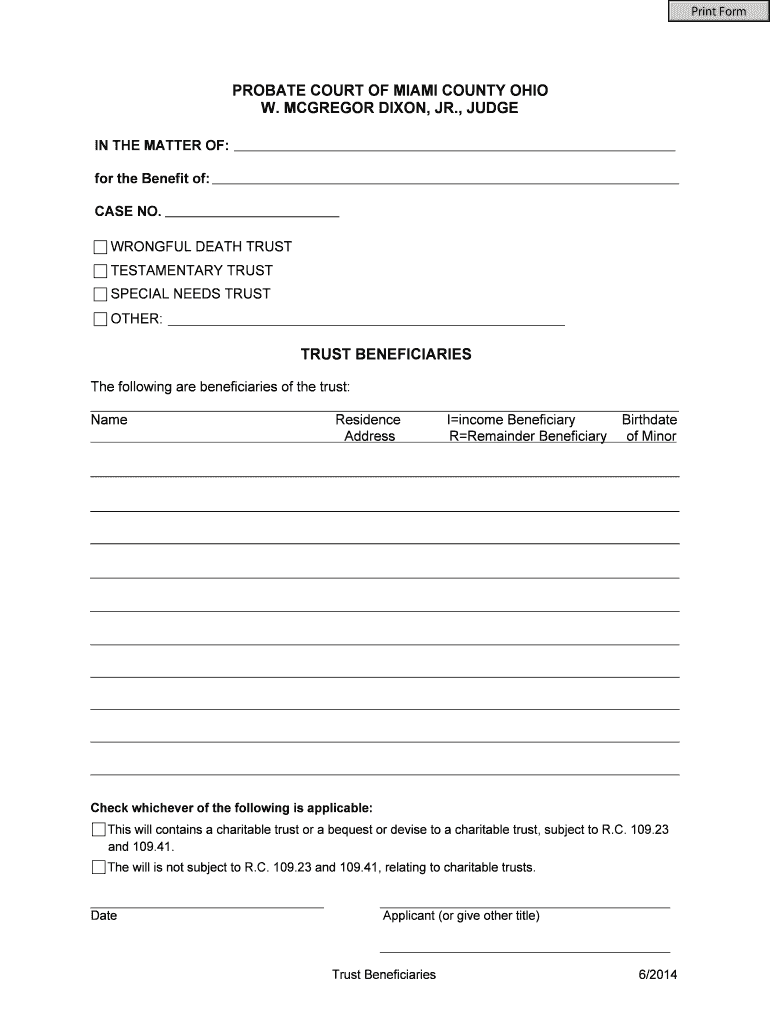

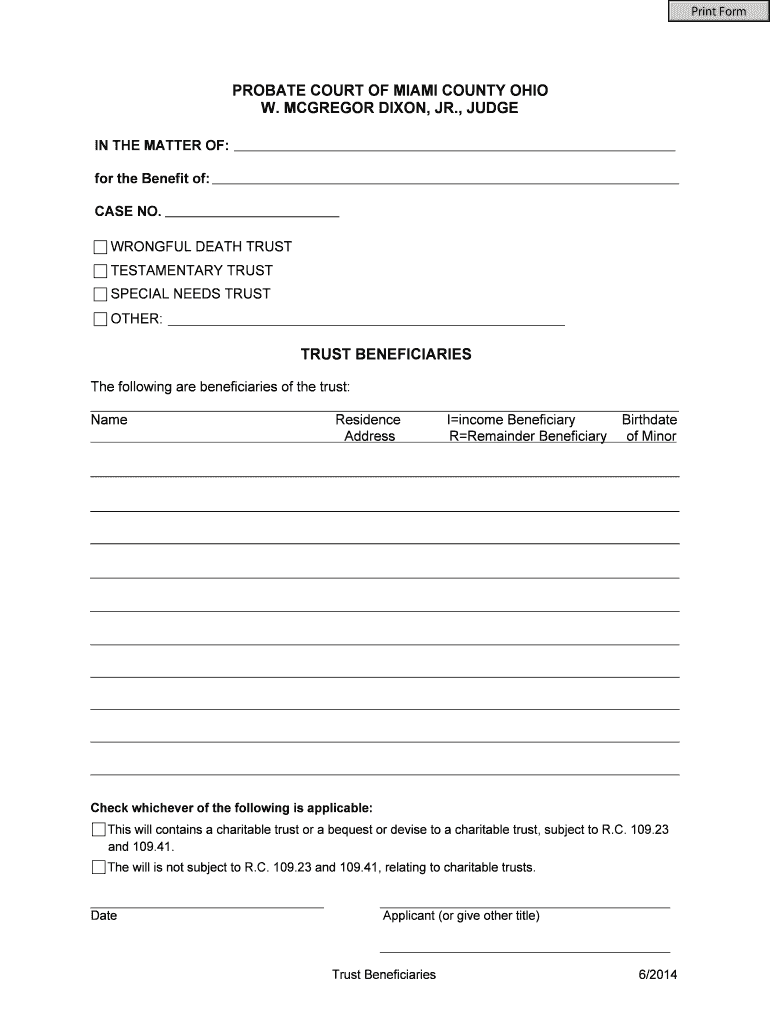

Print Form PROBATE COURT OF MIAMI COUNTY OHIO W. McGregor DIXON, JR., JUDGE IN THE MATTER OF: for the Benefit of: CASE NO. WRONGFUL DEATH TRUST TESTAMENTARY TRUST SPECIAL NEEDS TRUST OTHER: TRUST

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trust beneficiaries - co

Edit your trust beneficiaries - co form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust beneficiaries - co form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trust beneficiaries - co online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit trust beneficiaries - co. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust beneficiaries - co

How to fill out trust beneficiaries:

01

Determine the type of trust you have: Before filling out the beneficiaries, it is important to understand the type of trust you have. Trusts can range from revocable living trusts to irrevocable trusts, and the process may vary depending on the specific type.

02

Review the trust document: Carefully read and review the trust document to ensure you understand its provisions and requirements regarding beneficiaries. The document should outline who can be named as beneficiaries and any specific instructions or conditions that need to be followed.

03

Identify potential beneficiaries: Make a list of potential beneficiaries who are eligible to receive assets from the trust. Common beneficiaries may include immediate family members, relatives, friends, or charitable organizations. Consider the purpose and intent of the trust when identifying beneficiaries.

04

Determine the share of each beneficiary: Once potential beneficiaries have been identified, determine the share of the trust estate that each beneficiary will receive. This can be a specific dollar amount, a percentage of the trust assets, or a combination of both, depending on the trust's terms.

05

Consider contingent beneficiaries: In addition to primary beneficiaries, it is important to name contingent beneficiaries who would inherit the trust assets if the primary beneficiaries are unable to receive them. Discuss this with your attorney or legal advisor to ensure that all possible scenarios are considered.

06

Consult with a professional: It is advisable to consult with an experienced estate planning attorney or financial advisor who specializes in trusts. They can provide guidance and advice throughout the process, ensuring that the trust beneficiaries are properly documented and in accordance with relevant laws and regulations.

Who needs trust beneficiaries:

01

Individuals with revocable living trusts: Revocable living trusts are commonly used estate planning tools, and beneficiaries need to be designated to inherit assets upon the grantor's death. By naming beneficiaries, individuals can ensure that their assets are distributed according to their wishes and avoid the probate process.

02

Individuals with irrevocable trusts: Irrevocable trusts may be established for various purposes, often for tax planning or asset protection. In such cases, beneficiaries need to be designated to receive the trust assets per the terms of the trust agreement.

03

Charitable organizations: Trust beneficiaries can also include charitable organizations. By designating charities as beneficiaries, individuals can support causes they care about and leave a lasting impact through their estate planning.

In summary, anyone who has established a trust, whether revocable or irrevocable, should consider naming trust beneficiaries. Designating beneficiaries ensures that assets are distributed according to the trust terms and the grantor's intentions. Consulting with a professional can help ensure the proper completion of beneficiary designations and compliance with legal requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit trust beneficiaries - co from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like trust beneficiaries - co, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I sign the trust beneficiaries - co electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your trust beneficiaries - co in seconds.

How can I fill out trust beneficiaries - co on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your trust beneficiaries - co, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is trust beneficiaries?

Trust beneficiaries are individuals or entities who are entitled to benefit from a trust set up by a grantor.

Who is required to file trust beneficiaries?

The trustee of the trust is typically required to file trust beneficiaries.

How to fill out trust beneficiaries?

Trust beneficiaries are typically identified by name, relationship to the grantor, and specifics on their beneficial interest in the trust.

What is the purpose of trust beneficiaries?

The purpose of trust beneficiaries is to ensure that the assets held in the trust are managed and distributed according to the terms of the trust document.

What information must be reported on trust beneficiaries?

Information such as name, address, date of birth, and social security number of the beneficiaries may need to be reported.

Fill out your trust beneficiaries - co online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust Beneficiaries - Co is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.