Get the free VERIFICATION OF RECEIPT - Probate

Show details

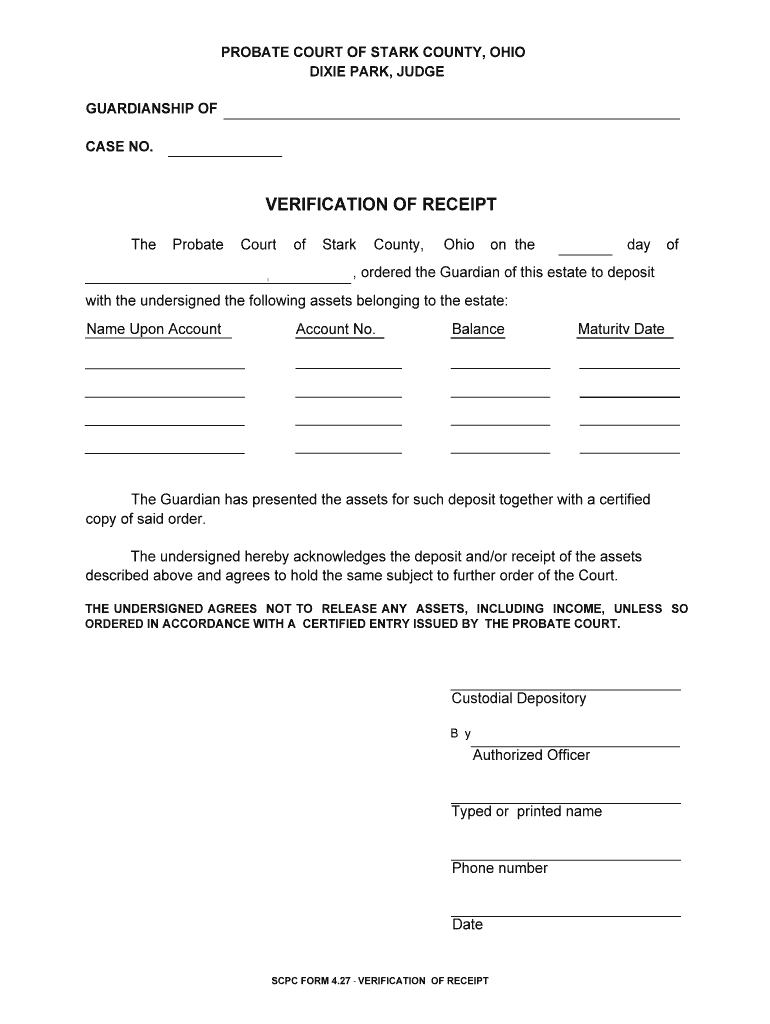

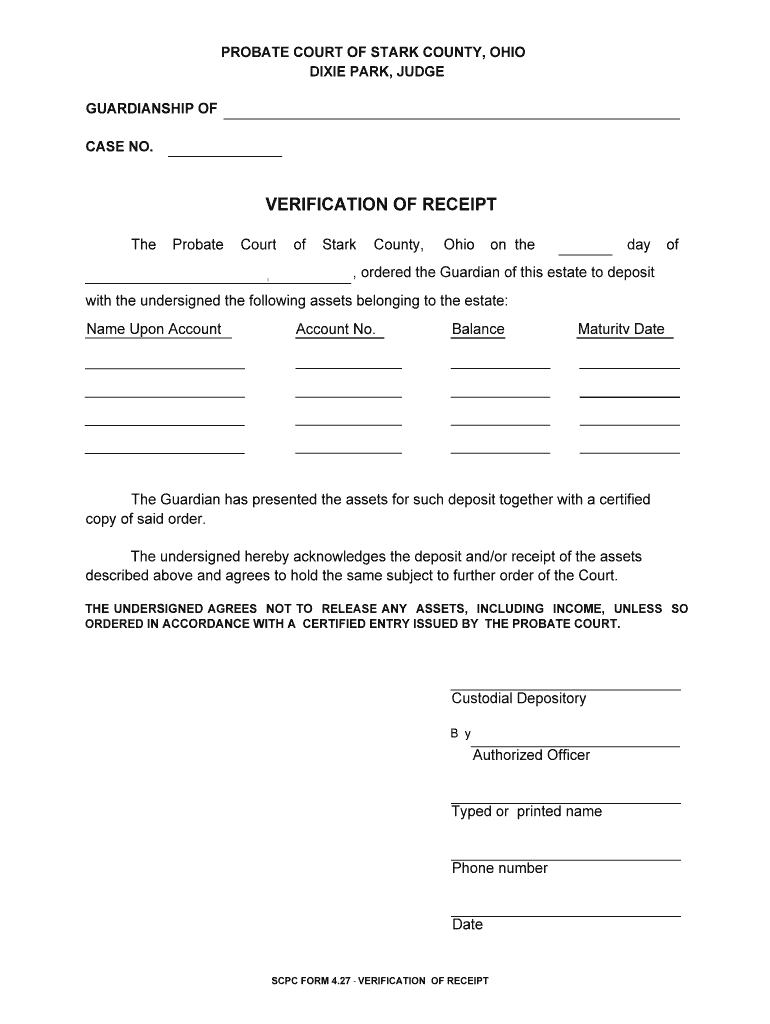

PROBATE COURT OF STARK COUNTY, OHIO DIXIE PARK, JUDGE GUARDIANSHIP OF CASE NO. VERIFICATION OF RECEIPT The Probate Court I of Stark County, Ohio on the day of, ordered the Guardian of this estate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign verification of receipt

Edit your verification of receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your verification of receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing verification of receipt online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit verification of receipt. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out verification of receipt

How to fill out a verification of receipt:

01

Start by obtaining a blank verification of receipt form. This form can typically be found online or provided by your employer, depending on the purpose of the receipt.

02

Begin by filling out the necessary information at the top of the form, such as the date, your name, and your contact information. This ensures that the receipt can be properly identified and attributed to you.

03

Next, provide details about the receipt itself. Include the date of the transaction, the name of the merchant or supplier, and a brief description of the goods or services purchased. This information helps to verify the authenticity and accuracy of the receipt.

04

Specify the payment method used for the transaction. This can include cash, credit card, check, or any other relevant payment method. Indicating the payment method helps to verify the source of the funds used.

05

If applicable, provide additional documentation or supporting evidence for the receipt. This may include attaching copies of invoices, purchase orders, or any other relevant documents that validate the transaction.

06

Finally, sign and date the verification of receipt form. This serves as your confirmation that the information provided is true and accurate to the best of your knowledge.

Who needs verification of receipt?

01

Individuals who need to track their expenses for personal financial management can benefit from maintaining verification of receipts. This allows them to have a record of their purchases and payments in an organized manner.

02

Businesses or self-employed individuals may require verification of receipt for tax purposes. Keeping accurate records of receipts helps in claiming deductions, auditing, and overall financial accountability.

03

Employees who need to submit reimbursement claims to their employers often need to provide verification of receipts. This ensures that their expenses are legitimate and can be reimbursed as per company policy.

In summary, anyone who wants to maintain accurate financial records, comply with tax regulations, or validate expenses for reimbursement purposes may need to fill out a verification of receipt.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete verification of receipt online?

Completing and signing verification of receipt online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out the verification of receipt form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign verification of receipt and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit verification of receipt on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign verification of receipt right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your verification of receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Verification Of Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.