Get the free Bridging Loans

Show details

Bridging Loans Company application form Please confirm if this is associated to a 0% facility fee product Yes No Intermediary details (customer facing) Are you? Directly Authorized Appointed Representative

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bridging loans

Edit your bridging loans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bridging loans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bridging loans online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bridging loans. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bridging loans

How to fill out bridging loans?

01

Start by researching different lenders that offer bridging loans. Look for reputable institutions with competitive interest rates and flexible terms.

02

Gather all necessary documents such as proof of income, identification, property valuations, and any relevant financial statements. Each lender may have specific requirements, so make sure to check their guidelines.

03

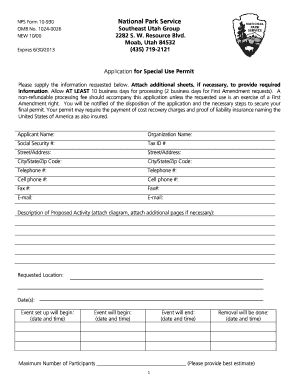

Complete the application form provided by the chosen lender. This form will typically require personal and financial information, as well as details about the property being used as collateral.

04

Submit the application along with all the required documents. Double-check that everything is filled out accurately to avoid unnecessary delays in the approval process.

05

After the lender reviews your application, they may schedule an assessment of the property to determine its value and suitability as collateral.

06

If your application is approved, carefully review the terms and conditions of the loan offer. Pay close attention to the interest rate, repayment schedule, and any associated fees.

07

If you agree with the terms, sign the loan agreement and return it to the lender.

08

The lender will then arrange the disbursement of the loan, which can usually be done via bank transfer.

09

As the borrower, it is important to make the necessary repayments on time and adhere to the agreed-upon schedule to avoid penalties or potential legal actions.

Who needs bridging loans?

01

Property developers and investors who require short-term financing to bridge the gap between buying a new property and selling an existing one.

02

Homebuyers who are in a chain and need temporary funds to complete the purchase of a new home before selling their current one.

03

Individuals or businesses who need quick access to funds for urgent expenses, such as paying off a tax bill or carrying out necessary repairs.

04

Entrepreneurs who require capital for business ventures that may not qualify for traditional bank loans due to their unique circumstances or short-term nature.

05

Those looking to buy property at auctions, as bridging loans can provide the necessary funds within tight timeframes typically associated with auction purchases.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit bridging loans from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your bridging loans into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit bridging loans straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing bridging loans.

How do I fill out the bridging loans form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign bridging loans and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is bridging loans?

Bridging loans are short-term loans used to bridge the gap between buying a new property and selling an existing one.

Who is required to file bridging loans?

Individuals or businesses in need of short-term financing for property transactions are required to file bridging loans.

How to fill out bridging loans?

Bridging loans can be filled out by providing information about the property being purchased/sold, the loan amount needed, and the repayment plan.

What is the purpose of bridging loans?

The purpose of bridging loans is to provide temporary financing until a long-term solution is in place, such as the sale of a property.

What information must be reported on bridging loans?

Information such as the loan amount, property details, repayment terms, and borrower information must be reported on bridging loans.

Fill out your bridging loans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bridging Loans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.