Get the free Traditional IRARoth IRA - Euro Pacific Investments - europac

Show details

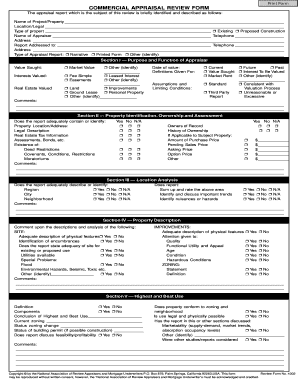

PREMIERE SELECT Traditional IRA/Roth IRA Invest in your retirement today. Saving for your retirement. 01 Sections in any lorem ipsum Dolores sit met Important head market. If you're planning for your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign traditional iraroth ira

Edit your traditional iraroth ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your traditional iraroth ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit traditional iraroth ira online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit traditional iraroth ira. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out traditional iraroth ira

How to fill out a traditional IRARoth IRA:

01

Determine eligibility: Before filling out a traditional IRARoth IRA, it is essential to ensure that you meet the eligibility criteria. Generally, anyone with taxable income and below the age of 70 ½ can contribute to a traditional IRA.

02

Choose a custodian: Select a reputable financial institution or custodian to hold your traditional IRARoth IRA. They will help you manage the account and assist with the necessary paperwork.

03

Fill out the application: Obtain the required application form from your chosen custodian. The form will typically ask for personal information such as name, address, social security number, and employment details.

04

Determine contribution limits: Familiarize yourself with the contribution limits set by the Internal Revenue Service (IRS) for traditional IRARoth IRAs. As of 2021, individuals can contribute up to $6,000 per year, with an additional catch-up contribution of $1,000 for individuals aged 50 and above.

05

Choose your contribution type: Decide whether you want to make a deductible or nondeductible contribution to your traditional IRARoth IRA. A deductible contribution allows you to potentially reduce your taxable income, while a nondeductible contribution offers tax-free growth but no immediate tax benefits.

06

Complete the beneficiary designation: Designate a beneficiary for your traditional IRARoth IRA. This is crucial as it determines who will inherit the account in the event of your passing.

07

Review and submit: Carefully review the filled-out application form, ensuring that all information is accurate and up to date. Once satisfied, submit the completed application to your custodian along with any required documentation.

Who needs a traditional IRARoth IRA?

01

Individuals looking for tax advantages: Traditional IRARoth IRAs offer potential tax benefits, such as tax-deductible contributions (depending on income and eligibility) and tax-deferred growth. This makes them suitable for individuals seeking to reduce their current taxable income and grow their savings tax-free over time.

02

Retirement savers: Anyone planning for retirement can benefit from a traditional IRARoth IRA. It allows individuals to save money specifically for retirement and take advantage of the compounding returns that can accumulate over time.

03

Individuals without access to an employer-sponsored retirement plan: Traditional IRARoth IRAs are especially valuable for individuals who do not have access to an employer-sponsored retirement plan, such as a 401(k). It provides an opportunity to save for retirement independently and enjoy the associated tax benefits.

In summary, filling out a traditional IRARoth IRA involves determining eligibility, selecting a custodian, completing the necessary application form, understanding contribution limits, choosing between deductible and nondeductible contributions, designating beneficiaries, and reviewing and submitting the application. Traditional IRARoth IRAs are suitable for individuals seeking tax advantages, planning for retirement, and those without access to an employer-sponsored retirement plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find traditional iraroth ira?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the traditional iraroth ira in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out the traditional iraroth ira form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign traditional iraroth ira and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit traditional iraroth ira on an iOS device?

Create, modify, and share traditional iraroth ira using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is traditional iraroth ira?

Traditional iraroth ira is a type of individual retirement account that allows individuals to save for retirement while deferring taxes on the earnings and contributions until withdrawal.

Who is required to file traditional iraroth ira?

Any individual who earns taxable income and wants to save for retirement can open and contribute to a traditional iraroth ira account.

How to fill out traditional iraroth ira?

To fill out a traditional iraroth ira, you need to open an account with a financial institution, make contributions up to the annual limit, and specify your investment choices.

What is the purpose of traditional iraroth ira?

The purpose of traditional iraroth ira is to help individuals save for retirement by providing tax advantages on contributions and earnings within the account.

What information must be reported on traditional iraroth ira?

The information that must be reported on a traditional iraroth ira includes contributions made, account balance, investment returns, and any distributions or withdrawals taken.

Fill out your traditional iraroth ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Traditional Iraroth Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.