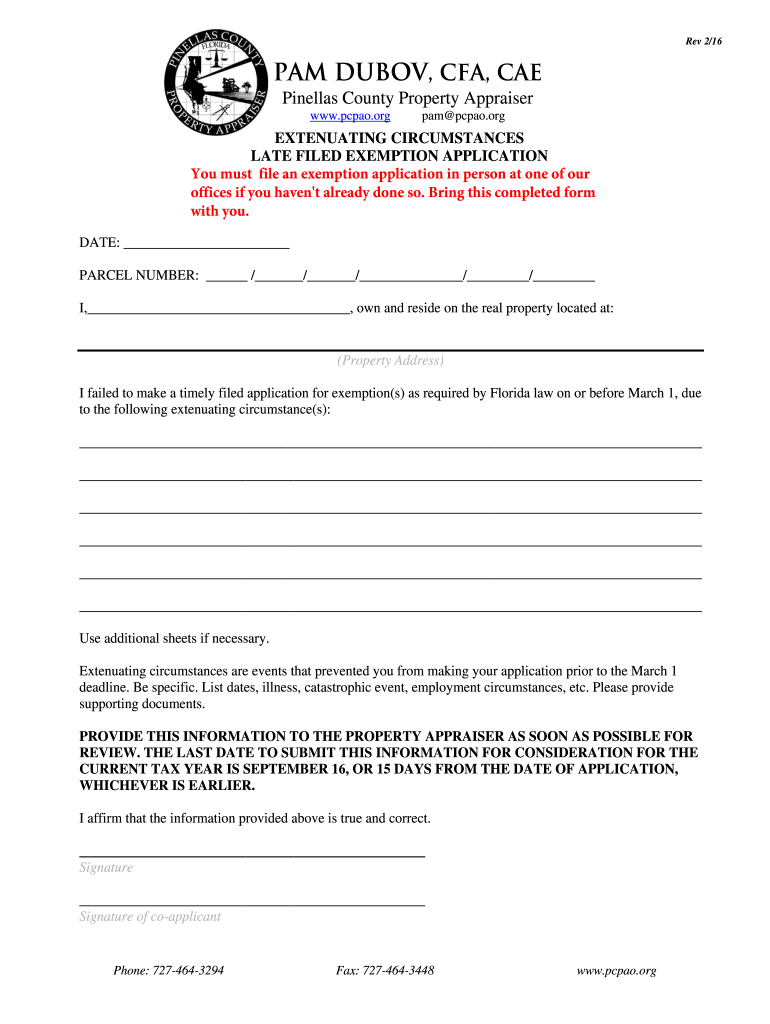

Get the free pcpao

Get, Create, Make and Sign pcpao form

How to edit pcpao form online

Uncompromising security for your PDF editing and eSignature needs

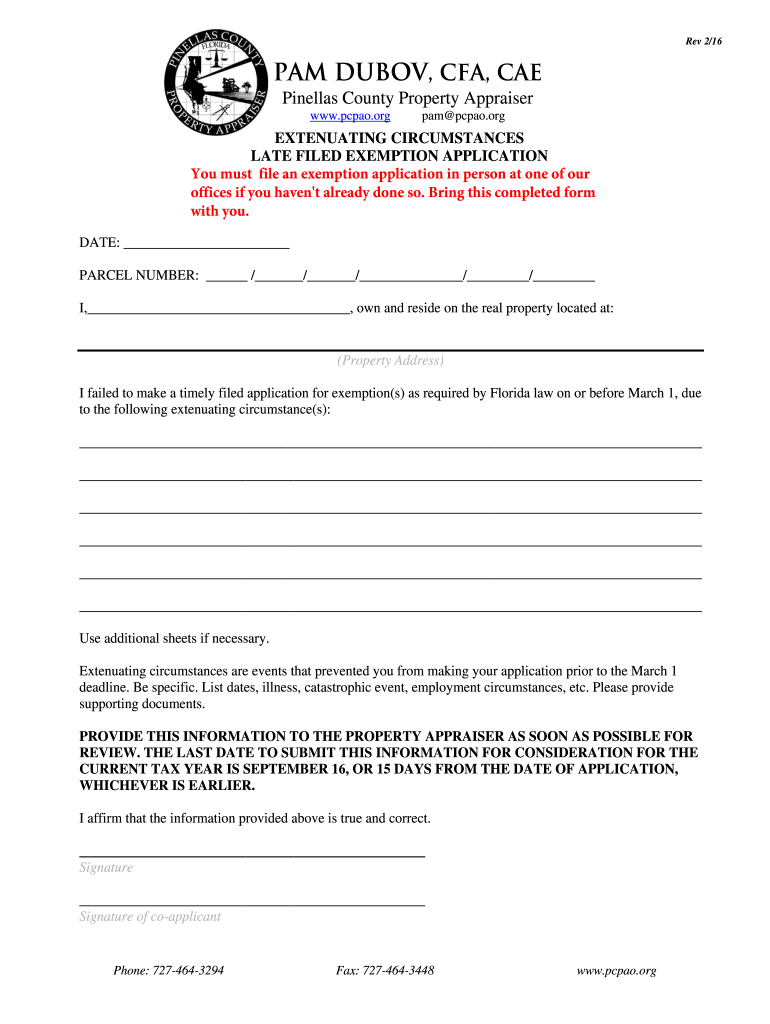

How to fill out pcpao form

How to fill out pcpao:

Who needs pcpao:

Video instructions and help with filling out and completing pcpao

Instructions and Help about pcpao form

What are the top three things you need to know about your notice of proposed property taxes if you're a Florida property owner hi friends welcome back to Tampa home group TV I'm Maria Hoffman its August 2019 and the notice of proposed property taxes should have arrived in your mailbox if you're a Florida property owner what are the top three things you need to know number one this is not a bill so don't pay it number two you are going to want to open it up read it carefully there are two figures here there's a just market value and an assessed value these are for tax purposes and if for some reason you need to know what your home would actually sell for onto the in today's market it may differ from these figures so were happy to help you out with that give us a call email me text me, and we can help you with that number three if you look at these numbers and feel a mistake has been made and let's say they're unfairly high you do have the statutory right to appeal them, but time is of the essence there is a deadline here in Hillsborough County that deadline is September 13th we can help you with that process we've helped many of our past clients go through that proper process if you need to do it and for your convenience I've put on my website the three links to the property appraisers in Hillsborough Pasco and Pinellas County, so you can find more information there, so thanks for watching if you have any questions feel free to call us were here to help you until next time be well Music

People Also Ask about

How do I get my homestead exemption online in Florida?

Do both owners have to apply for homestead exemption in Florida?

What documents do I need for homestead exemption in Florida?

Can I apply for the Florida homestead exemption online?

What documents are needed for Florida homestead exemption?

Who qualifies for property tax exemption in Florida?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

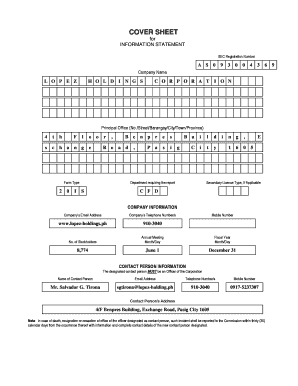

What is pcpao?

Who is required to file pcpao?

How to fill out pcpao?

What is the purpose of pcpao?

What information must be reported on pcpao?

How can I modify pcpao form without leaving Google Drive?

How do I complete pcpao form online?

How do I complete pcpao form on an Android device?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.