Get the free MOTT COMMUNITY COLLEGE PAYROLL DIRECT DEPOSIT FORM FOR - mcc

Show details

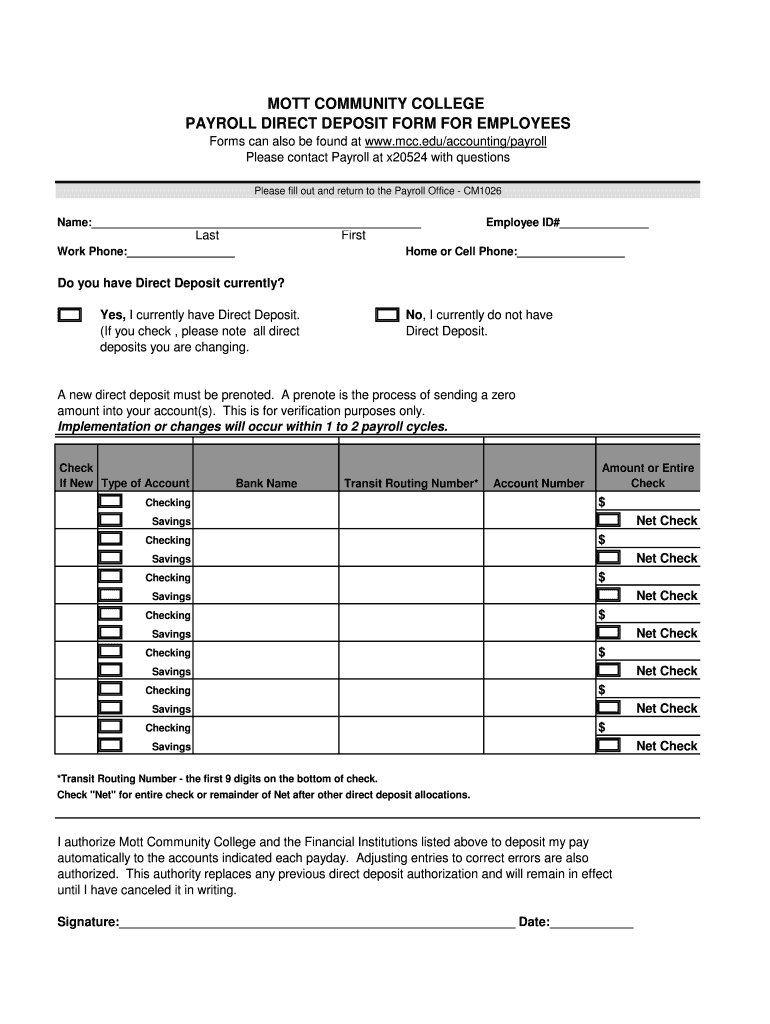

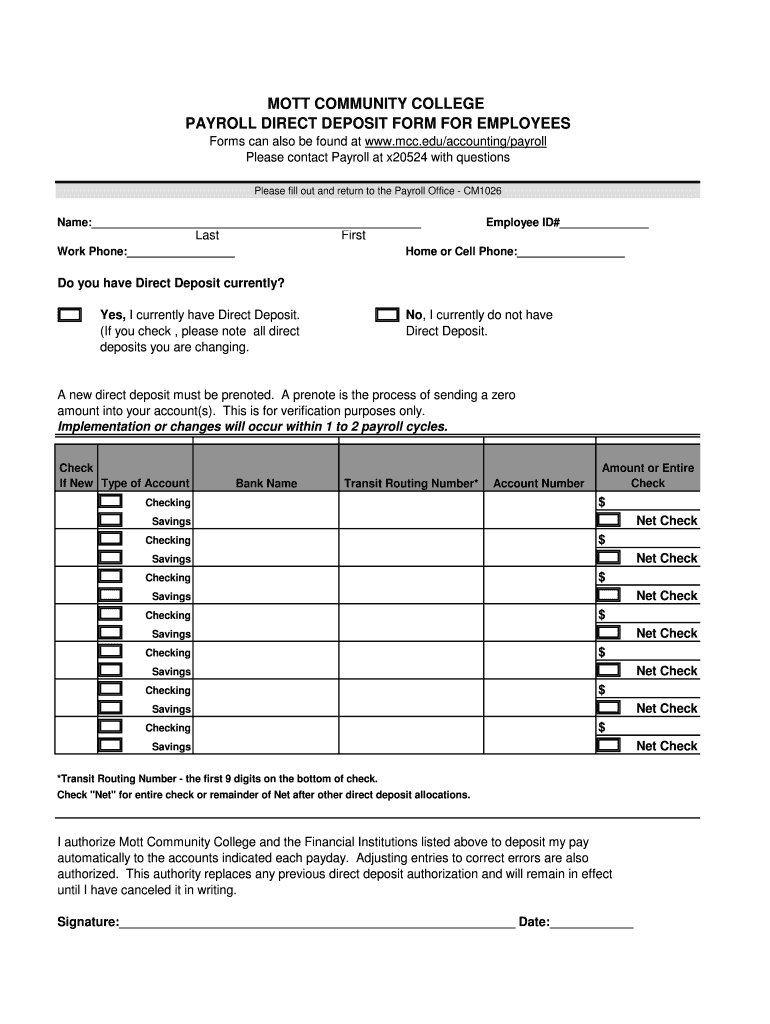

MOTT COMMUNITY COLLEGE PAYROLL DIRECT DEPOSIT FORM FOR EMPLOYEES Forms can also be found at www.mcc.edu/accounting/payroll Please contact Payroll at x20524 with questions Please fill out and return

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mott community college payroll

Edit your mott community college payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mott community college payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mott community college payroll online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mott community college payroll. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mott community college payroll

How to fill out Mott Community College payroll:

01

Gather all necessary information: Before starting the payroll process, make sure you have all the required information. This includes employee details such as names, addresses, social security numbers, hours worked, deductions, and any other relevant information.

02

Access the payroll system: Mott Community College likely uses an online payroll system, so log in to the designated platform. If you're unsure how to access it, reach out to your HR department for guidance.

03

Input employee information: Start by entering the employee details accurately into the payroll system. Double-check the data to ensure there are no errors or discrepancies.

04

Enter hours worked: Input the number of hours each employee has worked during the pay period. Make sure to properly classify regular hours, overtime hours, and any other relevant types of hours worked.

05

Include any deductions or allowances: If there are any deductions or allowances that need to be considered for each employee, such as taxes, benefits, or retirement contributions, ensure they are accurately recorded in the payroll system.

06

Review and verify: Take a moment to review all the entered information before finalizing the payroll. This step is crucial to catch any mistakes or omissions and to ensure everything is accurate.

07

Generate payroll reports: Once you have completed the data entry and verification process, generate payroll reports from the system. These reports should include information such as employee earnings, deductions, and any other relevant details. These reports serve as records and reference for future use.

08

Distribute paychecks or process direct deposits: After generating the payroll reports, follow the procedures established by Mott Community College for distributing paychecks or processing direct deposits. Ensure that employees receive their wages on time and in the designated manner.

Who needs Mott Community College payroll?

Mott Community College payroll is necessary for various individuals and entities within the college's administrative structure. These may include:

01

Employees: All staff members, whether full-time or part-time, require accurate payroll processing to receive their wages or salary.

02

Human Resources Department: The HR department oversees the management of payroll and ensures compliance with relevant labor laws and regulations.

03

Accounting or Financial Department: The accounting or financial department relies on the payroll information to accurately record and reconcile payroll expenses, deductions, and taxes.

04

Administration: College administrators require payroll reports and data to make informed decisions about budgeting, resource allocation, and financial planning.

05

Government Authorities: Payroll information is crucial for tax reporting and compliance with government regulations. Government authorities may require access to Mott Community College payroll records for auditing purposes or to verify employee compensation.

Overall, Mott Community College payroll is essential for the smooth operation of the college's financial processes and for ensuring employees are fairly compensated for their work.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mott community college payroll in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your mott community college payroll as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I edit mott community college payroll from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like mott community college payroll, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete mott community college payroll online?

Filling out and eSigning mott community college payroll is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

What is mott community college payroll?

Mott Community College payroll is the process of compensating employees for the work they have performed at the college.

Who is required to file mott community college payroll?

All employees of Mott Community College are required to file payroll in order to receive their salary or wages.

How to fill out mott community college payroll?

Mott Community College payroll can be filled out online or through the college's payroll system. Employees need to input their hours worked, deductions, and any other relevant information.

What is the purpose of mott community college payroll?

The purpose of Mott Community College payroll is to ensure that employees are compensated accurately and on time for their work.

What information must be reported on mott community college payroll?

Information such as hours worked, deductions, overtime, and any other relevant data must be reported on Mott Community College payroll.

Fill out your mott community college payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mott Community College Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.