Get the free Short Form Form 990 EZ Department of the Treasury Internal Revenue Service Address c...

Show details

Short Form 990 EZ Department of the Treasury Internal Revenue Service Address change Name change JULY 1, 2011, and ending S G Accounting MethodWebsite : HELPING ENERGIZE & REBUILD OURSELVES INC J

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign short form form 990

Edit your short form form 990 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short form form 990 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit short form form 990 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit short form form 990. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out short form form 990

How to fill out short form form 990:

01

Gather all necessary information: Before starting to fill out the form, make sure you have all relevant financial and organizational information readily available. This includes details about your organization's income, expenses, programs, governance structure, and any other required disclosures.

02

Review the instructions: Take the time to carefully read and understand the instructions provided with the short form form 990. This will guide you through each section of the form and help you provide accurate and complete information.

03

Provide basic information: Start by filling out the basic identifying information about your organization, such as its name, address, EIN (Employer Identification Number), and tax year. Ensure that this information matches the official records.

04

Report revenue and expenses: In this section, you will need to report your organization's revenue and expenses. Include details about any grants, contributions, program service revenue, investment income, and any other sources of income. Similarly, provide information on expenses such as salaries, rent, utilities, program costs, and administrative expenses.

05

Describe your organization's activities: This section requires you to describe the mission and primary activities of your organization. Explain the programs, services, or initiatives you undertake to achieve your mission. Be concise but provide enough detail to give a clear understanding of your organization's work.

06

Report governance and management: Provide information about your organization's governing body, its structure, and its key officers or board members. Describe any conflicts of interest policies in place and any compensation arrangements with officers, directors, or employees.

07

Comply with required disclosures: Acknowledge and address any required disclosures, such as information regarding political activities, lobbying, unrelated business income, or foreign activities. If none of these apply to your organization, ensure you indicate that accordingly.

08

Review and ensure accuracy: Once you have completed all the sections, carefully review the form for accuracy and completeness. Ensure that all calculations are correct, numbers are properly reported, and all required schedules are attached. It is also advisable to have someone else review the form to minimize errors or omissions.

Who needs short form form 990:

01

Nonprofit organizations: The short form form 990 is typically required for tax-exempt organizations that qualify to file a 990-N or 990-EZ. These organizations include charities, foundations, civic leagues, social welfare organizations, and other tax-exempt entities described in section 501(c)(3) or 501(c)(4) of the Internal Revenue Code.

02

Small organizations: The short form form 990 is specifically designed for organizations with relatively lower gross receipts and fewer assets. It is meant to simplify the reporting process for smaller nonprofits and reduce administrative burdens.

03

Organizations meeting certain criteria: To be eligible to file the short form form 990, an organization must meet specific criteria set by the IRS. This includes having gross receipts below a certain threshold (currently $200,000 for the tax year), total assets below a certain threshold (currently $500,000), and not being a private foundation.

Note: It is important to consult the IRS regulations and seek professional advice if you are unsure whether your organization qualifies to file the short form form 990.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in short form form 990?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your short form form 990 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in short form form 990 without leaving Chrome?

short form form 990 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the short form form 990 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your short form form 990 in seconds.

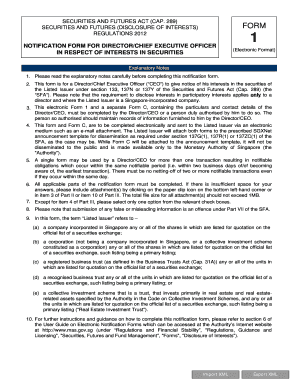

What is short form form 990?

Short form form 990 is a condensed version of the full form 990 that certain organizations can use to report their financial information to the IRS.

Who is required to file short form form 990?

Organizations with gross receipts less than $200,000 and total assets less than $500,000 are eligible to file the short form form 990.

How to fill out short form form 990?

The short form form 990 can be filled out electronically using the IRS's online filing system, or by physically submitting a paper form to the IRS.

What is the purpose of short form form 990?

The purpose of the short form form 990 is to provide the IRS with basic financial information about smaller tax-exempt organizations.

What information must be reported on short form form 990?

The short form form 990 requires organizations to report their gross receipts, total assets, and a basic statement of their mission and activities.

Fill out your short form form 990 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Short Form Form 990 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.