AZ Providing Financial Solutions Strategic Tax Planning Trust Questionnaire Form 2011-2026 free printable template

Show details

Strategic Tax Planning, LLC Tax Consulting Tax Preparation Trust Services Asset Protection TRUST QUESTIONNAIRE FORM REVOCABLE LIVING TRUST (Married Couple) NOTE: If trust is being re-stated you must

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ Providing Financial Solutions Strategic Tax

Edit your AZ Providing Financial Solutions Strategic Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ Providing Financial Solutions Strategic Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AZ Providing Financial Solutions Strategic Tax online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AZ Providing Financial Solutions Strategic Tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out AZ Providing Financial Solutions Strategic Tax

How to fill out AZ Providing Financial Solutions Strategic Tax Planning

01

Gather all relevant financial documents, including income statements, tax returns, and investment records.

02

Identify your financial goals and any specific tax planning objectives you have.

03

Consult with a tax professional or financial advisor to discuss your situation and get insights on tax strategies.

04

Complete any necessary forms or questionnaires provided by AZ Providing Financial Solutions for preliminary information collection.

05

Arrange a meeting to review your information with the strategist at AZ Providing Financial Solutions to discuss potential strategies.

06

Implement the agreed-upon tax strategies and regularly review your financial and tax situation to ensure alignment with changing laws and goals.

Who needs AZ Providing Financial Solutions Strategic Tax Planning?

01

Individuals seeking to optimize their tax liabilities.

02

Businesses looking for strategic tax planning to maximize deductions and credits.

03

High-net-worth individuals who require complex tax strategies for their investments.

04

Anyone approaching retirement who needs to plan for tax implications on retirement income.

05

Families looking to understand the impact of taxes on inheritances or educational funds.

Fill

form

: Try Risk Free

People Also Ask about

What kind of trust does Suze Orman recommend?

Suze Orman provides a lot of financial advice on a broad range of topics, but she's known for arguing that revocable living trusts in particular are some of the most valuable tools a person might use in the estate planning process.

What questions should I ask about trust?

5 Important Questions to Ask When Forming A Trust Why do you need a trust? Who will the trust benefit? Who will administrate the trust, now and later? Which assets will fund the trust? What are the long-term tax consequences?

How do you identify trust?

Want to Know If Someone Is Trustworthy? Look for These 15 Signs They are consistent. They show compassion and humility. They respect boundaries. They compromise and don't expect something for nothing. They're relaxed (and so are you). They are respectful when it comes to time. They show gratitude.

What does Suze Orman say about irrevocable trust?

With an irrevocable trust, as soon as the grantor transfers the assets into the trust, they remove all their rights of ownership to the trust and those assets. They can't make any decisions about how the assets should be managed, or if they should be sold.

What happens when you inherit money from a trust?

The trust itself must report income to the IRS and pay capital gains taxes on earnings. It must distribute income earned on trust assets to beneficiaries annually. If you receive assets from a simple trust, it is considered taxable income and you must report it as such and pay the appropriate taxes.

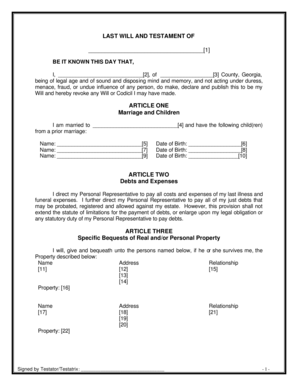

What are the basics of a trust?

A trust is a fiduciary1 relationship in which one party (the Grantor) gives a second party2 (the Trustee) the right to hold title to property or assets for the benefit of a third party (the Beneficiary). The trustee, in turn, explains the terms and conditions of the trust to the beneficiary.

What are the five elements necessary to form a trust?

The big keys you need to make a trust are: Intent to make a trust (California Probate Code section 15201); Mental Capacity to make a trust; A trust must have property (PC 15202) There must be a legal purpose to trust (PC15203) A trust must have a beneficiary (PC 15205)

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify AZ Providing Financial Solutions Strategic Tax without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including AZ Providing Financial Solutions Strategic Tax, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete AZ Providing Financial Solutions Strategic Tax online?

Completing and signing AZ Providing Financial Solutions Strategic Tax online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an eSignature for the AZ Providing Financial Solutions Strategic Tax in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your AZ Providing Financial Solutions Strategic Tax right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is AZ Providing Financial Solutions Strategic Tax Planning?

AZ Providing Financial Solutions Strategic Tax Planning is a service that helps individuals and businesses develop effective tax strategies to minimize liabilities and optimize financial outcomes.

Who is required to file AZ Providing Financial Solutions Strategic Tax Planning?

Individuals and businesses with complex financial situations or those seeking to optimize their tax positions may be required to engage in strategic tax planning.

How to fill out AZ Providing Financial Solutions Strategic Tax Planning?

To fill out AZ Providing Financial Solutions Strategic Tax Planning, individuals or businesses should gather relevant financial documents, review their income sources, deductions, and credits, and then consult with a tax professional to complete the necessary forms.

What is the purpose of AZ Providing Financial Solutions Strategic Tax Planning?

The purpose of AZ Providing Financial Solutions Strategic Tax Planning is to ensure compliance with tax laws while minimizing tax payments and maximizing financial efficiency.

What information must be reported on AZ Providing Financial Solutions Strategic Tax Planning?

The information that must be reported includes income details, deductions, potential credits, investment information, and any other relevant financial data that affects tax liabilities.

Fill out your AZ Providing Financial Solutions Strategic Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ Providing Financial Solutions Strategic Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.