IRS W-8BEN 1998 free printable template

Show details

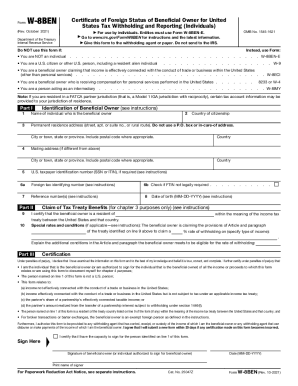

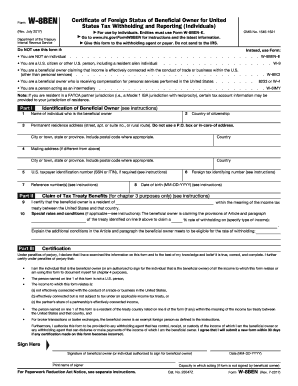

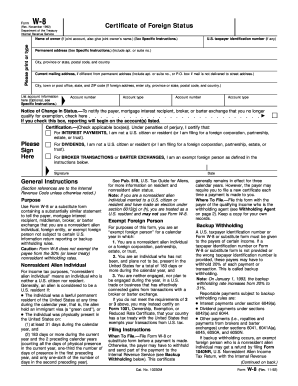

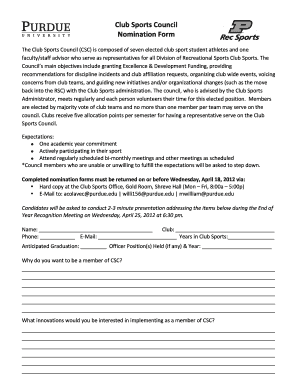

Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding October 1998 Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code. See separate instructions. Give this form to the withholding agent or payer. Do not send to the IRS* OMB No* 1545-1621 Do not use this form for A U*S* citizen or other U*S* person including a resident alien individual A foreign partnership see instructions for exceptions A foreign...government international organization foreign central bank of issue tax-exempt organization or private foundation claiming the applicability of section s 501 c 892 895 or 1443 b A person acting as an intermediary A person claiming an exemption from U*S* withholding on income effectively connected with the conduct of a trade or business in the United States W-8ECI or W-8EXP W-8IMY W-8ECI Identification of Beneficial Owner See instructions. Part I Name of individual or organization that is the...beneficial owner Type of beneficial owner Instead use Form W-9 W-8ECI or W-8IMY Country of incorporation or organization Disregarded entity Individual Corporation International organization Foreign central bank of issue Partnership Trust Estate Foreign tax-exempt organization Permanent residence address street apt. or suite no. or rural route. Do not use a P. O. box. City or town state or province. Include postal code where appropriate. Country do not abbreviate Mailing address if different from...above U*S* taxpayer identification number if required see instructions SSN or ITIN Foreign tax identifying number if any optional EIN Account number s optional Claim of Tax Treaty Benefits if applicable I certify that check all that apply a The beneficial owner is a resident of b If required the U*S* taxpayer identification number is stated on line 6 see instructions. c requirements of the treaty article dealing with limitation on benefits see instructions. d U*S* trade or business of a foreign...corporation and meets qualified resident status see instructions. e Form 8833 if the amount subject to withholding received during a calendar year exceeds in the aggregate 500 000. within the meaning of the income tax treaty between the United States and that country. of the. Special rates and conditions if applicable see instructions The beneficial owner is claiming the provisions of Article rate of withholding on specify type of income treaty identified on line 9a above to claim a Explain the...reasons the beneficial owner meets the terms of the treaty article Notional Principal Contracts I have provided or will provide a statement that identifies those notional principal contracts from which the income is not effectively connected with the conduct of a trade or business in the United States. I agree to update this statement as required* Certification Under penalties of perjury I declare that I have examined the information on this form and to the best of my knowledge and belief it is...true correct and complete.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-8BEN

How to edit IRS W-8BEN

How to fill out IRS W-8BEN

Instructions and Help about IRS W-8BEN

How to edit IRS W-8BEN

You can easily edit the IRS W-8BEN form using pdfFiller's online tools. Start by uploading your completed form to the platform. Next, make the necessary changes by clicking on the text fields you wish to modify. After editing, ensure to save your changes and download the updated form for your records.

How to fill out IRS W-8BEN

To fill out the IRS W-8BEN form, follow these steps:

01

Enter your name in the first field.

02

Provide your country of citizenship.

03

List your permanent address outside the U.S.

04

Include your mailing address if it differs from your permanent address.

05

Fill in the Taxpayer Identification Number (TIN) if applicable.

Ensure all information is accurate and complete before submission. Seek assistance from a tax professional if necessary.

About IRS W-8BEN 1998 previous version

What is IRS W-8BEN?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-8BEN 1998 previous version

What is IRS W-8BEN?

The IRS W-8BEN form is a tax document designed for non-U.S. citizens or entities. It certifies that the individual or entity is a foreign person and is used to claim benefits under a tax treaty. This form is crucial for foreign individuals receiving income from U.S. sources to avoid unnecessary withholding taxes.

What is the purpose of this form?

The primary purpose of the IRS W-8BEN form is to document the foreign status of an individual or entity. This status allows them to benefit from reduced withholding tax rates on certain income from U.S. sources, such as dividends and interest. By submitting this form, filers can help ensure that proper taxes are withheld according to treaty provisions.

Who needs the form?

The IRS W-8BEN form is necessary for non-U.S. individuals who receive income from U.S. sources. This includes foreign students, academics, and professionals who engage in transactions that generate income taxed in the U.S. Additionally, foreign entities may also be required to complete this form as part of their income tax obligations.

When am I exempt from filling out this form?

You may be exempt from filing the IRS W-8BEN form if you are a U.S. citizen or resident alien, as U.S. tax laws apply to you differently. Additionally, if you do not receive income from U.S. sources, there is no need to complete this form. Ensure that you assess your status carefully to determine the need for the form.

Components of the form

The IRS W-8BEN form comprises several critical sections, including details about the individual or entity's identity, citizenship, and the type of income expected. Key components include name, country of citizenship, mailing address, and TIN if applicable. It also requires a signature to verify accuracy.

What are the penalties for not issuing the form?

Failing to issue the IRS W-8BEN form can lead to significant tax penalties. Non-compliance may result in higher withholding tax rates applied to your U.S. income. Additionally, you could face challenges in claiming tax treaty benefits, leading to increased overall tax liability. Understanding these penalties can help emphasize the importance of proper form submission.

What information do you need when you file the form?

When filing the IRS W-8BEN form, you need to provide your complete name, country of citizenship, and a permanent address outside the U.S. If applicable, include a Taxpayer Identification Number. All these details must be accurate to ensure compliance and proper processing by the IRS.

Is the form accompanied by other forms?

Generally, the IRS W-8BEN form is submitted independently. However, depending on the source of income, additional documentation might be required to substantiate the claim for reduced withholding rates. Always check with the income source to confirm if supplementary forms are needed.

Where do I send the form?

The IRS W-8BEN form should be submitted to the withholding agent or payer who is responsible for paying your income. Do not send this form directly to the IRS unless instructed. The payer will use the information to determine the correct withholding tax rate applicable to your payments.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I am really new at trying this out. The fax feature sounds like it would be very useful to me. I am very interested in learning about all the features offered through this service.

Just what I needed to fill out promptly and neatly PDF applications and forms.

See what our users say