Get the free GST Impacts SMEs

Show details

Registration Form Inquiries Sarah: 603.2024.8608/ 016.255.7013 Fax: 03.2026.2093 Email: Sarah cch.com.my Website: www.cch.com.my Address: Commerce Clearing House (M) SDN BHD Level 26, Menard Weld,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gst impacts smes

Edit your gst impacts smes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst impacts smes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

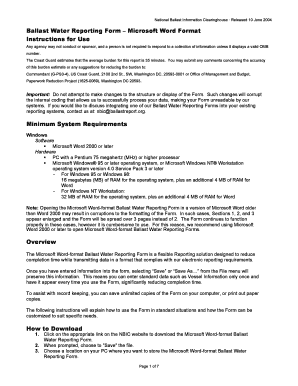

Editing gst impacts smes online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gst impacts smes. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gst impacts smes

How to fill out GST impacts SMEs?

01

Understand the basics of GST: Firstly, it is essential to have a clear understanding of the Goods and Services Tax (GST) and its impact on small and medium-sized enterprises (SMEs). Familiarize yourself with the key concepts and terms related to GST, such as input tax credit, taxable supplies, and tax rates.

02

Review the GST guidelines: Refer to the official guidelines and resources provided by the tax authorities in your country. These guidelines will provide you with specific instructions on how to fill out the GST forms and report your GST liabilities accurately.

03

Maintain accurate records: It is crucial to keep proper records of all your business transactions that are eligible for GST. This includes maintaining invoices, receipts, purchase bills, and any other relevant financial documents. Accurate record-keeping will ensure that you can fill out the GST forms correctly and claim the right amount of input tax credit.

04

Determine your GST liability: Analyze your business operations and identify the GST liabilities applicable to your SME. This may involve determining the tax rates, understanding the different GST schemes available (such as composition scheme), and assessing whether you are liable to register for GST based on your turnover.

05

Use GST accounting software: Consider utilizing GST accounting software to streamline your GST compliance process. These software solutions can automate calculations, generate GST reports, and assist you in filling out the necessary forms accurately.

06

Seek professional assistance: If you are unsure about how to fill out GST forms or need assistance with understanding the impact of GST on your SME, it is advisable to consult a tax professional or hire an accountant with expertise in GST compliance. They can guide you through the process and ensure compliance with the tax laws.

Who needs GST impacts SMEs?

01

Small and medium-sized enterprises (SMEs): SMEs, regardless of their industry or sector, need to understand and be aware of the impact of GST on their business operations. GST can significantly influence the cost structure, pricing strategies, and compliance requirements for SMEs.

02

Businesses involved in taxable supplies: Any business that provides goods or services that are subject to GST is directly impacted. This includes manufacturers, retailers, service providers, and wholesalers.

03

Businesses with turnover exceeding the threshold: In many countries, SMEs are required to register for GST if their turnover exceeds a certain threshold. Understanding the threshold and assessing whether your business meets the criteria is crucial to determine if GST compliance is necessary.

It's important for SMEs to stay informed about the implications of GST and ensure proper compliance to avoid any penalties or legal complications.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete gst impacts smes online?

pdfFiller has made it simple to fill out and eSign gst impacts smes. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit gst impacts smes straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing gst impacts smes.

Can I edit gst impacts smes on an iOS device?

You certainly can. You can quickly edit, distribute, and sign gst impacts smes on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is gst impacts smes?

GST impacts SMEs by affecting their cash flow, increasing compliance requirements, and potentially changing pricing strategies.

Who is required to file gst impacts smes?

All SMEs registered under the GST regime are required to file GST impacts SMEs.

How to fill out gst impacts smes?

GST impacts SMEs can be filled out using the GST portal online or by using GST software provided by authorized vendors.

What is the purpose of gst impacts smes?

The purpose of GST impacts SMEs is to enable SMEs to report their taxable supplies and claim input tax credits accurately.

What information must be reported on gst impacts smes?

Information such as taxable supplies made, input tax credits claimed, and GST payable must be reported on GST impacts SMEs.

Fill out your gst impacts smes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gst Impacts Smes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.